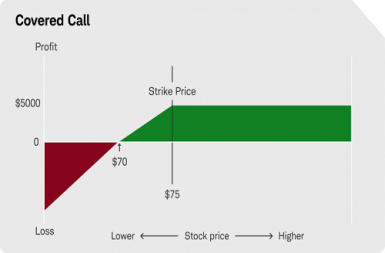

One of my favorite and most consistent investment strategies has been to write call options against long positions that I own. This is also called Covered Call Writing. In this post, I would like to explain this strategy, how it works, and why it is one of my favorites.

Call Options

Call options are options to buy an underlying stock at a specific price, called a strike price. Usually, 1 call option gives the owner the right to buy 100 shares of the underlying stock. It costs money to buy the call option. How much does it cost? It’s a function of what the strike price is relative to the market price of the stock at that time. The higher the strike price is relative to the market price of the stock, the less the options will cost, and vice versa. Call options typically have an expiration date which will also affect the price of the option; the longer until expiration, the more the option will cost, and vice versa. The opposite of call options are put options, which give the owner the right to sell at a specific strike price. My strategy typically does not involve put options.

Writing

Writing is another word for selling, at least in the options world. When you sell anything, whether it is a used car or a stock option, you get money for it. In the options world, as in the stock world, you can sell something that you don’t own. When you write a covered call, you already own the underlying stock, but then you sell the right to purchase more of that same stock. What is the net effect of all of this? First, you get money for having sold the call option (even though you didn’t own the call option when you sold it). Second, although you hope not to, you may be obligated to sell your stock at the strike price of the option. I’ll explain.

At Expiration

My objective when I sell a covered call option is that the option will expire prior to its being called and I get to keep my long stock position and all of the money I made when I sold the call. How does that happen? Let’s use an example to demonstrate. Let’s say I own XYZ stock and it is currently trading at $50 per share. I look and I see that XYZ has call options related to it at a strike price of $55 per share that are selling for $6 per option. How do I come up with $6 per option? It’s basically the $5 difference between $55 and $50, plus a little bit for the time between now and its expiration date. I think XYZ probably won’t rise from its current $50 to $55 between now and when the call option expires (probably a month from now), and so I decide to sell the $55 call option and pocket the $6 today. At the expiration of the call option a month from now, 1 of 2 things will happen: 1) If the market price of XYZ is below $55, the call option will expire worthless and I get to keep the $6 plus hold on to my XYZ position. However, 2) If the market price of XYZ rises above $55, say to $60, then my long position in XYZ will get called away at the strike price of $55. I still get to keep the $6 I got when I sold my call option, but I have to sell my XYZ at $55 even if it is trading at $60 at that time.

IMO

Writing call options and/or a covered call investment strategy is considered to be a relatively conservative way to use existing long assets to generate current income and total return. Because I already own the stock and I only write options to the extent that I own the stock, my downside is that I potentially give up some of the stock’s upside in return for generating current income. Of course, there is always a downside in owning a long position, but that downside is not magnified by writing a call against that long position. If you don’t mind taking the risk that your stock might go up more than you figured and that you might have your stock called away from you, then you too should consider a covered call writing strategy in order to generate current income. I plan to blog more about this in the coming weeks, so please stay tuned, or just go ahead and contact me now if you can’t wait to get started with your own covered call strategy.

Your math seems off to me… I doubt an out of the money call would trade for that high of a price with 30 days to expiration… You’re 55 call has no intrinsic value based on the current market price of 50, but your explanation of the valuation seems to suggest it has intrinsic value… So a valuation of six wouldn’t make sense. Which in turn means the payoff in this example is overestimated.