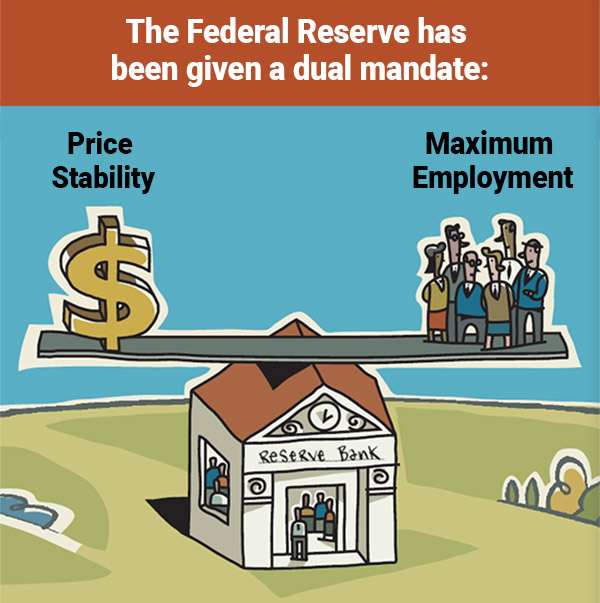

Chairman Jerome Powell yesterday issued a statement that stated which of the US Federal Reserve Bank’s objectives would be more important to them going forward. Hereafter, its “Maximum Employment” objective will be more important than will its “Price Stability” objective.

What It Means

For one thing, Powell’s statement means we can look forward to a low Fed Funds Rate from the Fed for the foreseeable future. The Fed Funds Rate is a short-term rate and the Federal Reserve does not have a direct way to set long-term rates, so long-term rates could very well rise, but short-term rates will stay low. This means that we can also look forward to an upward-sloping yield curve, which is normal and good for bond traders.

Powell’s statement also could mean the Fed could continue to backstop the corporate bond market in an effort to keep workers at those corporations employed. This is good for the workers who might otherwise claim unemployment, but not necessarily good for innovation in this country. There are companies that are on ice temporarily due to Covid (think about anything related to travel or entertainment) and there are companies that were already on the downside and Covid was perhaps the knockout punch. Perhaps these are companies that were in the process of being disrupted by new technologies. While it is nice to keep workers employed, it is not good to stop or hinder the disruption from taking place. Disruption is bad for those who get disrupted but good for the disrupters who replace the obsolescence.

Phillips Curve

Another implication of Powell’s statement yesterday is that he is throwing his (and the Fed’s) lot in with those economists who believe that the Phillips Curve is wrong. The Phillips Curve is the notion in macroeconomics that economic growth causes inflation, and that the Fed must act as the bulwark against higher inflation by raising rates in order to keep the macroeconomy from becoming too overheated and thus too inflationary. With his statement yesterday, Powell is not necessarily saying, “Inflation Be Damned!”, but he is saying he is willing to live with an inflation rate higher than 2% if the trade-off is that more people will remain employed or that more new jobs will be created. The Fed thus is taking even more of a pro-growth stance and is also saying it will remain pro-growth even if inflation ticks up above 2%. Workers and jobs matter more that some metric of inflation that is significant only in a theory that is under dispute.

Fiscal Policy

This also could pave the way for additional fiscal spending. If the Fed isn’t worried about the inflationary ramifications of a growth in government spending, then why should Congress be worried about it? Look for a really large infrastructure bill, likely after the Presidential Election since the Democrats in the House wouldn’t want to give President Trump a win before the election.

IMO

Powell’s and the Fed’s statement are pro-growth. That is bullish for the US economy and bullish for stocks. We are still in the midst of Covid and so growth will be difficult to come by until Covid subsides and/or we have a vaccine. But if you are a long-term buy and hold investor, the Fed is pro-growth and a bit more inflation won’t cause the Fed to put on the brakes.