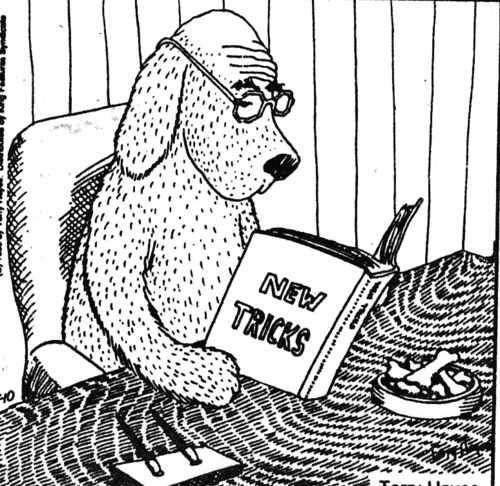

…Would you do it the same? Think about a financial decision you made during the past week – something you decided to buy or not, an investment decision you made, or maybe a dinner out. Now that you made the decision, are you happy with what you did? Or would you make a different decision? Did you consider alternatives? Or did you decide on its own merits without looking at alternatives? Chances are, the way you went about making that decision is similar to the way you make most of your decisions. After all, if you are reading my blog, you are likely in your 40’s or older and are relatively entrenched in your ways. You can’t teach an old dog new tricks, right?

New Tricks

Well, if you are not happy with a financial decision you made recently, perhaps you should think about using “new tricks”, or a new methodology for your own personal financial decision making. Maybe if you take your time to be analytical and look at alternatives, perhaps you will make a better decision or at least a decision you will be happy with, next time. Take your time – is there really a rush or a deadline for you to make your decision? If you feel like there is a rush, maybe next time you need to start the process earlier so that you won’t feel as rushed when the deadline comes? Start with a small decision, perhaps about where to get your morning coffee. You like Starbucks, but is Starbucks really worth the money for you? Could you be just as satisfied with a lower-cost alternative such as McDonald’s? Or can you brew it yourself, even if it means you need to wake up 10 minutes earlier? If you are happy with your Starbucks, then great! You have made a good financial decision for yourself and the cost of Starbucks is a good value for you.

Is Trendy Good?

Take it to the next level of how you invest your money. If you like trendy places like Starbucks (although I know there may be other coffee shops that are trendier), maybe you like to have your money invested in trendy stocks as well. Maybe Facebook, Alphabet/Google, Apple, or Netflix – all trendy high-tech stocks in companies that are still mostly growing. If you like those stocks, be prepared to pay a premium for them in the form of high price/earnings ratios. Does that fit your personality? Or would you be just as happy (or happier) owning less trendy stocks that cost less relative to their earnings? Unless you thrive on volatility (and some people do), less trendy stocks tend to be less volatile and therefore allow you better to sleep at night. In addition, the future earnings potential for these less glamorous stocks (such as high dividend stocks, for instance) may be just as rosy as for the aforementioned high tech stocks.

IMO

Step back and be honest with yourself about a recent financial decision you made, whether it involves big money or small. Are you happy with your decision? If not, then perhaps you need to look (honestly, again) at the way you made that decision. Maybe next time you need to be more careful with how you decide things that involve your money. Maybe part of being careful involves hiring a financial planner like me who will help you with that decision. If so, please let me know and I would be happy to help!