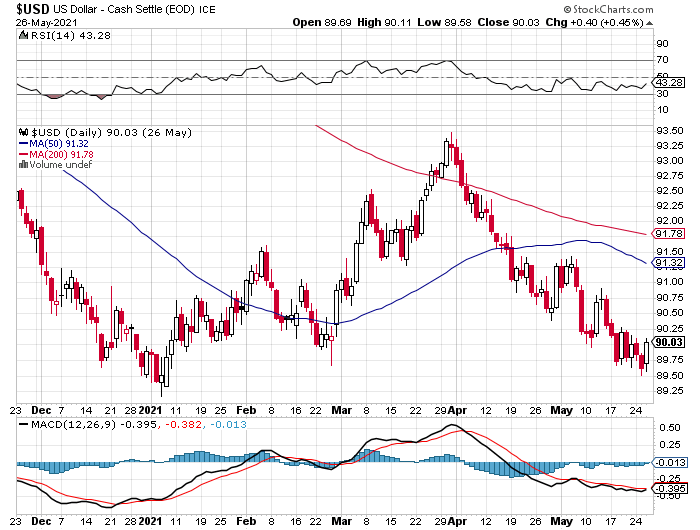

Let’s take a look once again at the strength of the US Dollar. As you can see from the chart, the value of the US Dollar (relative to other world currencies) has been declining since mid-March. From its high of about 93.25 in March, the Dollar index sits right at about 90. At 90, the Dollar is re-testing a support level it reached in early January 2021. Trading is showing some bottoming action, so we will see soon if the support holds or not.

Why?

Why has the Dollar been falling in value relative to other currencies? One reason is that US interest rates have stabilized during the same period and remain high relative to interest rates in other large world economies. For instance, from 1/1/21 to 3/31/21, which is the entire First Quarter, data from the Fed shows that the yield on the 10 Year US Treasury Note rose from 0.93% to 1.73%. However, since then, its yield has stabilized and dropped slightly to 1.58%, as I write this. Rising interest rates mean international money moves into the Dollar, which means the value of the dollar increases. When rates here are stable to falling, the opposite happens, and the Dollar falls in value. That is what has happened thus far during the Second Quarter.

What Else?

What else happened as the Dollar has fallen in value? The stock market rose. Since 4/1, the S&P 500 Index has risen from about 4,000 to about 4,200, but if you go back 3 weeks to early March, the Index sat at 3,750. A weaker Dollar means that more of them are needed to buy assets, so each Dollar is not as valuable.

Another piece of data is that the April annualized inflation rate was 4.2%, the highest in many months. Did the higher inflation rate cause the Dollar to decline? Or did the Dollar decline cause the higher inflation rate? Probably a bit of both. Supply chain issues coming out of the Covid economy have caused inflation to spike. The Fed says this is transitory, but we will see if they are correct. Higher inflation and a weaker currency go hand in hand.

IMO

Don’t look for a return to rising interest rates to bail out the decline in the Dollar. Yields on similar-termed government bonds in Europe remain below 0%, and so international sovereign bond investors will continue to buy US Treasuries because at least their yield is positive. This will continue to hold US rates relatively low, and likely not to increase much if at all. This means I project the Dollar Index will stay low and perhaps break its support level of about 89.5. What might be the catalyst to break the current situation? If supply chain issues prove to be temporary and rectify themselves, thereby showing inflation to be relatively tame or at least within the Fed’s target. Lower inflation figures should cause the Dollar Index to at least stabilize. Perhaps what is behind the bottoming action of the past week or so is the thought that the reopening of the economy is going well and that inflation will not spike as much as April’s figure suggests it might.