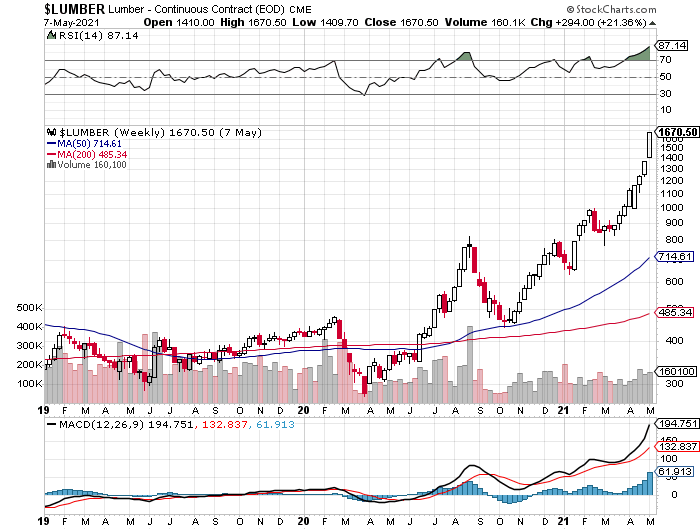

If you believe, as the Federal Reserve does, that inflation is under control and will likely remain so for several quarters at least, then you might want to reconsider your belief after taking a look at the chart of Lumber Futures. Presented here is a Weekly chart of Lumber Futures that goes back to January 2019. You can see that it has gone almost straight up since October 2020.

Why?

Why has the price of lumber quadrupled, from about $400 per 1,000 board feet pre-Covid to over $1,600 per 1,000 board feet now? According to this article from Vox.com, there are are a number of factors involved, including the following:

- Sawmills laid off workers when Covid hit.

- Demand for lumber was forecasted to drop due to Covid. Instead, demand rose because people decided to work on their homes during the Covid shutdown.

- Sawmills were slow to turn the switch back to On in the midst of the rise in demand.

- Now sawmills are finding it hard to find workers, a labor shortage common to a number of industries that may have roots in the increased Covid relief and unemployment benefits paid to workers.

- Beetle infestation in British Columbia is limiting the supply of lumber from that area.

Ramifications

Combined with sub-3% mortgage rates, the rising cost of lumber is causing the price of housing to increase. If you already own a home, then that doesn’t affect you. However, if you are a renter and/or you are in the market to purchase a home, then it will cost you more to do so. For sale home prices are not included in the Consumer Price Index measure of inflation, but “Owner’s equivalent rent of residence” is part of CPI. The rising cost of lumber will have an effect on CPI, whether directly or indirectly.

Another ramification is that people who may have been considering building a new home may reconsider once their project goes out to bid only to find out the cost of lumber has quadrupled. Same thing for homebuilders: how many tract home projects will no longer pencil with these much higher lumber costs? The result if that the already constrained supply of houses that are for sale will become even more constrained. With supply constrained while demand is increasing, home prices will likely continue to be strong, especially if mortgage rates continue to be low.

What To Do

Unless you live in a rent-controlled situation or other non-market factors are involved, then you don’t want to be a renter now. If you already own a house and plan to stay, then great! However, if you are looking to sell and move, then I advise that you make sure you have your new destination identified and under contract before listing your current house for sale. Buying the new home is the tougher of the two steps in this seller’s market. Don’t sell your current house and then have to move into a Residence Inn or other non-appealing temporary situation that will cost you a lot of money.

IMO

Home sales may not directly be a part of CPI, but if lumber remains high, the price of housing will reflect this new normal and will cause increased inflation, indirectly if not directly. If higher inflation numbers cause the Federal Reserve to rethink its stated positions on holding short-term interest rates low for at least a couple of years, then look for a rocky period in the stock market due to the prospect of higher interest rates.