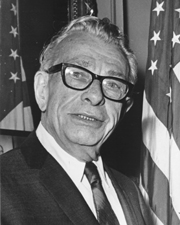

The US Senate has passed a $2 Trillion Coronavirus Assistance bill. The House of Representatives is likely to debate and vote on it starting Friday 3/27. Former (now deceased) Illinois Senator Everett Dirksen once famously said, “A billion here, a billion there, pretty soon, you are talking real money.” This $2 Trillion bill makes Dirksen look like a piker. We don’t know what the final bill terms will be but let’s examine the Senate bill.

What’s In It For You?

If you work for a living, it is more likely that you will remain employed. According to this article in the Washington Post, $504 Billion will go to maintaining the payrolls of larger businesses (over 500 employees), and $377 Billion will go to small businesses for the same reason. That’s a combined total of $881 Billion, or 44% of the total $2 Trillion. If you are a small business owner, it behooves you at least to look into a loan through this program because the loan will be at 0% interest rates and can be forgiven if you maintain your payroll through June 30, 2020 (at least as I read it – read it for yourself here in the text of the bill through the Senate website.) Small business owners can apply for a loan through a bank that is also an SBA lender – many banks are SBA lenders. Loan amounts are capped at $10 million and are specifically designed to help small businesses pay their expenses during this shutdown, including payroll, rent, and other expenses. Don’t lay off employees, and you don’t have to repay the loan. What remains to be seen is whether this SBA loan will be in senior lien position to other loans that your small business may already have on its books.

If you are a taxpayer, you will get a direct payment of $1,200 per taxpayer and $500 per dependent child. Sounds good, but don’t get too excited because the direct payment amount gets reduced at incomes starting at $75,000 ($150,000 for married filing jointly) and end altogether at incomes over $90,000 ($180,000 for MFJ). This direct payment benefit is aimed at the part of the populace that could use it most: those at the lower end of the income ladder. Moreover, as I have noted before, I am skeptical that this benefit will have a significant effect because so much of the economy is shut down – bars, restaurants, entertainment venues, and many retail stores. Nevertheless, $1,200 is $1,200 and will be nice to have for many people. This $290 billion provision, together with $260 billion designed to beef up unemployment insurance, will help cash flows for people in dire straits.

There are other provisions such as some tax cuts, aid to state and local governments, and aid to hospitals and medical facilities, that bring the total up to the $2 with twelve zeroes. It is a mind-boggling amount.

Where is it Coming From?

The US Treasury will borrow this money by issuing more T-Bills, Notes, and Bonds through the usual markets. Because interest rates are so low (below 1% at maturities of 10 years or shorter), the current cost of this capital investment is good. It is a valid point to ask what we are burdening our children, grandchildren, and subsequent generations with. It is likely that this debt will be refinanced over time and never repaid. If interest rates remain this low, then it might be worth the gamble. If not, then we are committed to a lot more debt service in the future. It’s a moral question.

IMO

Though I am a proponent of small government, I am in favor of this bill, warts and all. Granted, there is pork in the bill, though we don’t yet know the extent of that pork and won’t know until the House passes its bill and the President signs it. However, this is not a crisis that these businesses large and small got themselves into as a result of poor decisions or poor management or disruptive technologies. This crisis resulted from a pandemic and our federal, state and local governments’ reactions to it, specifically the cessation of a large amount of economic activity. This is unprecedented, and so politicians are operating without a playbook. With interest rates as low as they are, I am an advocate of this program, especially if we can limit the pork.