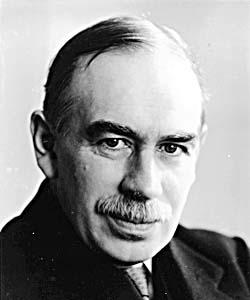

Most people know John Maynard Keynes as the father of “Keynesian” economic policy, which big-government statists have used as a theoretical justification for increased government intervention in the private economy. The thoughts underpinning fiscal deficits are Keynesian: that government increases its fiscal spending during hard times to stimulate aggregate demand so that more people become employed and the hard times ultimately subside. What’s lost in this argument is that Keynes believed the fiscal stimulus should end during good times – that part of the message gets lost in current politics.

Keynes As A Money Manager

What’s less known about Keynes is that he was also a money manager. In addition to managing his own wealth, Keynes for years managed the endowment for one of the colleges of his alma mater, Cambridge University. According to this article, Keynes was successful, earning a compounded annual return of 12% for 22 years ending with Keynes’ death in 1946. These years included the Great Depression, so 12% was pretty darn good for that time. In his personal portfolio, Keynes went from being nearly wiped out in the 1929 Crash to the equivalent of $13 million in today’s dollars by his 1946 death (according to Wikipedia). That’s outstanding!

Methods

How did Keynes manage money? A lot like Warren Buffett does today, and a lot like Benjamin Graham, Buffett’s teacher, did back in the day. Keynes bought stock in companies with strong balance sheets and strong, growing sales and held his positions for a long time, and avoided selling during down quarters or years. Keynes owned a relatively small number of concentrated positions because he preferred to have a strong level of familiarity with the firms in which he invested. Unlike Buffett, Keynes did not take full control over the companies in which he invested, at least through the Cambridge endowment fund, because Keynes preferred to have these investments more liquid in the event the money was needed by the college.

IMO

This shows that there is not a lot new. Buffett’s investment methods are considered state of the art even today, but Keynes was investing the same way almost 100 years ago. It also shows that the Keynes/Buffett Way of investing in strong companies at a favorable price and holding for the long term remains a superior way to build wealth over a long period of time.