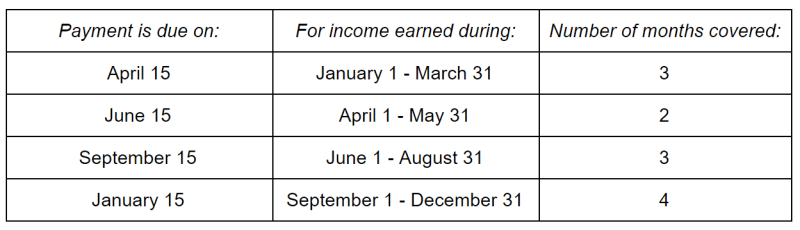

Today is June 11. Don’t forget to pay your quarterly estimated taxes on or before June 15, which is next Tuesday. “Wait a minute! I thought my taxes aren’t due until April 15 next year”, you might think. That is correct, if you are a regular employee, someone who receives a Form W-2 at the end of the year. If you are a W-2 employee (as I call them), you likely don’t have to concern yourself with making quarterly estimated tax payments, unless you have a lucrative side gig. For most other people, however, making your quarterly estimated payments is an important thing. This includes gig workers, independent contractors, and anyone else who isn’t on a company’s payroll and who receives a Form 1099 at the end of the year. Although the 2020 tax return date was delayed until May 15, 2021, there has been no delay in the due date for 2021 taxes, so June 15 remains the next due date for quarterly estimates.

Growing Numbers

According to this posting in Forbes from a year ago, 28% of workers claim to be self-employed and 14% claim to be independent contractors. Earlier postings show the independent contractor percentage to be 8% to 10%. A lot of people signed up to be Uber drivers in the 2-3 years prior to 2020, and all of them are independent contractors. Both self-employed workers and independent contractors are subject to paying quarterly estimated taxes.

Safe Harbor

How much should you pay to avoid a penalty? The IRS provides a somewhat confusing (is there any other type for the IRS?) Safe Harbor rule, which is that you can avoid a penalty if you pay 100% of your tax bill from the prior year (in quarterly increments), or 110% if you made over $150,000. Your state will also have its own Safe Harbor rule that may or may not match up with the IRS’s rule. For instance, in California, where I live, the 100% rule is in place but the timing of the payments is accelerated such that 70% of the payment must be made by June 15. California penalties for underpayment are steep, so make sure you are aware of your own state’s rules – unless you live in a no state income tax state.

IMO

Paying a penalty is the pits, so please pay attention and make your estimated quarterly payment by next Tuesday if you are self employed or an independent contractor. Other links to read if you have time on your hands: