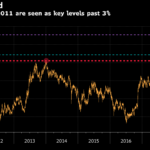

The 10-Year US Treasury is now yielding 3% (maybe just a bit under), which is up almost 100 basis points (1%) since late September 2017. That is a relatively big move in a relatively short period of time, but not unprecedented. The chart below from Bloomberg shows that the 10-Year rate moved from under 1.5% to over 2.5% during a 5 month period in the second half of 2016. From late 2012 through all of 2013, the 10-Year moved from the 1.4%-range to 3.05%. The point: The 10-Year rate fluctuates more than do shorter-term rates because shorter-term rates are more pegged to Fed rate decisions.

Different This Time

What is different this time is that we are likely entering a period of Quantitative Tightening, reversing the Quantitative Easing period we had been in since the Great Recession. This backdrop is why equity markets are not happy with the rise in rates. Interest rate concerns are what sparked the initial correction in early February 2018. The stock market seemed to steady itself as the 10-Year rate failed to hit the 3% marker, but the stock market now is correcting again as the 3% marker has been touched.

Bloomberg

This article from Bloomberg.com on April 20 offers a basic description of what the 10-Year at 3% means. The main take from it, in my opinion, is that the 10-Year is set by market forces, while shorter-term rates (particularly rates under 1 year) are more tied to the Fed Funds rate. The Bloomberg article states that the consensus of projections is that the 10-Year will end 2018 at the 3% level, meaning that rates should remain about stable for the rest of this year. I doubt this – all markets have become more volatile this year and more volatility would mean that the end of the year will not look like it does today.

Ceiling to Floor

Another point the Bloomberg article makes is a technical one: The 3% level on the 10-Year (Bloomberg actually uses 3.05%) could become a floor, after having been a ceiling for the past 7 years. This means that if the 10-Year yield moves above 3.05%, it will be difficult to move it back below that yield.

IMO

Higher interest rates are a sign of a stronger economy, so you could look at the higher interest rates as good news. I believe the stronger economy can be sustained even with the 10-year at 3%. 4% may be a different story. Corporate earnings remain strong. The debt-to-equity ratios of companies on a macro basis have been getting smaller, meaning that the effect of higher rates on corporate profits will not be as great as it was when the corporations had higher levels of debt. Corporate tax rates are going down and that should more than compensate for higher interest rates. If the consensus is right and the 10-Year rate remains around 3%, then this stock market correction will have been a buying opportunity. Stay in the market, stay focused on the long term, and keep a diverse portfolio that can help you absorb this struggle that is playing out between those who are more concerned about higher rates and those who are not as concerned about higher rates.