Last Tuesday I posted about my Covered Call strategy. Today I want to discuss one element of call writing: option expiration dates. For most of the largest indexes and individual stocks, there are many expiration dates to consider. I usually sell (write) options that expire weekly at the end of trading on the ensuing Friday.

Expiration

This is a big difference between owning a call option vs. owning the underlying stock or index outright. When you own the stock outright, you don’t ever have to sell it. There is no expiration date on its ownership. However, options have expiration dates, which means their value is finite. After their expiration dates, they are either worth what the underlying stock is worth (if the option is “in the money”), or they are worth nothing. They are binary: all or nothing.

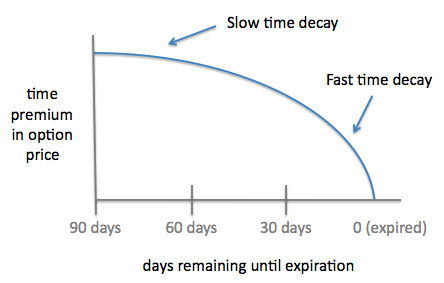

As the calendar moves closer to the expiration date, the value of a call option decreases, all else being equal. For example, a call option that is $1 out of the money one month prior to its expiration is worth more than a call option $1 out of the money one week prior to expiration. This is called the option’s “time value”: the value of a call option erodes over time.

The Trick

When writing call options, the trick is to choose the expiration date with which you are comfortable, and/or for which you earn the best value. I like to write options on a weekly basis because I feel like I can better understand what might happen for the next week than I can for the next 2 weeks or next month. Granted, because of the time value erosion in the value of the call options I don’t sell weekly options for as much as I would sell monthly options. However, a lot can change in a week, and I believe I can make more money with less risk by selling weekly options than I would if I just sold monthly options. Transaction costs, while there are some, are not significant enough to sway my methodology and cause me to write monthly options just to save money on commissions.

IMO

When an option expires has a significant effect on the value of the option because of the binary nature of options at their expiration. When I sell call options, I try to find the sweet spot between getting paid and minimizing risk. Most of the time for me that sweet spot is with options that expire every week. That way I keep a close eye on the markets and my positions without having to sit in front of my terminal constantly worrying.