Two legacies of the Covid-induced worldwide economic shutdown (or at least major disruption) seem to be higher levels of inflation and an increased number of workers (at least in the US) deciding to call it quits. Inflation, I believe, is a direct result of the shutdown and governments worldwide believing they could turn world economies off and back on again like a water faucet with little impact. Absent Covid, inflation would not be a problem now. The increase in the number of people retiring, however, has roots more in demographics than in Covid. Let’s look deeper.

Inflation

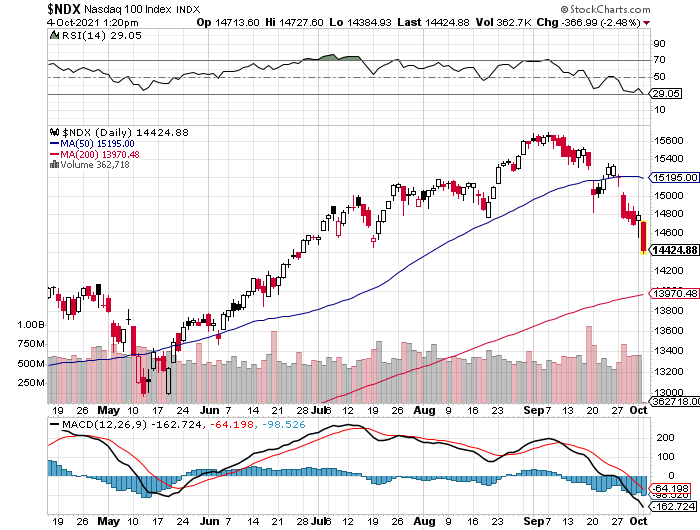

More evidence comes out seemingly every day. Today, this article on Fox Business states that the median expectation of inflation over the next year is 5.3%, which is a lot higher than the Federal Reserve’s 2% projection. Rising oil and energy prices continue to play a role, as this article about natural gas’s rally and this article about Saudi Arabia’s increased shipments to Asia attest. Now, as the information technology sector has exploded as a part of the world economy and the influence of the energy sector has ebbed, we aren’t necessarily going to experience 1970’s-like inflation or stagflation. However, rising energy prices will cause inflation, whether you drive an electric car or an “old-fashioned” gas-powered contraption. Then there are the continuing supply chain bottlenecks. My own eyeball inspection of the queue of cargo ships waiting to be unloaded at the Port of LA/Long Beach tells me that particular bottleneck is not abating. Christmas is coming soon and retailers are telling shoppers to get started now. Hope they have room in their houses to store stuff in secret for a couple of months. Lastly, there is the possibility of a US Budget bill with a price tag of somewhere between $1.5 Trillion and $5 Trillion. Apart from the politics of the budget, when the government infuses $Trillions into an economy that is already supply-constrained, even in the short term, prices are bound to increase. I have stated before that I believe high inflation is more of a short-term phenomenon, but the speed at which these supply chain issues can be resolved will dictate how quickly the inflation rate will be more normalized. Also, the smaller the budget price tag that is ultimately signed into law, the less likely higher inflation will become an issue.

Resignations

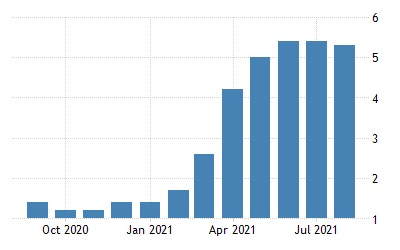

This article posted today says that 4.3 million American workers quit their jobs in August, the most in over 20 years. Workers in food service and retail led the way, and who can blame them? The motivation to want to work at a restaurant now, after having been laid off perhaps for weeks or months during the past couple of years, is probably not it once was. It is likely that many of these former waitpersons are now pursuing their dreams in the information technology sector or some other job that offers more stability. However, I believe demographics plays a role as well. The “Baby Boom” peaked during the late-1950’s, and people born then are now in their early 60’s. Though they probably would have been looking to retire sometime during the next few years, the disruptions caused by Covid have likely tipped a lot of them to retire sooner than they otherwise would have. So, I look at the phenomenon of increased numbers of workers quitting their jobs as part Creative Disruption – workers seeking more stable employment – and part ageing demographics. Regardless, workers quitting is inflationary. Restaurants either have to pay its wait staff more money and thus increase prices on the menu to remain profitable, or dip lower down in the skill level of the workforce, which is probably not to the restaurants’ collective benefit.

IMO

The water faucet analogy was never going to happen and we are now seeing how far-reaching the effects of what we have been through and are continuing to go through on display. The narrative has been that Covid is on the retreat and we are now on the upswing with respect to macro economic performance. However, things like product shortages resulting from supply chain issues or fed up workers moving on to better pastures intervene in the narrative. That’s why you have free markets and buyers and sellers engaging in everyday commerce. I believe in the long term the government stimulus is inflationary and will result in higher asset prices, including higher corporate earnings and higher stock prices. It won’t pick winners, except to the extent that larger, more well-capitalized companies will probably grow at a more rapid rate than will smaller insurgents. Stay long the larger-cap indexes and you should achieve your financial goals if you are a long-term investor.