As you are well aware, the stock market has become much more volatile particularly since January 2018. One of the main reasons for the increased volatility is there is less “depth of market” at any time available to accommodate any larger orders, particularly Sell orders. Another way to say it is that the “order book” is shallower than it used to be, even though trading volume is higher. Why is that?

Background

Having a deep market is important because it lessens the impact of descent caused by a large sell order. Think about film of high-rise rescues you may have seen, where the rescue team inflates a really big pillow or puts up a net or trampoline so that the person caught in the high-rise can jump into it and not be injured. A deep market is like that pillow. Without it, the jump from the high-rise ends more like Wile E. Coyote going off the cliff – splat! That’s perhaps an exaggeration, but you get the point.

Why No Pillow?

There are several reasons why the market or the order book is not as deep as it once was:

- Dodd-Frank and The Volcker Rule: Dodd-Frank Bank Reform laws passed in 2010, and the Volcker Rule, part of Dodd-Frank which severely limited the ability of banks to trade in equities markets, was implemented in 2015. The Volcker Rule thereby eliminated commercial and investment banks as a source of capital behind trading in equity markets. Now, instead of huge Wall Street banks standing behind their trading, you have hedge funds and high-frequency traders, which may be adept but don’t have the level of equity capital that the banks did.

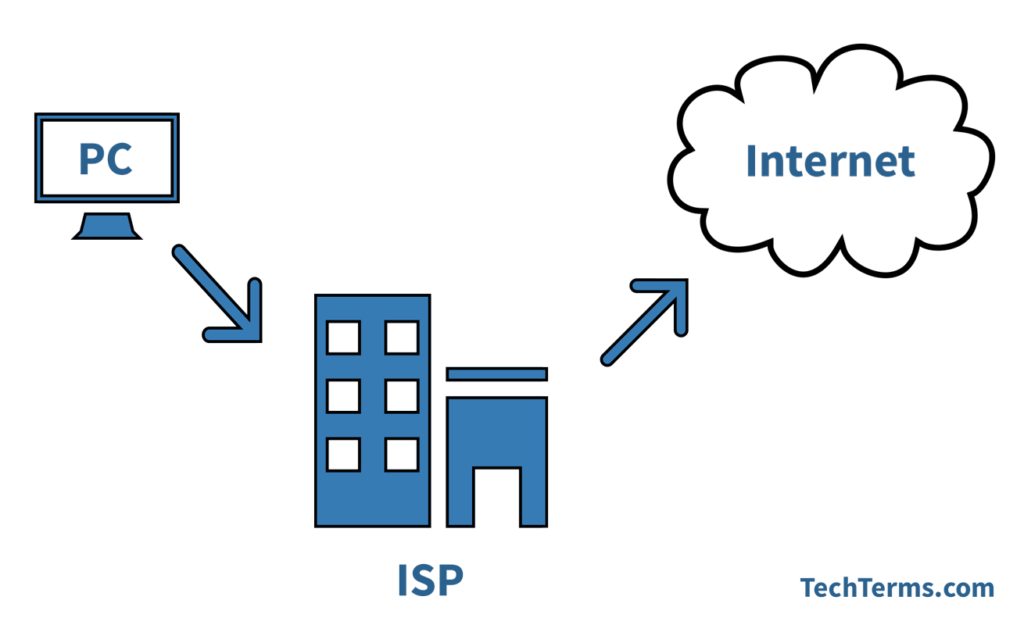

- High-Frequency Traders (HFT’s): HFTs are not evil, but the way they do business can be disruptive. Because of the availability of bandwidth and computing power, trades can be executed instantaneously. Whereas in previous years,

a trade was sent to a market maker (who may have been electronic) and held on the order book until filled, now the trade is held off the books until it is sent and filled in less than a blink of an eye. This works most of the time during the ordinary course of business, but it doesn’t work as well when there is an order that at any time is larger than the existing order book can handle. Instead, when there is a big order, a lot of other electronic traders’ buzzers go off in an effort to fill those orders. You can see how these disruptions caused by large orders can happen, and they do happen frequently. - Algorithmic Traders: These are different than HFT’s. Whereas HFT’s try to make a profit by skimming fractions of pennies from buy/sell order imbalances, algorithmic traders try to profit on statistical anomalies that present themselves during trading. Examples include

algo funds that buy positions when volatility is statistically low and sell positions when volatility is statistically high. Funds like these inherently exacerbate trends, and thereby cause more of the volatility they are attempting to profit from. Algo traders are not out there to provide depth of market; just the opposite, they are out there to profit from the shallowness of the market.

IMO

Because of the factors I bullet above, we have gone from a relatively deep, “pillowy” market in years past to a thin trading market that really scrambles when exogenous factors cause it to spike. I believe the most significant single factor is the Volcker Rule because it removed trillions of dollars of equity capital behind the support of the equities markets. If the Volcker Rule wasn’t in effect, the HFT’s and the Algos would not have the disruptive effect that they do in today’s trading.

I used this article from the Financial Times as a source, and it is a good summary, but I believe the FT article errs by not discussing the Volcker Rule as a source of volatility.