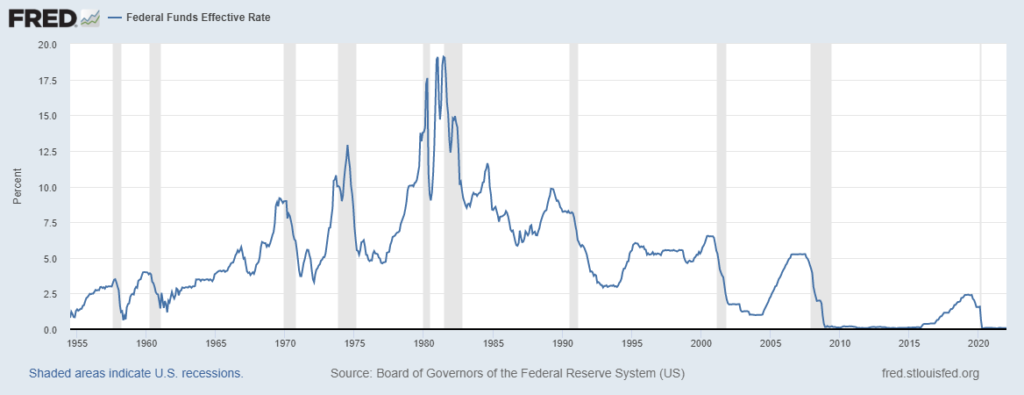

I have written before that investors get spooked by the threat of higher interest rates because higher rates on US Government debt means higher discount rates for the future cash flows of stocks and hence lower stock prices. Another reason that investors get spooked by projected higher interest rates is that rate increases by the Federal Reserve have in the past presaged recessions. It’s not a perfect correlation and it may take a couple of years for the recession to hit after the rate increases are commenced, but this chart from the Federal Reserve website shows that rates have gone up prior to recessions:

Look at the last three times the Fed raised rates:

- Starting in about 2016 and throughout the latter part of the last decade, ending with the (short-lived) Covid recession, which might have been longer lived had the Fed not bent over backwards to drop rates and to inject $Trillions into the US economy;

- Starting in 2005 and ending with the “Great Recession” caused by the mortgage-backed bond crisis; and

- Starting in 2000 and ending with the “Dot Com Bust” recession.

This is not to say that the Fed predicted Covid, or the Great Recession, or the Dot-Com Bust. Rather, I believe these events were the catalysts that plunged an already overheated economy into recession. In all of these instances, the Fed increased rates in an effort to cool economic activity and keep inflation in check, whereafter these bad events occurred and we had a recession.

This Time?

With the previous three times, the inflation threats that the Fed attempted to combat were tame in comparison to what we have now. At 7% annualized, the current inflation rate is a much larger beast to slay. I am dubious that 1/4% increases off of a near-zero current Fed Funds rate will have much of an effect on the inflation rate. There was nothing incremental about what the Fed did to try to help the US economy during Covid, and those relatively drastic actions did help but have also stoked inflation. Now the Fed will attempt to address inflation in an incremental way. Nevertheless, the stock market is spooked.

Statistically Significant

A counter-argument can be made that the data reflected in the FRED chart above is not statistically significant. Recessions are a part of the economy and likely occur despite actions central banks take to combat them. Just because the Fed raised rates and a recession happened a couple of years later doesn’t mean it will in the future. Rate raises are not necessarily causal. There are too many other factors involved with macroeconomics to aver that a rate raise by the Fed will presage a recession.

IMO

In the past, it has taken a couple of years from the commencement of rate increases until the onset of a recession. The Fed has not even raised rates yet – all they have done so far is state that they plan to do so, as well as plan to wind down other efforts to prime the pump. Which means that the Fed is still accommodative, which leads to the high inflation rate. Don’t look for a recession in 2022; instead, look for fairly strong growth. If the Fed Funds rate is increased 4 times in 2022, as is predicted, that means it will sit at 1% or maybe 1.25% at the end of 2022, which is not exactly high. The problem is, stock investors will likely continue to have the jitters. If corporate earnings continue to grow as projected, and investors remain jittery at the same time, it could mean there could be bargains to be had as long as the jitters continue.