You may have read or heard that the price of oil went “below zero” earlier this week. Before you get too excited, this doesn’t mean that your local gas station will be paying you to fill ‘er up, instead of the other way around. Instead, the “below zero” relates to the oil futures market, and specifically to the futures contract that was to expire the next day. For all of you procrastinators out there, it means that those oil producers who waited until the last day to sell their product ended up getting screwed.

Oil Futures

Oil producers substantially sell their oil through the futures market. The New York Mercantile Exchange (the NYMEX) provides the major market for oil futures, and their futures mature every month. One futures contract is for 1,000 barrels or 42,000 gallons of oil. If you are “long” on a futures contract at maturity, you will take delivery of however many contracted barrels you are long.

The futures market functions so that oil producers have a market mechanism they can rely on to more smoothly sell their product and to lock in a price ahead of time so that they know what their revenues will be. For buyers on the other side of the transaction, through the futures market, they can book their price and quantities so as better to plan the amount of oil they will have in storage at a given time.

May Contract

With respect to the May contract, which is the contract that matured earlier this week and went below zero, the reason it went below zero is that there is very little excess storage capacity right now. Big oil storage tanks stateside and oil supertankers out at sea are mostly already full. Buyers of the May contract would have to take physical delivery of the oil in May, but with storage capacity already full, there was no place to put the oil, so sellers had to pay buyers to take it off their hands. My point is that the “below zero” aspect was a very short-term phenomenon due to the lack of storage capacity.

Coronavirus

Why is storage capacity so chock full? The Coronavirus shutdown, of course. With so many businesses closed down, and particularly with airline travel way down, meaning jet fuel consumption is way down, daily demand for oil is down about 20% by some estimates, from about 100 million barrels per day pre-Coronavirus to perhaps 80 million today. As a physical product with long production and storage periods, oil has difficulty with a demand shock such as we are in today.

Investment Opportunity?

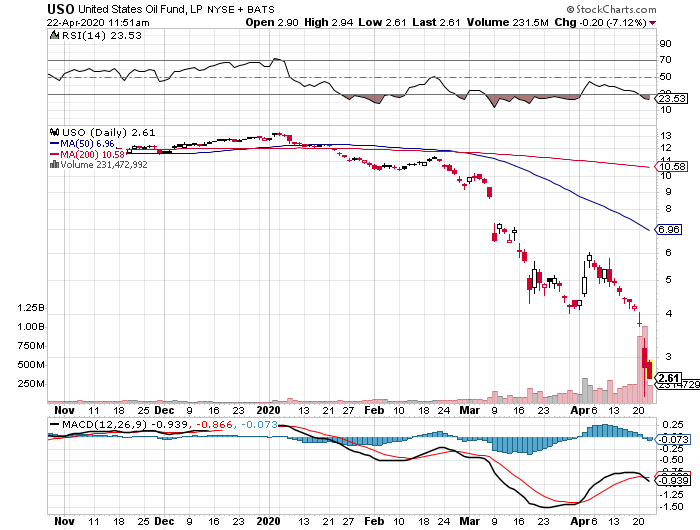

The opportunists among us might look at an upside-down below zero oil market and think that there might be an opportunity to invest and make a lot of money right now. They might be right particularly if they have an empty oil tanker or land-based tank system that can accommodate upwards of 42,000 gallons of oil and can hold on to that oil for a year or more before reselling it. As to other ways to profit from this anomaly, they are hard to find. Unless you are either a genius or lucky short-term trader, the only way for the ordinary investor to make money through this specific anomaly is to buy an asset now and holding it for the long term. The problem is finding an asset that you would own for the long term that was beaten down consistent with the “below zero” May futures contract. You could perhaps look at the USO, which is the US Oil Futures ETF, which has fallen to under $3. If you think it could soon return to say $5, that would be a nice return, and maybe worth a play. See the chart here:

Majors

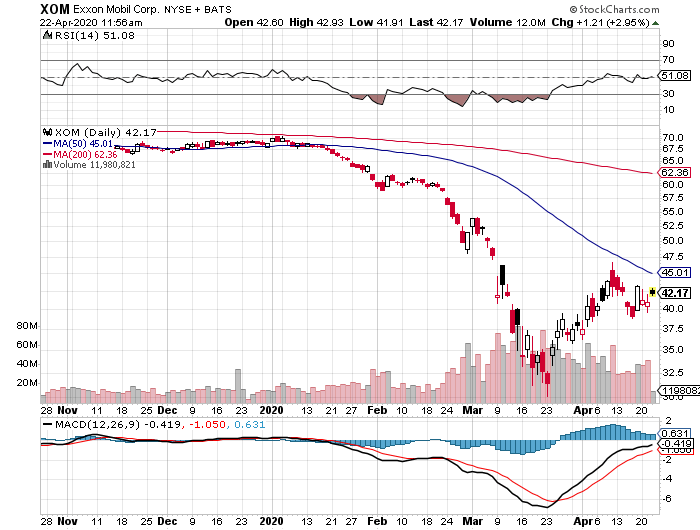

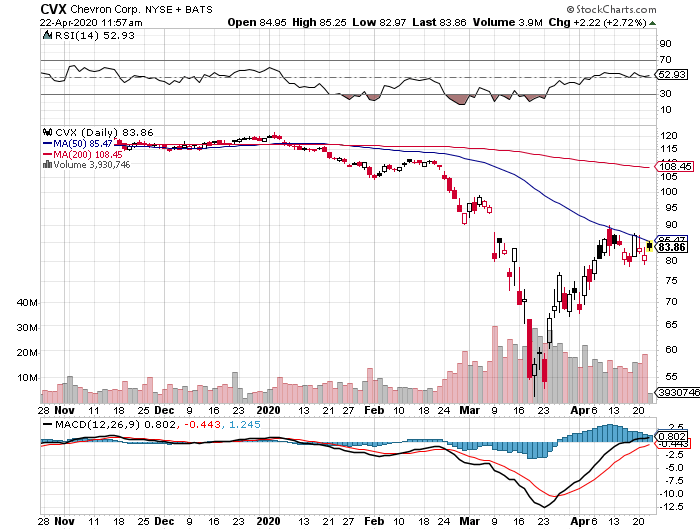

What about your major producers such as ExxonMobil and Chevron? While they have of course taken a hit due to the Coronavirus economic shutdown, they did not seem to react badly to the “below zero” May contract. No big deal, say XOM and CVX investors. See the charts here:

You can certainly make the case to buy XOM, CVX, or any other oil-related company now at beaten-down prices and hope to sell higher as general economic activity improves. After all, if you by XOM now at $42-ish and it returns to the mid-$60s, where it was just 4 months ago, that would be a 50% return. However, my point is that the majors didn’t seem to be significantly affected by the “below zero” May contract issue.

IMO

As with most situations, it is better not to speculate short-term but to invest long-term. As long-term opportunities go, investing in major oil companies or other oil-related businesses may be a good one if you can see your way out of the downturn we are currently in. Then again, there are other economic segments that you might say the same thing about. If you have patient money and you can stomach an eventful ride, there are opportunities out there.