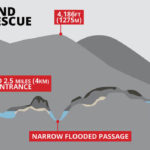

The world is riveted to the story of the Thai youth soccer team and their coach who got stuck in a cave in Thailand. It is an international rescue operation, which is something for humanity to be proud of, regardless of the outcome, which has turned out to be positive.

Don’t Go In There

Most people recognize that the mistake was to have gone into the cave in the first place. This group went all-in on an adventure wherein there was only one exit and its door was closing quickly. There may have been upside to exploring this particular cave, especially to pre-teen and teenage boys, but the upside could not have been commensurate with the downside, which was the possibility of losing their lives. Of course, this lapse in logic is not atypical when it comes to teenage boys.

Lessons for Investing

Perhaps I am drawing an obtuse connection here, but I think there is a lesson here for investors. The lesson is: Don’t enter an investment where there the risk/reward ratio is asynchronous: limited upside but unlimited downside risk. And, if you do so, please don’t go All-In! You could lose everything! Always leave yourself a plausible exit strategy. Realize that if you potentially could lose everything in an investment, make sure it is only a small amount that you can afford to lose.

Casino Analogy

Imagine a casino in a Communist country, and you decide to play Roulette there. You decide to put all of your money on Number 4. If you lose, you lose everything. If you win, that’s great, but the Communist government takes 90% of your winnings. That is effectively what this Thai soccer team did: They entered a situation where the risk/reward ratio didn’t make any sense.

Investing Analogy

Most publicly-traded stocks have some market, so you can usually get out of a stock, even if it is for pennies on the dollar. The same thing for real estate – there is value in the land if nothing else, and the owner can usually sell it for some value. The closest examples to the Thai Cave are probably some type of private limited partnership, such as an individual oil well that is a dry hole, or an annuity or another insurance vehicle where the insurer is poorly-rated and ultimately goes bankrupt. In these situations, it is very difficult to sell your interest once you buy it. However, there is upside to both, and so these are imperfect analogies but you probably get the point.

IMO

This being 2018, and with the world’s media focused on these unfortunate Thais, now that they have been saved, it is likely that their story will be sold for big bucks, and their upside to them will have been monetized. That was probably not their intent when they entered the cave, but things could work out that way. Another upside to the story, as I mentioned above, and also not the intent of the cave explorers has been the sense worldwide that everyone is pulling for them and hoping for their rescue, even for the poor coach who led them into the cave in the first place. Beware of caves when you invest your money!