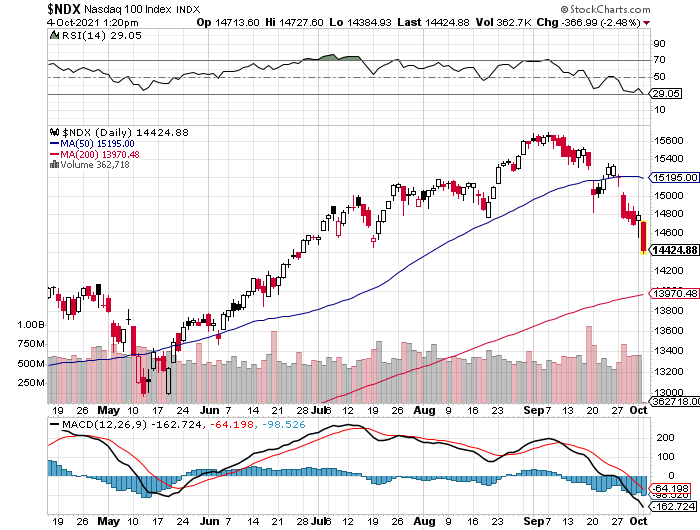

October is not off to a good start for stocks in the tech sector. After a weak September, the tech-heavy Nasdaq 100 index is down today (Monday 10/4) about 2.3% as I write this, and it is down about 10% from the highs it reached in early September. There are several reasons that pundits say are causing this sell-off, but there is one reason that is not given that could mean that this sell-off will be short-lived. Let’s examine.

Rising Interest Rates

One stated reason for the tech sell-off is rising interest rates, and specifically rising US Treasury rates. This is not because investors are going to sell their tech stock holdings and take their money and buy 10 Year US Treasury Notes because the yield on those Notes has risen from 1.3% all the way to 1.5%. Instead, rising Treasury rates cause a tech sell-off because the “risk free” rate is now higher. Remember that the value of a corporation today is its projected future earnings stream discounted back to the present day, with the discount factor equal to the “risk-free” rate (i.e., US Treasury rates) plus a risk coefficient specific to that corporation. When the risk-free rate goes up, even by 20 basis points, then the discount factor also goes up, and the resulting corporate valuation goes down. Rising interest rates are therefore a valid reason why sky-high tech valuations could tumble, because those sky-high valuations were previously justified based corporate earnings being discounted at such a low rate.

Facebook Issues

Last month, the Wall Street Journal ran a series of articles from “inside” Facebook that portrayed Facebook as a corporation focused solely on profits at the expense of teenage girls and their self-esteem and of political consensus and continuity, among other issues. Then, last night on CBS 60 Minutes, one previous Facebook employee went public with information she had copied and taken while she worked there. All of this is bad for Facebook and its stock. FB is down 5.7% today and 15.7% from early September as I write this. Radio silence so far has been the reaction from Facebook management. Also, as Facebook goes, so go the stocks of derivative companies whose models and future prospects are tied to Facebook. What companies will want to advertise on a platform that knowingly proceeds with a business model that causes harm to teenage girls? Is Facebook in the process of being canceled by pop culture? This could go either way, but I believe Facebook management is pretty savvy and that a sincere mea culpa would go a long way toward healing. Too much is at stake if they don’t show some remorse.

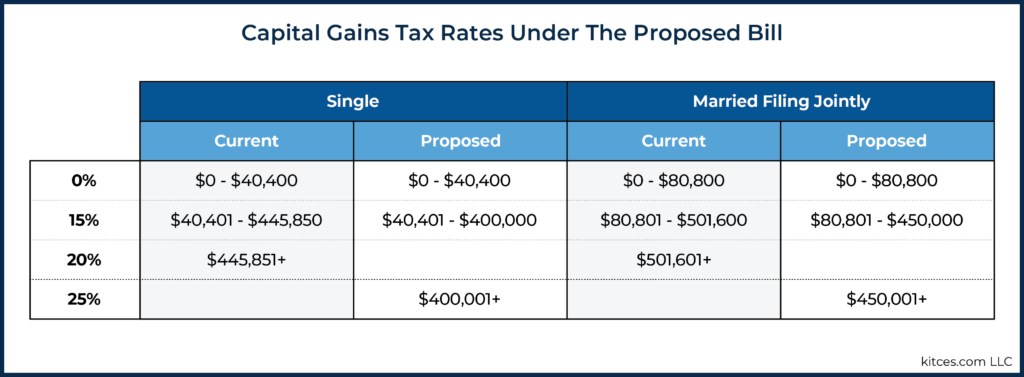

Political Uncertainty

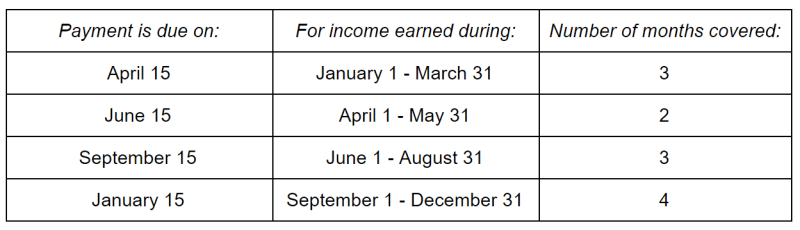

A third reason stated as to why tech stocks are selling off is uncertainty as to the Federal Budget, debt ceiling expansion, infrastructure spending, and even tax and capital gains rates for next year or even, unbelievably, this year. Specifically, these are issues that the Democrats in the House and the Senate need to reach not just consensus but unanimity on. Unanimity because their majorities in both chambers are razor thin, and the Republicans are in near unanimity that any Democrat plan is a race car speeding in the wrong direction. Infrastructure may be bi-partisan but that’s probably all that is. If we don’t know what tax rates are going to be, then how is that good for investment? I believe this will drag out for quite a while because there is limited political incentive otherwise. The longer this uncertainty does drag out, the worse it will be for the stock market.

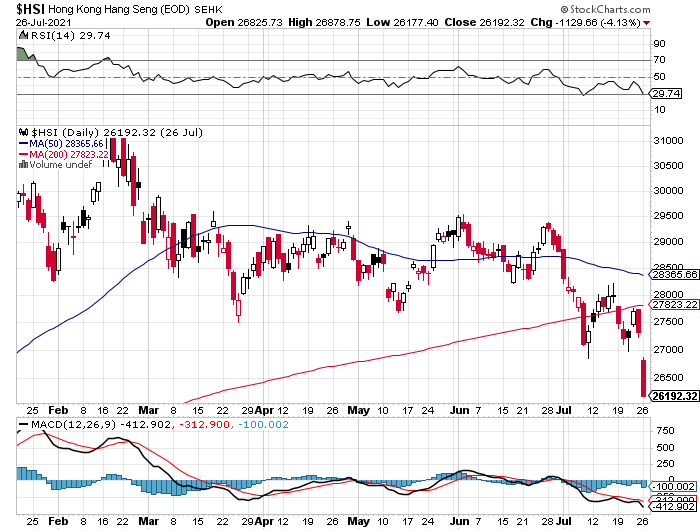

Supply Chain Disruption

As I live in Newport Beach, CA, and it was a beautiful morning yesterday, my wife and I went for a walk on the beach. Before our eyes were two of the biggest news stories in the country: the very sad oil spill off the Huntington Beach coast that is due to a leaking pipeline from an offshore oil rig, and also the queue of cargo ships waiting to unload at the ports of Los Angeles and Long Beach. Your and/or your kids’ Christmas presents could very well be sitting out there on a ship that is temporarily anchored off of South Orange County. Tech stocks are suffering because of this shipping and unloading bottleneck because a lot of high-tech stuff is manufactured and/or assembled in Asia. Delays in shipping that stuff means delays in booking sales by the companies selling that stuff. If you view Amazon as a high-tech company, its stock is actually virtually unchanged for 2021 as of today specifically because of supply chain disruptions. This is quite a reversal for AMZN after the barnburner 2020 stock performance (up about 80% for the year). Though the supply chain may not be as important for software companies, it certainly is for the hardware companies that require the software as well as vendors such as Amazon that are part of the supply chain. These supply chain disruptions are a result of the Covid economic shutdown worldwide, and though these issues should gradually go away as more people worldwide get vaccinated and Covid becomes endemic, it could take a long time for this to happen; years instead of months.

Corporate Earnings

The big nullifier with all of these could be corporate earnings. Poor current corporate earnings is not being given as a reason why tech stocks are selling off. Certainly, any and all of the reasons given could negatively affect corporate earnings in the future. The extent to which these mega-mega-cap high tech companies avoid all of the minefields out there and continue to produce earnings that are at or above expectations will ultimately drive the market.

IMO

I have not sold any of my holdings in the Nasdaq 100 index (I do not own individual stocks in that index). All of the stated reasons given as to why tech stocks are selling off are valid reasons, but I am not convinced that any of these will be bad enough to tank any one stock or the entire sector. I view the Facebook troubles as pretty severe but Facebook’s management must know the peril they are in and I believe they will make it through, bloodied but not broken. Batten down, but ride out the storm. That’s my opinion, and you can use it however you want.