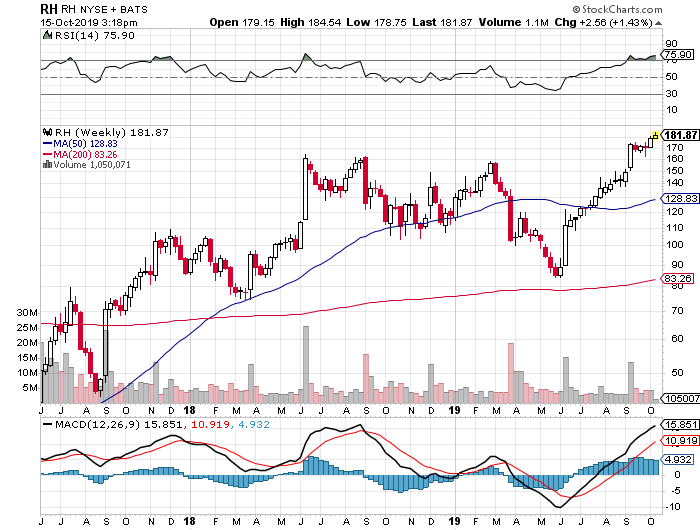

RH, formerly known as Restoration Hardware, is confounding to me. They seem to do everything wrong, but their stock keeps going up! As this weekly chart shows, RH is up almost 40% YTD 2019 and has more than doubled since a correction in May from below $90 to above $180.

What Does RH Do “Wrong”?

Catalogs: RH still sends out catalogs to its existing and would-be customers. Not just cheap, thin catalogs, but heavy, thick, glossy, expensive catalogs, and multiple catalogs each year. It doesn’t seem to make sense in this age of the Internet and corporate websites that a large-scale retailer such as RH would bet big on catalogs, but they have done so. The Sears Catalog is a bit of American nostalgia that was a big thing in the early 20th Century, and some other retailers still mail catalogs, but not on the scale of RH. Yet, sales grow at RH and operating margins remain strong, in the high-teens, according to the RH corporate website. By the way, RH also has a big, glossy website, to complement its catalogs.

Big Stores: RH is opening new, big Gallery stores and has a presence in most major retail markets in the US, with an eye toward international expansion of its retail stores. This defies the conventional wisdom that the likes of Wayfair and Amazon will gain market share in the furniture segment without such a large build-out of “old fashioned” retail stores. RH believes that its customers want to see, feel and experience their product first-hand and not on some website, and so far so good with that.

Lack of In-Store Inventory: RH has big retail stores but they don’t have a lot of inventory in them. Instead, RH’s stores are more like showrooms. If a customer wants to buy something, even something small, chances are the in-store salesperson will order it through the RH website and have it delivered either to the store or to the customer’s home. Usually, the reason one goes to the store is to buy something and bring it home, but not at RH. Granted, it doesn’t make sense to stock large furniture at the store, but RH doesn’t typically stock much at all at their stores.

What does RH Do Right?

Inventory Control: Since it stocks most of its inventory in warehouses and not at stores, RH can better manage its levels of inventory. This keeps them from overspending. RH also has a “just in time” system that works well most of the time, although its website does admit to some glitches. RH has also been able to avoid issues with tariffs by moving some manufacturing out of China and into other countries. It hasn’t been 100% smooth but RH has done a good job keeping things running.

Membership: Instead of constant sales, RH keeps its prices relatively stable but offers a membership program that currently charges $100 per year in exchange for 25% off full-priced items. Sounds kind of like Amazon Prime, but without the Video service. RH believes its membership program increases customer loyalty.

High-End Demographic: RH’s products appeal to a high-income demographic which appears not to be as price sensitive. Sales and remodels of high-end homes are still strong and mortgage rates remain low, all of which are good for RH.

Restaurants: Who ever heard of opening a restaurant in a furniture store? RH is doing just that in a few locations, and the restaurants are a hit and are causing a buzz. The restaurants are driving traffic to their stores, which is good for sales. The food is good, too!

Good Products: RH’s high-end customers are satisfied by high-quality products from RH. RH produces good stuff that their customers like, and so they go back and sign up as members so that they can buy more stuff at a better price. It’s a good cycle for RH.

IMO

I am not recommending to buy or not to buy RH. The purpose of this post is to recognize that RH does things in ways that fly in the face of conventional wisdom and that despite this, or maybe because of this, RH has been able to enhance shareholder value, particularly in the last couple of years.