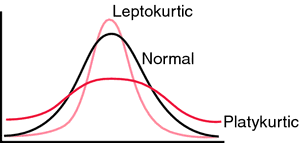

The strategy for Coronavirus is to “flatten the curve” by shutting down large segments of the economy, Social Distancing, and other measures. “Flatten the curve” means to lengthen the period of time of peak infection so as not to overrun our health care system and thereby reduce the number of deaths. Another name for a flatter curve (i.e., flatter than a normal distribution bell curve) is a Platykurtic curve. Think of a platypus with its flat face.

What we have in the stock market is kind of what we would potentially have in the medical system if we didn’t take these measures such as Social Distancing. There has been so much trading volume and so little liquidity available in the trading markets that we have a very steep distribution of depth of market. The high trading volume is flooding the market with orders and the market is having to adjust wildly and quickly to adapt and accommodate all of the buy and sell orders. This is why we are getting 1, 2 and even 3 thousand point swings in the Dow on a daily basis, and why a swing less than 1,000 points in the Dow one way or another now seems like a relatively calm day. Another word for a steep curve is Leptokurtic.

Causes of Leptokurtosis in the Stock Market

Sometimes the cure is worse than the disease. We had the “Great Recession” of 2008-2009, and the banking system bore a lot of the blame. In order to “cure” the abuses of these banks, and as part of the US Government bailout of several commercial and investment banks, through Dodd-Frank and the Volcker Rule, the US Government henceforward prevented banks from trading on their own account. At the same time, the Government increased banks’ capital requirements (i.e., the ratio of equity capital to total bank assets). The net result of these reforms was that it removed the greatest source of liquidity to the trading market. What replaced these big banks as sources of liquidity? Over time, hedge funds, high-frequency trading firms, and ultimately computer-based trading algorithms stepped into the void. Nice opportunity for these firms, but they have nowhere near the capital base that the Goldman Sachs’s, the JP Morgans and the Citigroup’s have. The trading markets became thinner and steeper, more reactive than proactive, and several orders of magnitude more volatile. The cure that banking regulators came up with may have prevented the last meltdown from happening again, but it created the situation that we have now. How much longer will ordinary investors, including those of us who have our retirement savings invested in market index funds, put up with this extreme level of volatility?

How to “Flatten the Trading Curve”

As Governments are trying to “Flatten the Curve” with respect to Coronavirus, the US Government, particularly the Federal Reserve, should try to “Flatten the Curve” with respect to stock trading. One way would be to keep the current high or even raise bank capital requirements while at the same time allow big banks back into the proprietary trading business. This would avail a whole bunch of new equity capital to backstop trading. Perhaps in time all of this new capital would crowd out the computer algorithms, or at least minimize their profitability so that these market swings are minimized. I advocate this deregulatory approach rather than more regulations on trading. Perhaps there are other ideas out there but I would only advocate those that allow the markets to do their job and not to burden traders with more regulations.

IMO

Platykurtic and Leptokurtic are great SAT words, which is ironic because according to collegeboard.org, the SATs are canceled through May. Our governments are trying to make the Coronavirus curve platykurtic while at the same time they are doing nothing to make the stock depth-of-market more platykurtic. Coronavirus can make you very sick, but so can this extreme volatility in the stock markets – at least it gives you severe indigestion. Desperate times call for desperate measures, and as we are trying to flatten the Coronavirus curve by shutting down major segments of the economy, we should also attempt to flatten the stock volatility curve by allowing large, well-capitalized banks back to doing what they did well for years before the do-gooders attached the strings that these banks now abide by.