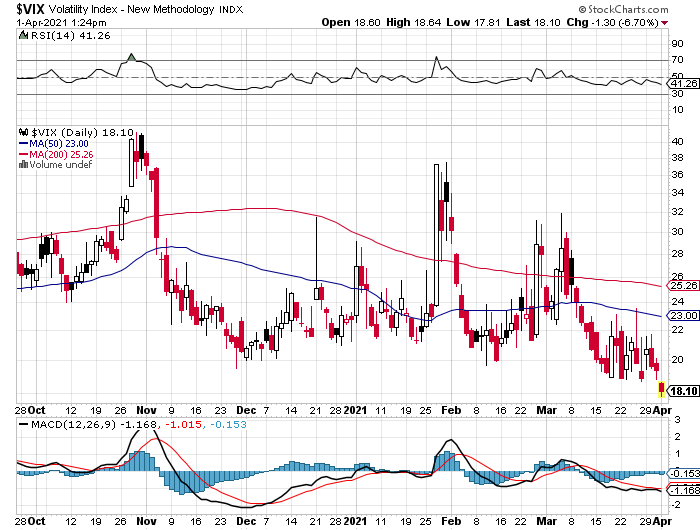

As of this morning, the VIX Index, aka the Fear Index, is hovering at around 18, which is the lowest it has been since pre-Covid. The Equity Put/Call Ratio is low, at around 0.74, which is below its 200 Day moving average of about 0.8. The stock market is “melting up”, with the S&P 500 at an all-time record high and the Nasdaq 100 Index up over 1% today and only about 5% off its record high after a sell-off from mid-February into early March. The $1.9 Trillion American Rescue Plan stimulus bill has been signed, and now President Biden has proposed another $2.3 Trillion to be spent on “infrastructure”, although details of the bill suggest otherwise. The rising stock market suggests that investors believe the upsides of all of this government spending will outweigh the downsides and that corporate earnings will rise, and so investors are buying stocks. Do you believe investors are showing their complacency in this view?

Inflation: The Danger

The big risk with all of this government spending is that inflation will rise and that the dollars that people have will be worth less in the future due to this inflation. Higher inflation means higher interest rates, and though the Treasury market has stabilized for the time being, rates will rise if indicators show that the inflation risk is elevated. It was a rise in rates across the yield curve that caused the mini-correction that we had, especially in the Nasdaq 100 Index, during February and early March. Look for another mini-correction in the stock market if rates move up again, even by another 10 basis points. For instance, if the 10 Year US Treasury Yield rises from its current level of about 1.68% to 1.8%, a rate that it hasn’t hit since pre-Covid, look for stocks to sell off again, with high-multiple Nasdaq 100 stocks being the most vulnerable.

Are Investors Really Complacent?

Though the readings on the VIX, Put/Call Ratio, and the record or near-record levels of the big stock indexes might suggest that investors may be complacent and may not be heeding the risks of higher inflation and higher interest rates, I’m not so sure that the readings show complacency. True, the VIX Index is lower than it has been in over a year, but before Covid, the VIX seldom broke above 20 for the prior 4 years. True, the 10 Year Treasury Yield is up, but its yield was north of 2% as recently as July 2019 and for most of the 3 years prior to then as well. Perhaps the low Put/Call ratio and the “melt-up” in stock prices doesn’t reflect complacency as much as it reflects investor optimism that our nation and our economy are finally returning to “normal” after the Covid period.

IMO

I believe the key will be the rate at which inflation will rise. Watch things closely here. If most of the supply chain issues can be addressed and the rise in inflation can be kept in check, then current investor optimism will have been justified. However, if the stimulus spending coincides with an economy that struggles to emerge from supply chain bottlenecks and other international issues, then the bet may have been misplaced. My guess is that inflation will rise to perhaps the mid-2%’s, but that will be manageable and we will make it work. “Be skeptical when others are greedy” is a good thought to keep in mind at this point.