The helicopter crash in which Kobe Bryant and 8 others lost their lives is so sad, especially for me because of the young lives lost. The terror those people experienced in those last seconds must have been excruciating. Every day is a gift!

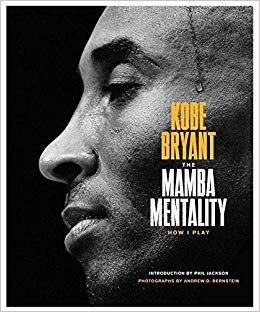

Mamba Mentality

Kobe’s nickname was The Mamba, and he talked about his “Mamba Mentality”, so I looked up what it means. From what I can discern, it is the mindset that one has when they have put in the level of work that is necessary prior to an event, whether the event is a basketball game or an ordinary day at work. If you have put in the necessary work and completed the necessary level of preparation, your mindset will be that you will win. Knowing that you have prepared will give you confidence. By all accounts, there was nobody in the NBA that worked harder than Kobe Bryant. His physical abilities and his legendary tolerance for pain were big helps, but his mindset based on the hard work and preparation was what really set him apart and made him ultimately one of the NBA’s best-ever players.

Mamba Investing?

“Mamba Mentality” translates well to any endeavor. Success is predicated on hard work. If you put in the time, there is a much better chance that good results will follow.

Coaching

Kobe did a lot of work on his own, but he also benefitted from working with outstanding coaches including Phil Jackson and Duke’s Coach K. While I am not comparing myself to either of the two best ever basketball coaches, I am saying that good coaching combined with “Mamba Mentality” hard work is a formula that will lead to investing success more often than not. My ask is that you consider working with a financial planning “coach” such as myself or another qualified person in whom you have confidence and a level of comfort.

Epilogue

A lot of people are sharing their personal stories of Kobe Bryant and I will as well. I live in Newport Coast, CA, very close to where Kobe and his family lived. Kobe went to the same church as me. I saw Kobe and his wife at church, in the supermarket, and around town from time to time. The last time I saw Kobe was late last year. My homeowner’s association had a meeting at the neighborhood community center. I looked in the gym and there were Kobe and his daughter’s team, having a practice. Kobe was visibly happy. Now he, his daughter, and two other beautiful young girls on that team are gone. Two mothers with daughters on that basketball floor are gone. So sad for me. There has been too much of this in my life lately. May all of those beautiful young souls rest in peace!