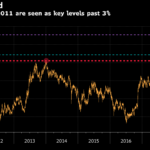

The price of an ounce of gold is virtually unchanged from a year ago. As I write this on May 22, 2018, gold is trading at approximately $1,292 per ounce. A year ago, May 22, 2017, gold closed at approximately $1,289 – $3 lower than where it is now. This is not to say it has stayed right at that level the whole time – gold bottomed at about $1,225 in July 2017 and topped out at about $1,373 in January 2018, which is a 148-point range or about 11% of its current price. However, at the end of the day, gold is right back where it was 1 year ago.

So What?

Why is it significant that gold is virtually unchanged over the past year? I think it is significant because of what it says about the worldview of investors on a macro level. There are at least 3 sources of the value of gold:

- As a hedge against inflation;

- As a safe haven during wartime, global unrest, or geopolitical uncertainty;

- Due to its inherent beauty and related uses in jewelry.

If you watch TV news, we have had all kinds of geopolitical uncertainty during the past year, such as:

- Trump is a loose cannon who may inadvertently start a nuclear war;

- Syria is in the midst of a bloody civil war with Iran and Russia involved;

- North Korea fires several rockets in the direction of Japan and conducts nuclear tests, after which Trump calls the Nork leader “Rocket Man”;

- Iran continues to develop nuclear capability; Iran is revealed to be cheating on its “deal” and Trump withdraws from the “deal”;

- Putin wins re-election and Russia continues to take an aggressive posture;

- Oil goes up to over $70/barrel.

Despite all of that and the fear reported by our media, gold remains almost unchanged. This tells me that investors see through the fear-based reporting and judge that the geopolitical threats now are about what they were a year ago. North Korea most likely won’t attack us or our allies. The other issues aren’t severe enough to upend the current geopolitical balance. Not that everything is cool, but we are getting through all of this day by day.

Inflation

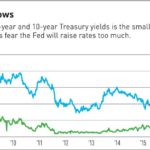

US Treasury rates are up by 80 to 100 basis points during the same period, depending on the maturity. Higher interest rates do signal higher inflation in the future. But gold remains unchanged. Why? Is gold no longer an inflation hedge? Or is the sense that inflation may be higher but not yet so high that it will be a problem. Maybe a little higher inflation is good! We have been fighting de-flation for the past several years – maybe it is about time that ended. Also, maybe it is the sense that the Central Banks will be able to control inflation with interest rate increases – if inflation increases but remains under control, perhaps there is not as much of a reason to buy gold.

Crypto

Another phenomenon during the past year has been the rise of Crypto – Bitcoin and the like. Some call Bitcoin “digital gold”. Perhaps for Millennials and younger investors, Crypto is replacing gold as a crisis hedge. Perhaps this new emerging competition for the Chicken Littles out there is another reason gold is struggling.

William Devane

If you watch Cable TV you have no doubt seen ads to buy gold by actor William Devane and others. These ads play to people’s fears. Don’t fall for it. While it is always good to own natural assets such as gold, the sky is not falling. Even if it does fall, do you know for certain how gold will react? While gold has done well during past crises, will it do so again? We don’t know. In the meantime, you could be foregoing upside in other asset classes if you put too much of your money in gold. Anything in moderation is ok; too much may be harmful. That applies to owning gold.