My file drawers are in a constant state of being overstuffed. I still get paper bank and credit card statements and after I reconcile the statements and pay the bills I stuff the paper into organized files. As time passes, these files get more and more full of old bills. How long should I keep stuff before I toss it?

Paper Chase

For this post, I am using another recent blog posted by Ross Menke at HumbleDollar.com titled “Paper Chase“. Menke says you should have 3 buckets: a “forever” bucket, a 3-to-7 year bucket, and a 1 year bucket. All of your papers should fall into one of these buckets. The 1 year bucket should be the largest. Said another way, there has to be a really good reason to hold on to bills, statements, etc., more than 1 year. Here is more detail on what Menke says:

Forever: Passport, birth certificate, medical records, estate documents such as trusts, wills, medical power of attorneys, insurance policies, real estate and mortgage documents (while you still own the property), and retirement plan contribution records. Menke also says to keep tax returns forever but not supporting records. I keep my tax returns in electronic form.

3 to 7 Years: The IRS says to keep documents that support your tax returns for 3 to 7 years. I keep a Taxes file for each year. According to Menke, I should toss everything after 7 years at the most. The IRS doesn’t conduct as many audits now, so unless you are pushing the envelope for a number of years, your chances of being audited are pretty small. However, that said, if you go by the IRS’s own 3 to 7 year guideline, you should be safe.

1 Year: Everything else! Throw it out! Bills, bank statements, credit card statements, brokerage statements, receipts. Most statements can now be retrieved, if needed, through electronic means, so you don’t need to save paper copies of them. When you get your new Homeowner’s insurance policy each year when you pay the bill, throw last year’s policy away. Same thing with your car insurance policy. Don’t let your files get clogged up with 2 and 3-year-old insurance policies that aren’t even in effect anymore. It is a good idea to save recent utility bills because they may be helpful to prove that you live in a certain place – to enroll your kids in school, for instance. However, throw the bills away after a year.

Why?

Why is it important to throw stuff away and keep your filing current? It’s just like losing weight: You will feel lighter, more nimble, and more able to deal with situations as they arise. As Marie Kondo says, if it doesn’t give you joy, then get rid of it. Throwing stuff away helps you gain and keep control of your life.

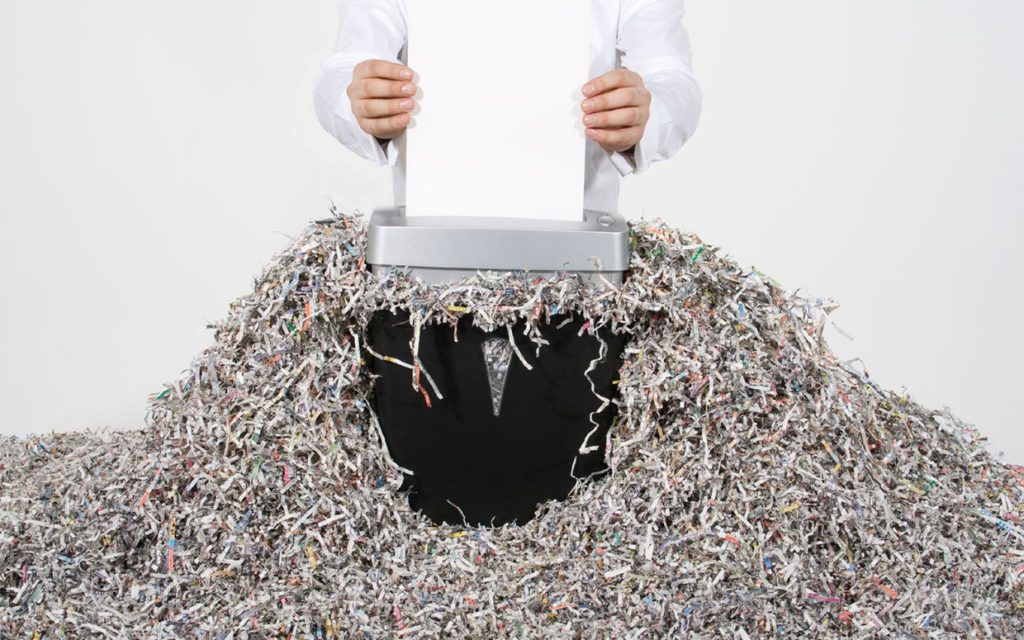

Shred It!

If it is possible, buy a shredder at your local Staples and shred stuff. Then you can put it in your Recycle bin and keep your privacy. Make sure you remove staples or paper clips before shredding, otherwise it’s bad for the shredder. Don’t have a shredder or have too much to shred? Your local city may have a shredding program. Contact them, or contact whoever collects your trash and recycling. If you don’t shred, then at least rip up or cut up your papers so as to make it difficult for bad guys to piece together your account numbers.

IMO

Getting rid of old papers that clutter up your files is an important part of financial planning because it keeps you focused on the future instead of the past. It’s January, and never too late to start a New Year’s Resolution, so I recommend you take some time and pull out the papers you don’t need, using the guide that Ross Menke (with help from the IRS) writes about and that I summarize here.