For most of the past 13 months of stock market rally, I and others have written about our concern that the rally is being propelled by a very few number of stocks, particularly by those mega-cap companies that have benefitted through the economic shutdown caused by the Pandemic. In short, the rally has been strong but not very broad. According to this article in Monday’s Wall Street Journal, that seems to be changing. More and more stocks are participating in the current rally, and that is a good thing if you are looking for a sign that the current rally has legs. (Today’s down action notwithstanding).

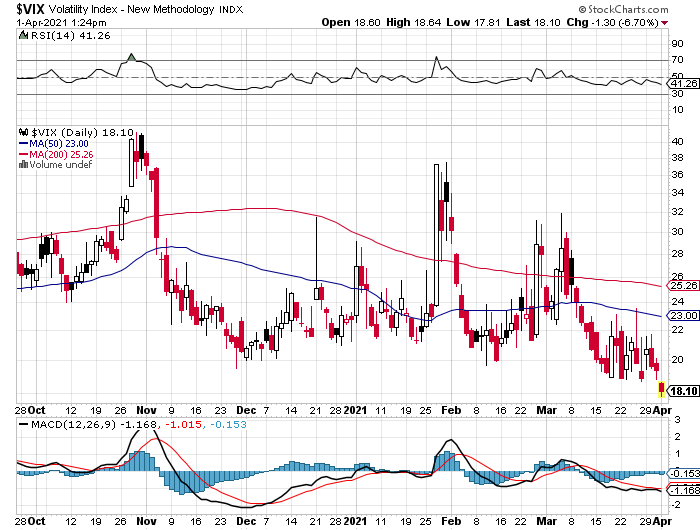

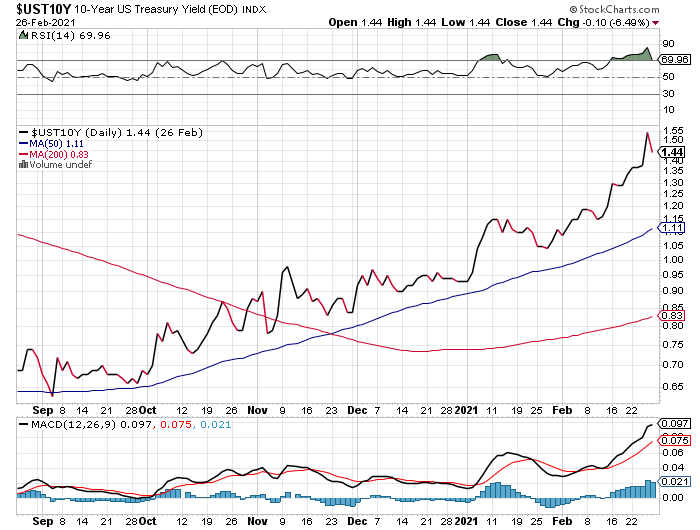

200-Day Moving Average

The WSJ article says that the current rally is broad because 95% of all stocks are trading above their 200-Day moving average, a situation that hasn’t happened since 2009, also the first year after a market correction. 200 days is about 40 weeks of trading, and if 95% of stocks are on a 40 week uptrend, then that is indeed evidence of a broad market rally. The 200-Day is considered to be more indicative of a stock’s long-term direction as has more data points than shorter-term indicators such as the 50-Day.

Stay At Home Stocks

This has not been a straight-up rally for the entire breadth of the stock market, and it remains lopsided with the mega-cap stocks carrying the bulk of the load. However, as more people get vaccinated and more aspects of the economy reopen, companies and stocks that had trouble during the worst of the pandemic begin to show life again and investors continue to look for opportunity. Interest rates remain low and therefore returns in the fixed income sector still aren’t there, and so investors continue to invest in stocks rather than bonds. It seems like a situation wherein the mega-caps have led the way and the rest of the stock market universe is now following along.

IMO

I have been very concerned for the past year about the lack of market breadth. We’re not out of the woods yet, but if 95% of stocks are above their 200 Day MA, then that is a good sign that there is true breadth, and that an issue with one of the mega-cap stocks won’t cause the entire house of cards to tumble down.