Most people are happy that 2020 is coming to a close, and for several obvious reasons. Though I obviously didn’t enjoy all of the bad things that happened in 2020, I did enjoy how our country adapted and made the best of a bad situation. Our ability to adapt resulted in stock market indexes that are at or near all time highs despite all the bad that happened in 2020, and that is an accomplishment.

My Outlook for 2021

Interest rates are low and will continue to be low during 2021 and beyond. Rates may bump up a bit potentially at the longer end of the yield curve but you won’t make money investing in bonds during 2021. As a result, I think we need to re-think the “60/40” portfolio. Instead, investors should look to holding a certain amount of cash in their bank accounts, perhaps in a money market account, that they can access easily. Investors will earn almost as much in money market accounts as they will in other more sophisticated bond investments. If you can swing it, consider holding a year or more worth of your living expenses in a money market account. If you spend $200,000 per year, then put that into a money market. Call your bank or brokerage firm ahead of time to make sure you are getting the best money market rate that you can.

Invest The Rest

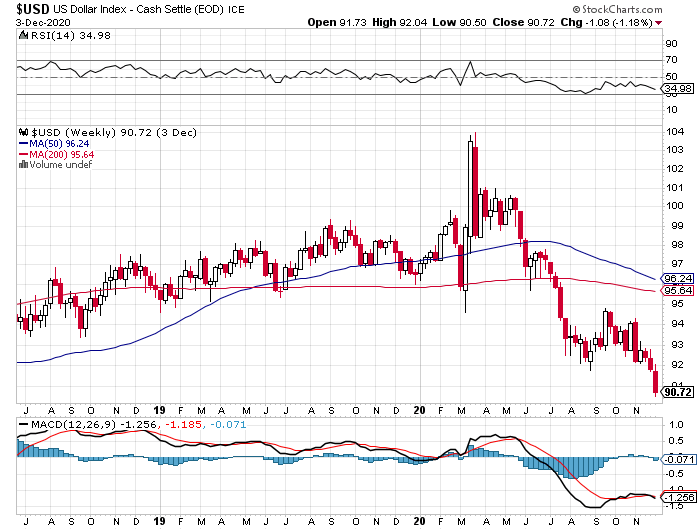

Once you have a sufficient cash reserve, then go ahead and invest the rest. I recommend a mixture of ETFs so that each investment you make is inherently diversified. Look at an S&P 500 Index ETF as the basis, and then potentially look at sector ETFs, including the tech-heavy Nasdaq 100 ETF. Consider emerging market or other international ETFs – there is an argument that the US dollar is headed lower, which will be good for international holdings. By investing in ETFs, including within fund families at firms such as Vanguard or Fidelity, you can diversify and still avoid paying high fees. Consider also dividend ETFs if you need current income, because your current return on dividend ETFs will be greater than the current return on bonds. I believe investors should overweight stocks as long as interest rates remain in the low range where they currently reside.

Geopolitical Issues

The coronavirus vaccine, continued economic recovery as a result of the vaccine, and the latest stimulus bill (depending on its final form) are all bullish for stocks. Stock indexes had a great run in 2020 especially after late March, but I believe the stock rally still has some legs. Internationally, Britain and the EU have reached a post-Brexit trade agreement, which will be good. Agreements between Israel and several Muslim countries are a good thing. Iran is becoming more and more isolated as a result of these agreements, so that remains as a threat, but there never is a time when there isn’t some kind of threat. I don’t see Iran striking out on its own without backing from other Muslim states. It will take all of 2021 to occur but the whole world will benefit from the coronavirus vaccine. Economies worldwide will recover, though likely at different rates. All of this will be bullish for economic activity and bullish for stocks.

Alternatives

Inflation hawks have been warning investors about looming inflation for years and it hasn’t happened yet. That said, deficit spending by governments worldwide is inflationary, if standard economics textbooks are to be believed. Will the trillions of dollars that governments have spent to keep their economies afloat finally cause the inflation predator to rear its ugly head? I believe inflation could be slightly higher but not significantly so. As a result, investors should slightly overweight their holdings of real assets such as gold, commodities, and especially residential real estate. Consider also Bitcoin, which is not a real asset but has been acting as an inflation hedge.

IMO

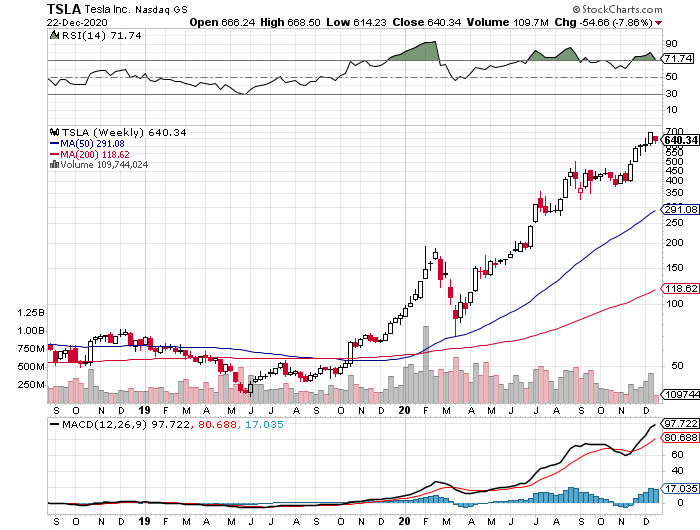

You may be wary of investing in stock indexes right when they are at or near highs, but consider what your investments might look like 3 to 5 years hence. Stocks may have their issues in the short term but have almost always outperformed in the long term. Don’t take any flyers on bubble stocks such as TSLA or hot IPOs such as DoorDash right now – wait and see how these shake out for a bit. If you miss some profits, oh well, but those profits will have been due to the greater fool theory rather than fundamental improvement. Stay diversified in stock ETFs and you should be rewarded during 2021.

Happy New Year and Welcome 2021!!