The release last week of CPI data that showed that May’s annualized inflation rate was 5% got a lot of media attention as well as rebuke from inflation hawks and my conservative brethren. If it were to continue for a whole year, 5% inflation would far exceed the Federal Reserve’s forecast and would be a big change in assumptions going forward. However, a deeper dive into the components of the data shows that things may not be as bad as the banner headline number indicates. Specifically, according to the US Bureau of Labor Statistics, almost all of the increase in May’s inflation reading was due to a rise in energy costs, which had been extremely depressed a year ago due to Covid. The Federal Reserve believes May’s 5% inflation level (as well as April’s 4.2%) is “transitory” and will be normalized once more of the economy opens up and energy production returns to pre-pandemic levels.

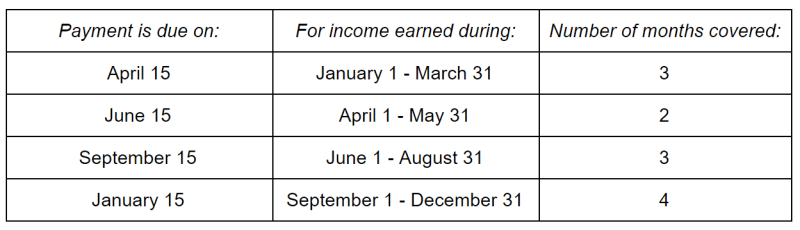

Base Year Effect

If you are comparing data from one year to the next and your prior or “base” year’s data was anomalistic, then you have what’s known as a base year problem. That’s what we have here with energy prices. 12 months ago we had the entire energy sector shutting down due to the pandemic economy. Recall that people weren’t driving to work or flying on planes and thus were not using gasoline or jet fuel. Recall also that during April 2020, May 2020 oil futures fell to below $0 because storage was full and producers needed to offload their production. Now, West Texas Intermediate Crude is trading at about $71, which is an incredible increase from just above $0 12 months ago but not that much higher than the $50 to $60 range that held during much of 2019, before Covid. And this is without worldwide production having reached full or near full capacity, as US production is down in part due to changes in government policy. The BLS data show that annualized inflation in energy components was 25.1% in April and 28.5% in May, compared with a year ago when producers were paying buyers to take oil off of their hands. Last year was an anomaly and we are hoping that the Fed is correct that we should be on more normal footing going forward.

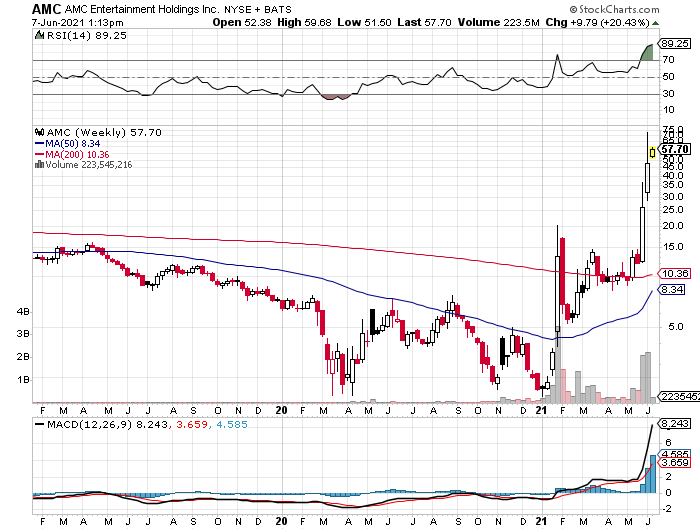

Other Components More Normal

The BLS groups data into several components in addition to Energy, such as Food (in several subcategories), furnishings, apparel, medical care, sporting goods (?), and used cars and trucks. Of these, the only one (other than Energy) to have had an abnormal increase was used cars and trucks, which were up nearly 30% (annualized) in May. Ok, but again we had negative inflation a year ago (due to Covid) and supply chain issues with all automobiles. Specifically, the auto industry is going through a shortage of semiconductors. A lack of semiconductors means fewer new cars are being built, which means prices are up both for new and used cars. Assuming semiconductor production ramps back up (it will, right?), we should see auto prices leveling off. I can’t believe that car companies won’t try to take advantage of the increased demand for cars if they are able to do so. Food sector inflation is actually down from a year ago, from 4% to 2.2% currently. Remember meat plant shutdowns due to Covid a year ago? That’s not as much of an issue now and so food inflation is trending in the right direction.

IMO

This analysis leads me to believe that perhaps the Fed is more right than wrong and that the inflation Cassandras are more wrong than right. Though the US population is substantially vaccinated, that is not so for the rest of the world, including developing countries. Increased worldwide vaccination rates will mean greater production which will mean supply goes up and prices level off or go down. Bond investors appear to agree with this thesis as the yield on the 10 Year US Treasury has stabilized in the mid 1.5%-range. Let’s hope we are all right and inflation remains at an acceptable level.