I watched last night’s news channel coverage of events related to Russia’s attacks on Ukraine, and also have been reading various investment analysts’ takes on what the military action may mean for US equity markets. These takes have ranged the gamut from “buy the dip” to “don’t buy the dip”. Today’s equity markets reflected the lack of consensus among the experts as they opened up way down and closed way up – up about 3.4% for the day in the case of the Nasdaq 100 Index. I am in the “buy the dip” camp, and I also believe that Putin and Russia will have a tough time in Ukraine. One TV pundit speculated this is the beginning of the end of the Putin regime. I won’t go that far but I think this is a big mistake by Putin. Here are the reasons why I think so:

- Russia may have the superior armed forces, but their history has been that they have been much better in defense than on offense. WWII may have been a hard-won success, but Russia had been invaded and was playing extreme defense. More recent Russian military action in places such as Afghanistan and Chechnya, wherein Russia was playing offense, were not as successful. By the way, this is not just true for Russia – the US’s record in offensive operations has been less than stellar. It is really difficult to succeed with an offensive operation because your opposition is fighting for their very existence.

- Ukraine’s military may be smaller, but they will be well-armed with Western armaments, likely with the exception of airplanes and helicopters. Russia will likely establish air superiority – Russia’s missile strikes during the fist night seemed to have that aim in mind. All that said, while short on numbers and short on air power, look for Ukraine’s armed forces to score some unexpected hits.

- I’m skeptical that the Russian people are all in for this war. Putin’s statements prior to last night’s activities indicated that the pretext for the war is to avenge genocide that either has occurred or may occur in the Donbas region in eastern Ukraine, and to cleanse the Ukraine government of the “nazis” in place there. Do the Russian people really buy that? Because it is not based in reality. If the Russian people don’t buy the pretext and unless they really believe their very existence is threatened by the current Ukraine government, it will be very difficult for Putin to muster the public support for this military operation, even in Russia. This is 2022, not 1956, and the Russian people are online and have access to information on demand. They may interpret such information differently than Western Europeans or Americans do, but they will probably know when they are being lied to. Perhaps they are used to it now, after having been lied to by Moscow for decades. Once Russian troops start dying, even in small numbers, it could be difficult even for the tyrant Putin to maintain support. Even in Russia.

Small Markets

Regarding the “Buy/Don’t Buy” question, I think it boils down to Russia and Ukraine being small markets that will not significantly affect the profits of US companies. The level of commerce between these combatants and US companies, while important, is not as important as the level of commerce with other markets, including emerging markets. American consumer goods are not manufactured there, so supply disruptions and related inflation will likely not be a factor. Oil and energy is one area that will be affected. Russia is basically a petro-state. For a country whose universities produce some of the best engineers who have achieved great things in science, it is a sad statement to say Russia is on the same level as Saudi Arabia. Energy prices have increased in the run-up to this conflict and there is a good chance prices will continue to head north. That said, oil is a commodity, and there are other sources of oil that can make up for the absence of Russian product. Perhaps this conflict also will factor in to the Federal Reserve’s actions for the coming year; perhaps interest rates won’t rise that much. Equity markets do not like uncertainty, and Russia does provide uncertainty. I think the balance is in the side of the Russia/Ukraine situation will not affect the US economy that much, especially in the long term. This will be true moreover if my surmise that the military operation does not go as smoothly as Putin believes actually comes to fruition.

IMO

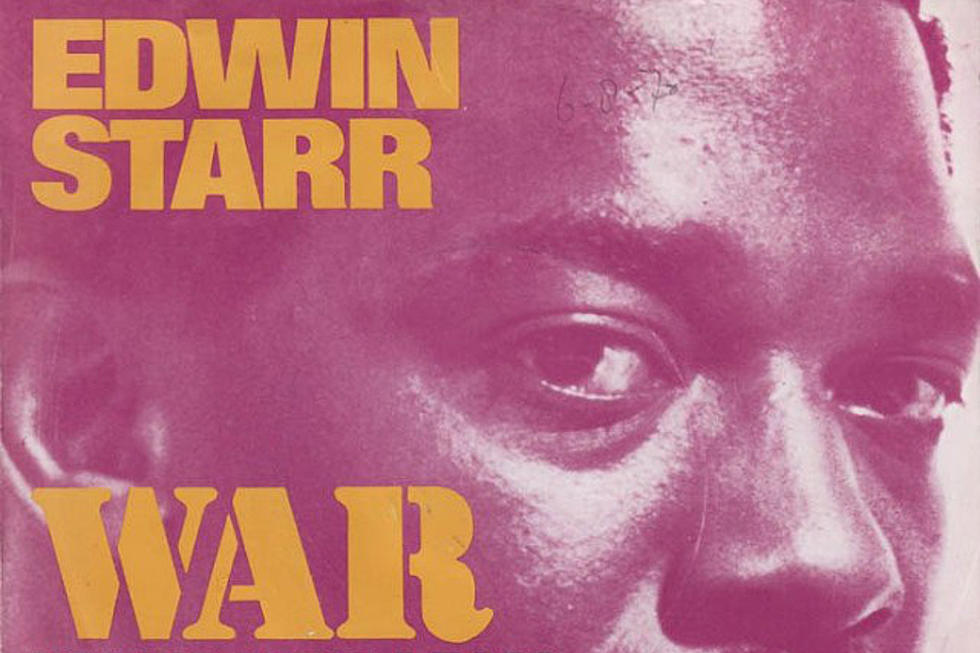

The Russia/Ukraine conflict in and of itself will not have significant repercussions with US companies, especially in the long term. The oil and energy sectors will be most affected, and others will make up for any vacuum that results from the absence of product from Russia. Putin will have a harder time than he thinks in Ukraine because its pretext is fake and because its military is not designed for offensive operations. As someone who has been in Ukraine, it is all very sad to me. I will finish with a photo of Edwin Starr, the artist of my favorite anti-war song, appropriate titled “War”, as well as a link to that song on YouTube:

https://www.youtube.com/watch?v=dQHUAJTZqF0. War by Edwin Starr on YouTube