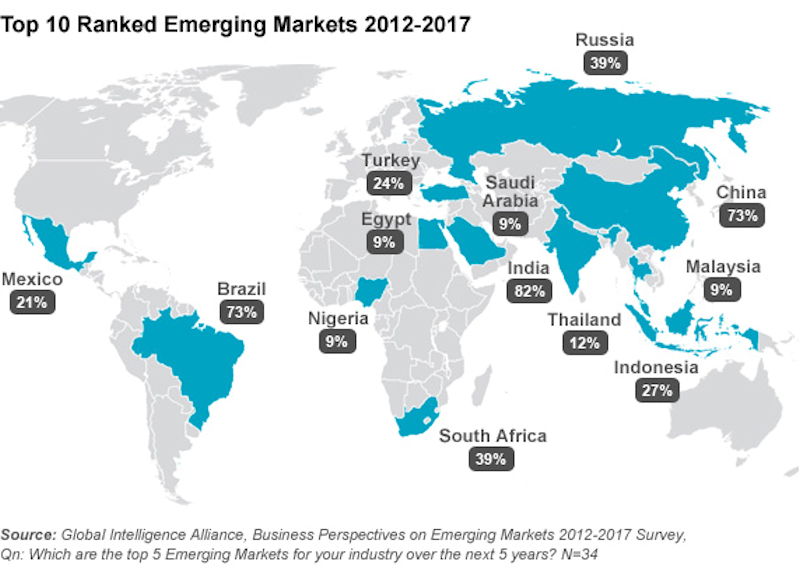

Investing in emerging markets sounds like a great idea but it is difficult to do successfully if your native currency is the US Dollar. It is difficult for a number of reasons, including the following:

- Some emerging market currencies are not easily convertible to US Dollars at a reasonable exchange rate.

- Some countries do not allow direct investment in their businesses by Americans or any foreigners.

- Tariffs can really hurt emerging market economies, both because of the added cost of the tariff and because of the political uncertainty associated with them.

- The exchange rate will continue to be a problem even after you have invested your money. Right now, for instance, the US Dollar had been killing emerging market currencies. Emerging markets have been significantly hurt by extreme devaluations particularly of the Argentine Peso and the Turkish Lira.

- Interest rates: The US has been raising interest rates while most of the emerging market world has not. The result of this differential in rates is that the US Dollar goes up and emerging market currencies go down. So, even if an emerging market company is performing well in its native currency, Americans investing dollars in that company may be losing money because of the currency effect, which is largely driven by differences in the direction of interest rates in the respective countries.

- Want to buy a mutual fund that specializes in emerging markets? That is a possibility, but do your research before you buy. Many emerging market mutual funds charge high expenses – reasonably so due to the travel and other expenses commensurate with managing investments in emerging markets all over the globe. Go to Morningstar.com and research the holdings of the fund that you are interested in. Many of these funds’ top holdings are banks and financial services companies domiciled in emerging markets. You think about Emerging Markets and you think about cheap labor for manufacturing and you think this is where all the money is being made. However, many emerging market industrial companies are not publicly traded. As a result, the fund managers revert to owning financial service companies, which is a derivative play with respect to where the growth in these emerging markets is. My point is, you may not be getting a true emerging market investment experience when you invest in emerging market mutual funds.

- This includes ETF’s. The largest emerging market ETF is the EEM, which tracks the iShares MSCI Emerging Markets Index. Its two largest holdings are Tencent (China) and Taiwan Semiconductor, both of which are huge companies. Country-specific ETF’s, of which there are many and probably one for any country you can think of,

are also weighted toward the largest public companies in each country. Nothing wrong with any of that, but you are investing in large companies, including many banks, when you invest in ETF’s such as the EEM or country-specific ETF’s. - There are alternative investments such as hedge funds and private equity that specialize in emerging markets, but you really have to know what you are getting into, and you will likely pay high fees and be unable to cash out when you might want to.

IMO

I view Emerging Market investing as a component of a well-rounded portfolio. It makes sense that, while the US is the world’s largest economy, it is not the majority of the world’s economy, and that there are probably some great growth opportunities in emerging markets. With the way emerging market investing is currently constituted, you can capture some great growth opportunities through investing in mutual funds and ETF’s, but it is difficult to find a pure play in emerging markets. Another way to view emerging market investing is as a hedge against a weakening US Dollar, if current trends reverse and the Dollar starts to weaken.