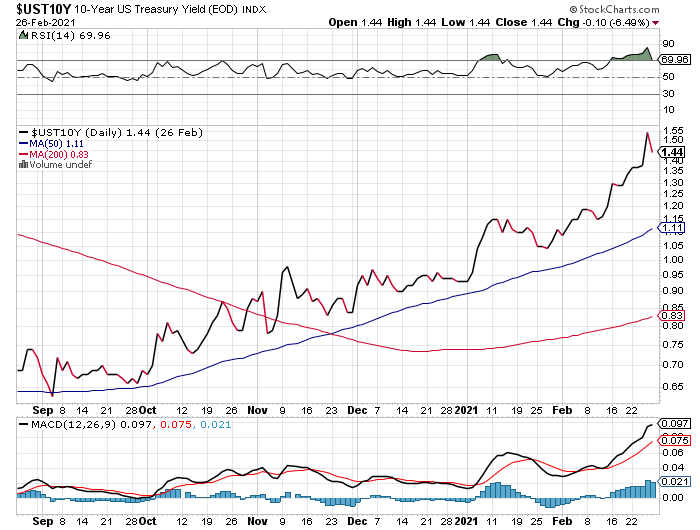

Last week we saw the Nasdaq 100 Index sell off as interest rates, specifically the yield on the 10 Year US Treasury, rose. For instance, on Thursday 2/25, the Nasdaq 100 fell by about 3.5% while the 10 Year yield rose about 20 basis points to about 1.55%. Did these two phenomena occur by happenstance or are they linked? It’s investing, so of course they are linked, but how are they linked? Perhaps not how you might think

Cost of Borrowing?

You might think that stocks go down when rates go up because higher rates increase the cost of borrowing for companies. That is true, but if you think about it, higher rates don’t affect tech companies as much as they do older industries, and the Nasdaq 100 is full of high tech companies. The Apples, Microsofts, and Googles of the world have so much cash and working capital already on their balance sheets that they don’t really have the need to borrow money in a substantial amount. So, if the yield on the 10 Year Treasury goes up 20 basis points, Apple, Microsoft and Google aren’t affected operationally, and their profits won’t take much of a hit. Companies in “old economy” industries such as energy and utilities, by contrast, do finance using debt and so will take an earnings hit if rates go up. Yet it was the Nasdaq 100 Index that took the biggest hit when rates went up last week. Why is that?

Appeal of Alternatives to Stock

The answer is that higher rates make investing in bonds and debt that much more appealing. With the tech stocks that comprise the Nasdaq 100 Index at all-time highs prior to last week’s sell-off and with their future earnings discounted back to the present at lower and lower discount rates that mirror rates along the US Treasury yield curve, any increase in interest rates is bound to have a profound effect on the discount rates that the number crunchers use to value these high-tech companies. If rates go up, then prices go down. Look at it another way: When Treasury rates were below 1% all across the yield curve, as they were for most of the last 3 quarters of 2020, then an investment in Treasuries doesn’t look that appealing. However, if now and investor can earn 1.5% in “risk-free” Treasuries, then that becomes more appealing – not great yet, but better. If so, an investor might be tempted to allocate slightly more money into Treasuries and away from stocks because stocks are already so pricey. With comparatively more money flowing to Treasuries and less to stocks, particularly Nasdaq 100 stocks, then you can see why the Nasdaq 100 stock were the main victims of last week’s increase in interest rates and not other sectors that use more debt to finance their operations.

Today

I am writing this on Monday 3/1 (Happy March!) and the trade-off between Treasuries and the Nasdaq 100 remains, but in the other direction. Yields on 10 Year Treasuries are down about 10 or more basis points from Friday’s close, and the Nasdaq 100 Index is now up over 2.5%. Clearly institutional investors are watching Treasury yields closely as changes in rates seem to be driving both the stock and the bond markets.

IMO

In a way it’s good news that fundamental issues such as changes in interest rates are what’s important to the stock market, rather than external issues such as geopolitical maneuverings or terrorism. If so, then although most economists predict that economic activity will improve in 2021 over 2020 as businesses emerge from the Covid shutdown, the stock market may not rise in accordance with the economic improvement. Why? Because interest rates will rise as the economy improves. If rising rates mean that some investors may choose bonds over stocks, then the stock market may have a rough go of it as rates continue to rise. How quickly rates rise and to what extent may be the roadmap for stocks as well, because a more gradual rise in rates will be preferable to a short, sharp shock.