Back on December 22, 2020, I wrote that Tesla was severely overvalued and that investors should get out right away. It was trading at about $600 per share at that time and its market cap was more than those of the next 9 automakers combined.

How Wrong I Was

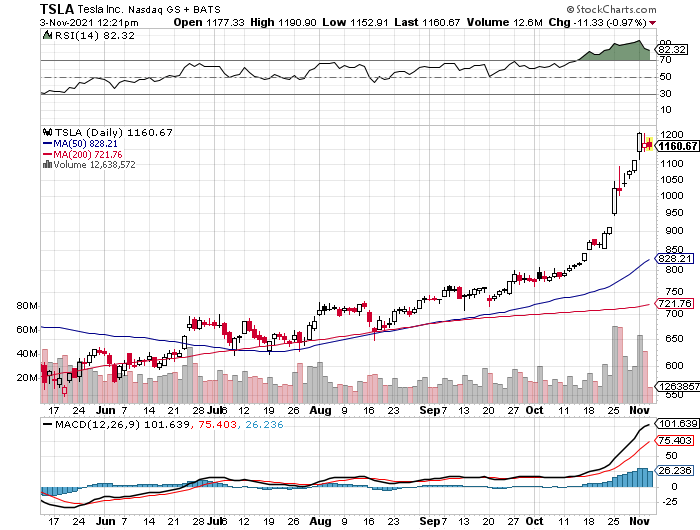

Since then, TSLA has doubled to about $1,200 per share, with about 400 points or 2/3 of that uptrend having occurred since October 1. Instead of the next 9 automakers, TSLA is now worth more than the next 11 automakers combined, and its market cap is in the stratosphere at over $1.1 Trillion. Congratulations to Elon Musk and the entire Tesla team for this outstanding achievement! Had you followed my advice back in December, you would have missed out on doubling your money in TSLA. Oops!

But…

Despite the facts of the matter that prove my December call to have been totally wrong, I believe that my reasoning was sound. And, if I believe my reasoning for recommending a Sell back then was sound, then what do you think my recommendation is today? Sell, even more emphatically. Let me clarify: If you own a block of TSLA and you still think it could go up more, then sell part of your block and have at it with a smaller position. If you can, cash out on your original investment and go forward with “house money”. If you don’t own TSLA now but like what you see (who wouldn’t), don’t buy now, but wait for a correction. If and when TSLA corrects, look beyond the stated reasons for the correction and buy in at that point if you are so inclined. Stocks that run up quickly (say by 100% within a year) tend to endure periods of profit taking and consolidation. Wait for that if you must play in the TSLA sandbox. If no correction occurs, don’t play.

Meme Stock

TSLA has clearly become a “meme” stock – a stock that is popular on social media and among retail investors. Just during the past week, I have had people whose investment experience is otherwise limited ask me about TSLA call options. These are not investment pros; rather, they are everyday folks who are caught up in the TSLA frenzy and are eager to play. That tells me that TSLA has become untethered to any sense of fundamental value and is currently trading based on the “greater fool” theory. Granted, TSLA is profitable (a fantastic achievement!), but it trades at 380 times current earnings and 148 times projected future earnings (Source: Finviz.com). As I said back in December, only if TSLA hits every most-optimistic growth rate can one justify a 148 times forward P/E. And, if and when TSLA does hit the most optimistic metric, the stock will probably go up again. I don’t view myself as a fundamentalist, value-based “cheapskate” investor. I don’t think P/E ratio is a valid valuation metric for growth companies. I do like playing momentum opportunities when I see a good one. However, TSLA at $1.1 Trillion and 148 times forward earnings following a doubling during the past year is beyond the pale.

Don’t Short

One work of caution: Don’t short the stock. Buy a put if you would like, but TSLA puts are costly. My advice back in December was to sell, and not to short. Had you shorted at $600/share, you would have lost your shirt during 2021. It is very hard to predict when a popular meme stock will fall from grace. Don’t try it yourself at home.

IMO

When the kids are in there playing TSLA just like the hottest video game, you should think that there is trouble ahead. I can’t tell you when that will be, but I can see short attention span kids fleeing the stock as soon as they lose money or find the next sparkly thing to throw money at. I still believe that new entrants into the electric car market – both established auto companies (Volvo, BMW) and new entrants (Rivian, Polestar) will eat away at TSLA’s share of the e-car market. If you have “fun” money that you are willing to risk, then be my guest with TSLA, but don’t bet the farm on it.