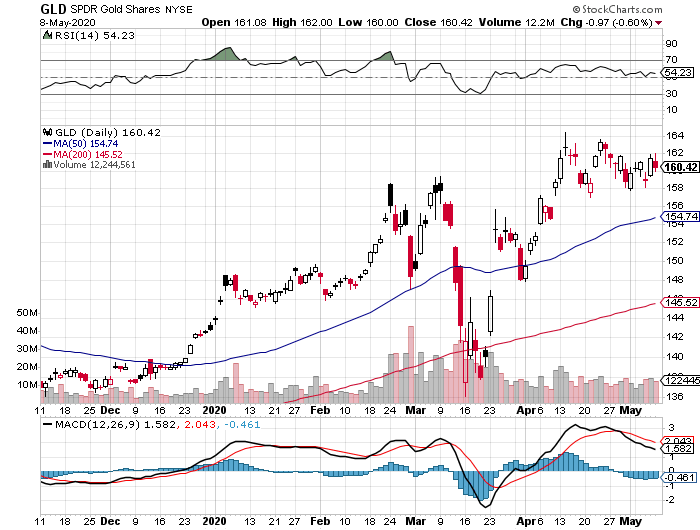

In the US in the past, major economic intervention by the Fed and the US Treasury and a spike in the money supply such as we are having now have led to inflation. For example, the “Guns and Butter” policies of the 1960s resulted in increased inflation in the 1970s. Will this $4 to $5-Trillion expansion we are seeing now lead to inflation down the road? Gold buyers seem to believe so. The spot price of gold in the futures market has risen from about $1,500 per ounce in late March to over $1,700 currently, and the Gold ETF (Ticker symbol GLD) has risen from under $140 to over $160. What do I think?

The Financial Crisis

When was the last time the Fed intervened in a major way and what happened with inflation then? You need to look back only a scant 12-13 years to the “Great Recession” caused by the MBS unraveling in 2007-2008. As a result of that crisis, the Fed expanded its balance sheet by over $3 Trillion and kept it there until it started slowly to reduce its balance sheet during the past couple of years. Did inflation result? Not at all. In fact, Deflation may have been a larger issue. Inflation remained in check because, at the same time the Fed was adding to its balance sheet, the global supply chain was in expansion mode and more and the supply of goods to consumers remained inexpensive. In addition, microprocessor power continued to expand and so people and companies could purchase more power for less cost. Today’s iPhone has 1 to 7 million times more memory than did the computer on Apollo 11. The growth in international trade as well as in computer power is deflationary and so the segments of the economy that drove the recovery from the Great Recession kept inflation in check.

This Time It’s Different?

Will this time be different such that we will have inflation where there was none after the Great Recession? Let’s look at the aspects that I outlined above that kept inflation down the last time. The growth in computing power doesn’t seem to be slowing down. Not-too-distant future trends are projected to include 5G WiFi access and quantum computing, both of which will speed up and improve our ability to access information on the internet. True, iPhone prices go up but the capabilities of smart phones continue to improve. I believe that the growth in technology will continue to be a headwind that will work to keep inflation low.

However, I do think that the global supply chain is in the process of at least a big hiccup. The reputation of China is at least a big loser in this COVID pandemic. Companies have been and will continue to look for alternative sources of manufacturing, and there could be a period of disruption as this adjustment takes place. In addition and related to supply chain issues, we have meat shortages projected due to the closing down of some meat processing plants and also due to the shift from supplying to restaurants vs. supplying to grocery retailers. If the supply of restaurants diminishes through the closure of some restaurants and the reduction in the number of seats available in the restaurants that remain open, what do you think might happen to the cost of going out to eat? There is a good chance that it will cost significantly more.

IMO

So I do think there is some validity to the inflation argument this time, at least for the short term, meaning the next few years. Then again, if it is harder to get a dinner reservation and it costs more to eat out, perhaps people will adjust and eat at home more, thereby keeping prices lower. Don’t forget, we have 14% unemployment which could be headed higher, and so there may not be the disposable income available out there to pay for higher restaurant prices even if and when they do open up again. I think this is a more disruptive and deeper recession than we had after 2008 and we could see higher inflation at least for a short period. Don’t bet the farm on it, but it is always good to have a portion of your portfolio invested in inflation hedges such as Gold or even real estate (particularly residential real estate this time). Perhaps there is some merit to the rise in the price of Gold.