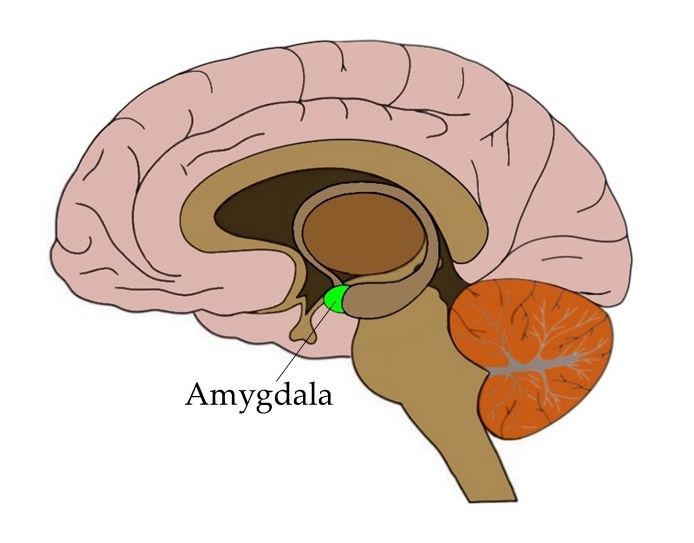

The Amygdala is the part of your brain that plays a “primary role in the processing of memory, decision-making, and emotional responses, including fear, anxiety and aggression.” (Wikipedia). Studies of human behavior related to investing show that the amygdala kicks into high gear during periods of stock market volatility and/or during market corrections. Fear generated by the amygdala is why people tend to sell while the market is cratering, buy when the market is at a high, and generally not to act rationally.

Economic Man vs. Amygdaloid Man

Most economic theory has the base assumption that the investor is always rational and always acts in their own best interest. For instance, the “efficient frontier” theory says that an investor will always choose an investment that provides them for the highest possible return for the lowest possible risk. This is all very rational and machine-like. Nobel laureate Richard Thaler calls this the “economic man” theory, after which he proceeds to shoot holes in that theory. Economic Man assumes that such man doesn’t possess an amygdala, or at least that they are able to squelch any input that the amygdala and its onslaught of emotion and fear will have on one’s ability to make rational decisions, especially during volatile markets.

Contrast “Economic Man” with “Amygdaloid Man”, wherein most if not all decisions are made by gut instinct and ruled by fear. Which do you think is closer to the way most investors make decisions about how and when to invest their money? They probably know they should be more rational and they even may try to do so, but the amygdala is very strong and more than counteract any rules or rationality one tries to use when they invest.

Quantitative Strategies

It is for this reason that the investment world is moving in the direction of quantitative, computer-based trading strategies, specifically to try to keep the fear and emotions out of the decision-making process. If an investment manager relies purely on rules, or, better yet, on proven quantitative models for how and when to buy or sell securities, studies show that such an investment manager is more likely to achieve the ultimate goal of investing, “buy low and sell high”, and thereby make money for their clients and themselves.

IMO

We are in a period of higher stock market volatility. Please try as best you can to keep your foot on your amygdala and to not get too involved with the day-to-day ups and downs of the stock market. One good way to keep your amygdala at bay is to work closely with a professional investment manager (such as myself!). If you work with a professional and at least talk through decisions you are considering, you are much more likely to make a better, more rational decision and to establish goals, plans to meet your goals, and to stick with your plan.