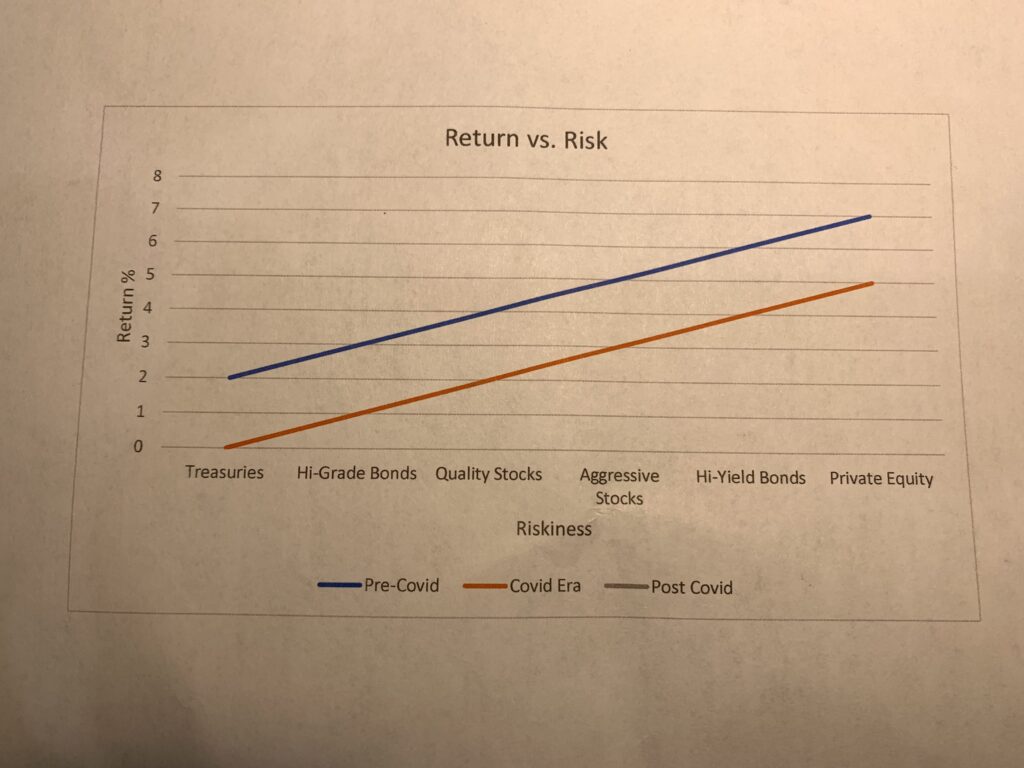

This point is directly from the latest Insight Memo from Howard Marks, the legendary investor and head of Oaktree Capital Management. Mr. Marks says he believes (and I agree) the major stock indexes have risen so dramatically since March because interest rates have been reduced to near zero. The Fed reduced the Fed Funds rate by 150 basis points to near zero in one fell swoop in March, and longer-term rates soon followed suit. This decline in rates reset return expectations across the gamut of asset classes. If bond investors are willing to accept 150 – 200 basis point lower returns on their investments, then stock investors will accept lower returns on their investments, which means that stock prices increase, as long as returns (i.e., earnings) remain constant.

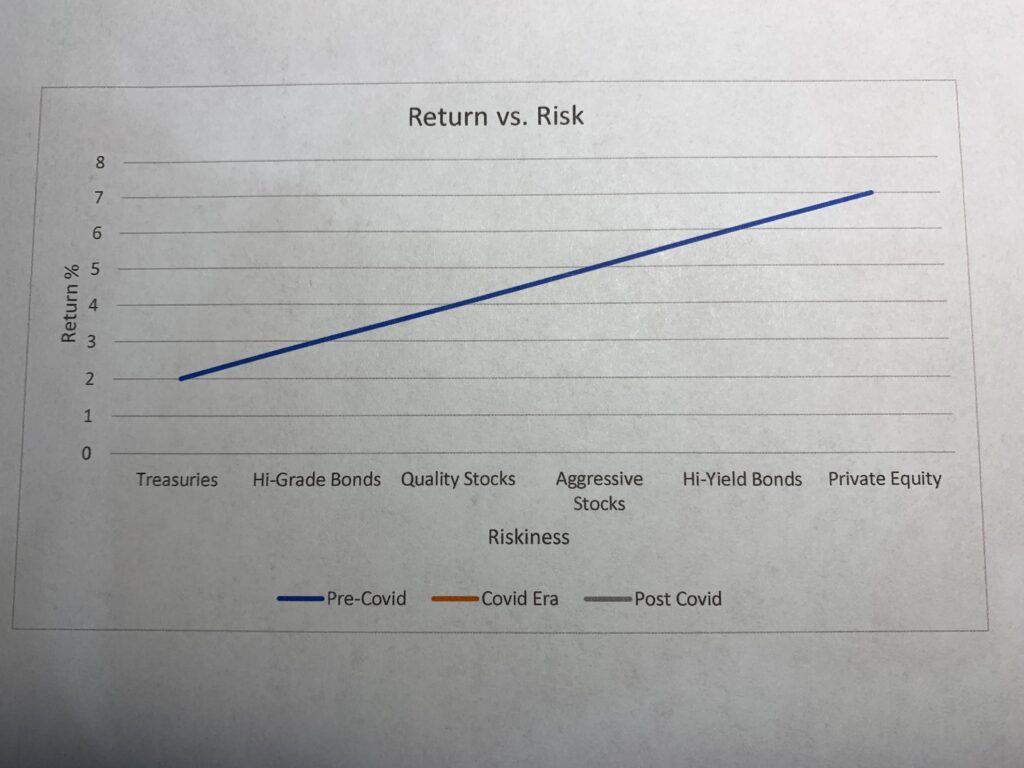

The following two charts (created by me using my admittedly wanting level of technical skill but taken directly from Howard Marks’ memo) illustrate what I mean. The blue line on the first chart shows the returns that investors expect with different investments with increasing levels of risk. Riskier investments require higher rates of return, from “risk-free” US Treasuries up to private equity capital. Before Covid, investors were looking at a return of perhaps 2% or thereabouts on Treasuries and upward from there – that’s what this chart attempts to portray:

This next chart adds an orange line that shows how investors’ expected returns have shifted during this Covid era. Notice that expected returns during the Covid era are lower across the board from the pre-Covid era:

The Fed

It is the Fed that took the first step when it dropped the rate on the Fed Funds Rate to near 0%. That step took down the yields on all Treasuries across the entire yield curve. With “risk-free” Treasury returns at near zero, investors searching for return quickly began to invest farther out on the risk spectrum, particularly in “quality” and “aggressive” stocks, thereby bidding their prices up and expected returns down. Without the Fed Funds and US Treasury rates as low as they are, we would not have had the stock market rebound to the extent that it has.

The Future

The Fed has been explicit that rates will remain low for the next several years. The long end of the yield curve has seen higher rates in recent days, meaning the yield curve is less flat and more upward sloping, which is probably a good thing. Investors therefore don’t need to guess which way the Fed is leaning, which eliminates an element of uncertainty from the forecast of where stock prices are headed. The point is that interest rates that are this low and will remain this low for the next several years are bullish for stocks. This is not to say the stock market will head straight up because there are a lot of other uncertainties out there related to Covid, geopolitics, US elections and ensuing governance, as well as fiscal policy. There will also continue to be technological disruptions through which some companies will win and others will lose. Yet we have seldom had a situation wherein rates are this low and we have been told that they will remain this low for a period of time. Understand that the Fed has given us investors this knowledge and this investing environment. We ought to take advantage of it.