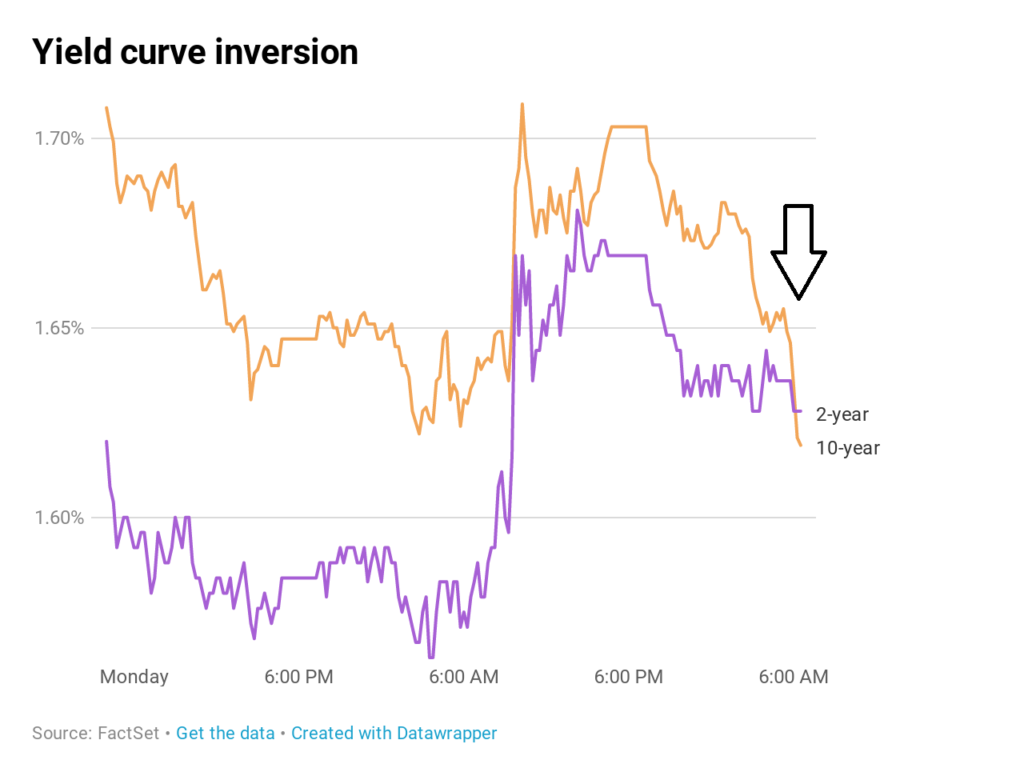

The Dow Jones Industrial Average dropped 800 points on Wednesday, August 14, a day after it rose 400 points. The market is volatile! An inverted yield curve is given as the reason why the Dow dropped on Wednesday. In the past, an inverted yield curve has sometimes preceded an economic recession, which means lower earnings for companies, which means lower stock prices.

My Take

Here are my thoughts about what is going on with the market:

- The yield curve is inverting because money is being poured into the longer end of the yield curve, and not because rates on the shorter end are increasing. According to the US Department of Treasury, the 10 Year Bond hit a recent high yield of 3.24% on November 8, 2018. The current yield is just over 1.5%, less than half of what it was a scant 9 months ago. By contrast, the 3 Month T-Bill’s yield has dropped from 2.35% on 11/8/18 to 1.91% currently – a much shallower decline in yield.

- Money is being poured into the longer end of the yield curve because alternatives for yields on government-issued securities worldwide are even lower. Negative interest rates are back. According to Marketwatch, the 10 Year German bond has a current yield of negative 0.7%, and the 10 Year Japan bond has a current yield of negative 0.24%. Interest rates are negative in much of the world (except for the US) because economic growth in these places is extremely weak or non-existent. Large institutional investors see these negative rates and weak growth and figure these other countries aren’t going to grow out of their problems any time soon, and they see that US Treasuries at least have a positive yield, and that the US economy’s rate of growth in the 3% to 4% range far exceeds that of other developed countries, and so they decide it is a good wager to lock in yields for 10 years, even if those yields are half of what they were 9 months ago. This speaks volumes about the future outlook for Europe and the rest of the developed world.

- Meanwhile, the metrics for the US economy remain good and do not signal an oncoming recession. Despite the 800 point selloff on Wednesday, stock price indexes, which are a leading economic indicator, remain near all-time highs. Unemployment is sub-4%, and workforce participation is rising slightly. Corporate earnings are forecasted to improve, albeit not at the rate they did during 2018.

- The Federal Reserve has been and remains accommodative, including their most recent 25 basis point cut in rates. Per the Fed, it still has $1.4 Trillion of excess reserves in the system, so money is not tight. In addition, the Fed Funds Rate of 2.25% is about half of the nominal GDP growth rate – a metric some economists look at as a predictive element.

IMO

My point is that this semi-inversion of the yield curve is different than previous inversions that have come before recessions. Most other indicators point toward further growth in corporate earnings and therefore appreciation in stock prices. Moreover, there are other issues in play, such as the China trade issue, that can be solved with some political will on both sides. I believe this semi-inversion will not be followed by a recession within the next 2 calendar years, at least.