It’s probably too much to ask for but it sure would be nice if we could get some long-term stability in tax rates and tax policy in this country. The Biden Administration’s tax plan and the (Democratic) House Ways and Means plan that was revealed last week would significantly raise a number of tax rates and would reverse the Trump Administration’s rates that were enacted just 4 years ago. To boot, President Biden wants the capital gains tax rate increase (to 25% and to 28% for taxpayers with $5 million of AGI) to be retroactive to April 2021. How’s that for changing the rules after the game is already underway? Totally unfair, in my opinion. Last weeks revelation of the House plan caused a mini sell-off in the stock market due to the uncertainty of the capital gains rate, as well as of other provisions such as the step-up in basis rule and the combined lifetime gift rule. Financial advisors and planners are at a loss for how best to advise their clients going forward because of this uncertainty and the potential retroactive nature of the proposal. With taxes, the lower, the better, but just as important is stability in rates and policies across administrations and the ability therefore for planners and their taxpayer clients to make long-term plans and be at least somewhat confident that the rules of the game won’t change significantly and especially retroactively along the course.

House Plan

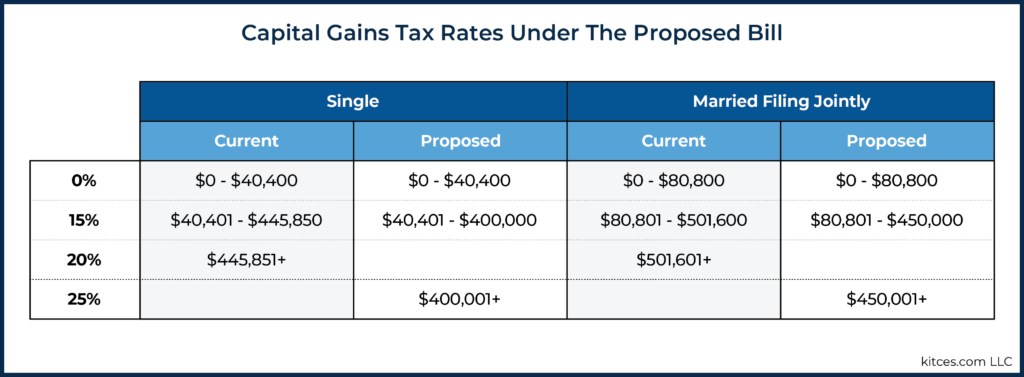

You can Google “House Tax Plan” and find any number of summaries of the House Tax Plan that was revealed last week. Here is one good link that leads to several other good links: https://taxfoundation.org/biden-administration-tax-proposals/. I am not going to go into the whole plan here, but let’s instead look at the capital gains tax rate plan that will affect many investors. Remember that capital gains taxes kick in upon the gain on the sale of stocks (and real estate and other investment assets) that have been owned by the seller for 1 year or more. (Otherwise any gain is taxed at ordinary income rates). Here is a chart published at a leading financial planning website called Kitces.com that shows the proposed increase in capital gains taxes (effective immediately, per the House plan, as opposed to April 2021 per Biden):

You can see that the capital gains rate moves from 15% to 25% for MFJ’s with AGI over $450,000. That’s a big increase and understandably a cause of uncertainty for this group of taxpayers. “Boo Hoo,” you might say if your AGI is under $450,000, but such a change is disincentivizing – why would someone strive to make over $450K if they are just going to pay more in taxes? Maybe you wish you had that problem, but if you did, how would you act? My point is that the “current” rates have been in effect only for 4 years, and now we are proposing a radical change in rates, which could easily be followed by another change in rates downward should the Republicans prevail in 2024. Such a roller coaster with tax rates makes it really difficult for taxpayers to plan their financial futures.

Filibuster

One provision of our government intended to address this specific subject is the filibuster rule that requires a 3/5’s majority in the Senate to pass a law. One would think that a requirement that 60 senators need to vote in favor to pass legislation would prevent these major changes in tax law, right? However, since the late 1970’s, the senate has not abided by the 3/5’s rule and has instead passed budget and tax law through “reconciliation”, which requires only a simple majority to enact budget and tax law. As the parties have become more divided since then (maybe doing away with the filibuster rule for budgets and taxes is part of the reason why? Just sayin’. ), administrations of both parties have used reconciliation to enact budget and tax legislation, as well as other major legislation such as the Affordable Care Act. Now there are thoughts to do away with filibuster altogether, which I believe would be a big mistake and would lead to major swings in government policy in areas even not related to the inflow and outflow of federal funds.

IMO

Putting the filibuster back in as it relates to tax and budget laws would go a long way toward stabilizing our federal tax rates and would really help with long-term planning. Keeping rates lower rather than higher would help even more, but I believe the stability at any level would really help. Perhaps another way would be to make any changes good for 10 years, which is what the George W. Bush administration tried to do, but even that could be overturned by a subsequent administration of the opposite party. True, the right to vote is there for a reason and tax policy is a major reason why voters opt for a certain party or candidate in every election. However, changing the rules, and especially changing them immediately or even retroactively before any legislation is actually passed and signed into law is really unfair to taxpayers and it needs to change if we want to be able to make long term (meaning more than a year) plans for our future.