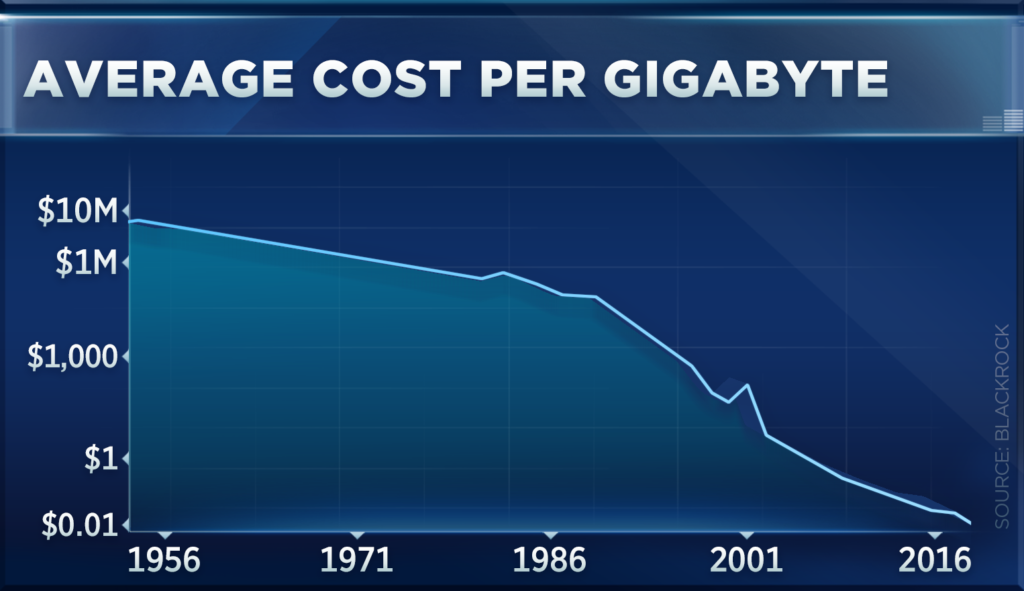

A new technology is invented that makes producing a product quicker or cheaper, and the new technology renders an older technology obsolete. It’s a story that has happened throughout history. Autos and trucks supplanted wagons pulled by horses. Planes supplanted trains – for some uses, not all. Austrian and Harvard economist Joseph Schumpeter used the term “creative destruction” in the early 20th Century to describe this process. In more recent years, another Harvard economist, Clayton Christensen, used the example of how steel companies recycled steel to make rebar, and thereby disrupt the steel industry by lowering input costs. Disruption can happen through products or processes. As an investor, think about companies who are doing the disrupting vs. companies whose products or processes are being disrupted by new products or processes. Invest on the side of the disruption.

Legg Mason

Disruption is happening in the financial services industry. The latest example is the tribulations of Legg Mason, a well-established investment management firm, famous for its mutual funds. Legg Mason’s core mutual fund business is being disrupted by alternatives such as low- or no-cost ETF’s as well as by the stable of funds available through Vanguard, Schwab, and the like. More and more, investors don’t see the value in investing through Legg Mason when they can get the same basic products with similar or better performance through Vanguard. As a result, Legg Mason is losing assets under management to Vanguard (and Schwab and other similar firms). Legg Mason is publicly traded, and it’s stock took a big hit with the 2008 Financial Crisis and has never really recovered. Legg Mason’s stock is down about 50% since its pre-financial crisis high. Now Legg Mason is in a control battle with hedge fund Trian and its takeover-experienced leader Nelson Pelz. I don’t see Pelz’ wisdom in this – he is, after all, the guy who has lost an estimated $1 Billion in General Electric over the past several years (according to Fortune magazine). However, perhaps there is light at the end of the tunnel if a few things break right.

IMO

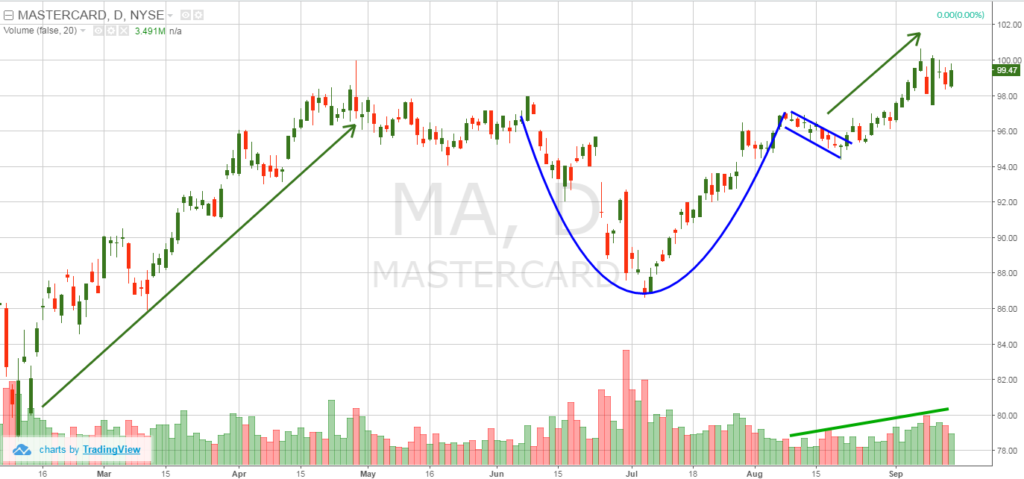

My point is that you should look at a company or an investment from the standpoint of, “Is this a disruptive company?” or “Is this a company that is vulnerable to disruption?” Most times, it makes sense to invest with the company that is the disruptor, because if they truly have a cheaper or better product or process, the world will eventually come to them, though it may take some time to do so. Stocks in disruptive companies usually don’t come cheap, at least from the standpoint of P/E ratio. However, it is probably better to be on the side of history, despite the price. Not all disruptive technologies or companies will make it – for instance, the jury is still out and will remain so for Tesla. So, don’t bet the farm on any one disruptive technology. Even Elon Musk, CEO of Tesla, has diversified, via SpaceEx, the Boring Company, and other smaller ventures. Not all individual companies will make it, but disruptive technologies and processes will always be a thing and you can make good money following these disruptors if you do it the right way.