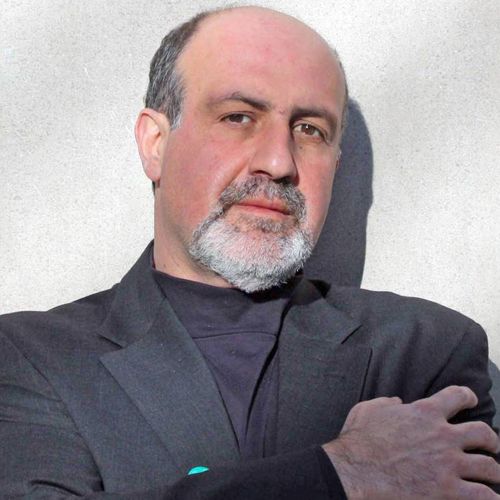

Author Nassim Nicholas Taleb is topical again due to the Covid-19 pandemic. Taleb is the author of several books. The best known among his books are “The Black Swan”, published in 2007, and “Antifragile”, published in 2012 as an extension and culmination of his thought processes that included those outlined in “The Black Swan”. I have read both books. Both are pertinent to the Covid-19 pandemic, but which book has more to offer as we sit here now with the pandemic having hit and as we are debating the merits of reopening various states’ and ultimately the national economy? I argue that we should look to “Antifragile” as a guidepost for reopening.

The Black Swan

The Covid-19 is being described in the media as a Black Swan, meaning a once-in-a-century or so event that nobody could have predicted. This is convenient because the pandemic that Covid is being compared to is the Spanish Flu, which was just over 100 years ago, right after the end of World War I. I disagree. There have been several diseases, including many that originated, as Covid has, in China, in the years since the Spanish Flu. What sets Covid-19 apart is that it seems to be more communicable than the previous flus, and also that someone infected can remain asymptomatic for several days while they are out there infecting other people. A bad flu epidemic doesn’t seem to be that unusual. What is unusual is the economic shutdown that we have forced ourselves into. I agree with Wall Street Journal columnist Holman W. Jenkins on this point. It would have been very difficult to predict that the governments of the US and many other developed countries would have voluntarily shut down their economies.

Taleb’s lesson in The Black Swan is that Black Swan events aren’t really that rare, and that while you might not be able to predict the specific details of a Black Swan event prior to its happening, you can predict and should be prepared that a plus or minus 3 standard deviation event will occur, perhaps when we least expect it.

Antifragile

Taleb’s lessons in The Black Swan may have been useful prior to the onset of the pandemic (say 6 months ago?), but now that we are here and “already pregnant”, so to speak, I think we need to look to Taleb’s magnum opus “Antifragile” for how we should proceed henceforward. “Antifragile” gets to the heart of the debate about the economic shutdowns, the shelter in place orders, “flatten the curve”, and how quickly or slowly we should reopen restaurants, entertainment venues, stores, and the remainder of the economy.

In “Antifragile”, Taleb argues that attempting to shelter people and other organisms from the daily phenomena of the outside world results in them becoming more fragile and less able to adapt once they are set free and launched into every day life. Think about a child who stays with their mother and close family for 5 years before going to Kindergarten. Do you think that child will be more able or less able to adapt to their Kindergarten classmates than will another child who has had a lot of prior interaction with other children their own age? Taleb argues that isolation makes one more fragile, not stronger.

Instead, Taleb writes, the way to strengthen a person over time is to launch them and expose them to all that the outside world has to offer, diseases included. A person builds up immunity to diseases they are exposed to at school or work so that the next time they encounter the disease, they will have some natural resistance to it and are able to avoid getting sick. A child who plays and interacts with a variety of other children will not only gain immunity to disease but will (hopefully) learn how these other people act and think and (hopefully again) learn some social skills. Exposure and interaction is the way one gains strength, not isolation and sheltering inside. Taleb couldn’t find an antonym for fragile so he made one up and called it Antifragile.

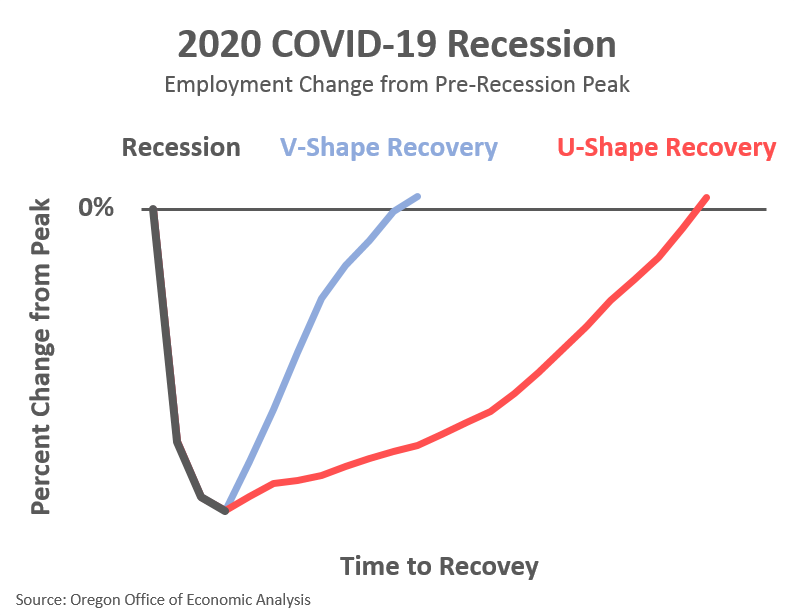

Shelter or Open?

Given this very general overview of Taleb’s two most famous books, how do you think Taleb feels about the debate as to how much longer to shelter in place? I think he would say “Antifragile” should be the blueprint and that the economy should open up sooner rather than later so as to allow people to acquire some level of immunity to this new virus. “Flatten the Curve” is saying a similar thing in a different way. “Flatten the Curve” was intended to slow but not stop the spread of the disease so that the medical system will have time to deal with all of the illness. Implicit in this notion is that people will continue to get sick with Covid, albeit at a slower rate, until either a good treatment or a vaccine is developed. By the way, a vaccine is not a sure thing. The common cold is viral and there is still no vaccine and this is the year 2020.

IMO

Parents cannot completely isolate their children from any bad things out there in the world, and if they try to do so, they are failing by not developing their childrens’ social skills. Likewise, governments cannot forever keep their citizens isolated. Citizens will abide for a short time but not for very long. We are social animals, and if we are bound (collectively) to acquire some form of Covid-19, let’s get on with it. With a few limited exceptions, “Flatten the Curve” has succeeded in keeping demand for medical services at reasonable levels, even below normal levels. Let’s hope that governments heed Taleb’s advice and undertake an “Antifragile” method of opening up our nation’s businesses, even if it is at a slow pace.