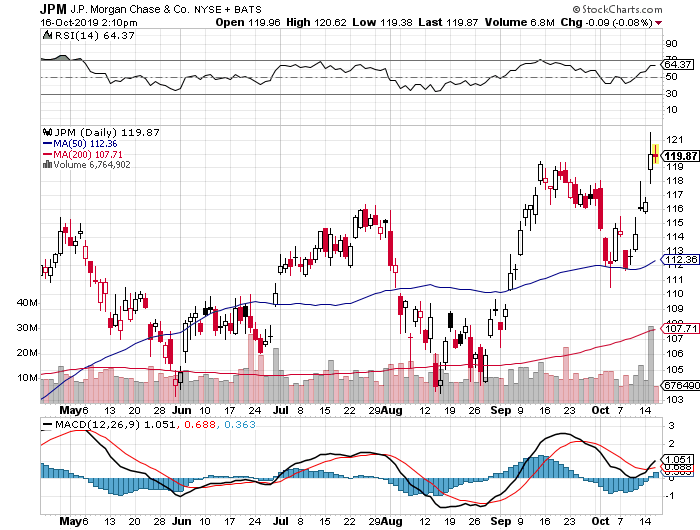

We have two pieces of information that are in conflict. On one hand, former Harvard President and US Treasury Secretary and current Harvard Economics Professor Larry Summers said recently that US interest rates could go to zero or below if we have another recession. On the other hand, Bank stocks are up, with JP Morgan (JPM) at an all-time high of about $120 as I write this. These two information points are in conflict because zero interest rates have been bad for European banks and they would be bad here in the US. Is Summers correct, or are investors correct for buying bank stocks such as JPM?

Summers

Summers’ statement was prefaced in that “if” there is a recession, “then” interest rates in the US would drop to zero. In his comments, Summers says he believes we are headed to a recession but probably not in the next 12 months. Summers served as Treasury Secretary under President Clinton and is a critic of the Trump administration’s economic policies.

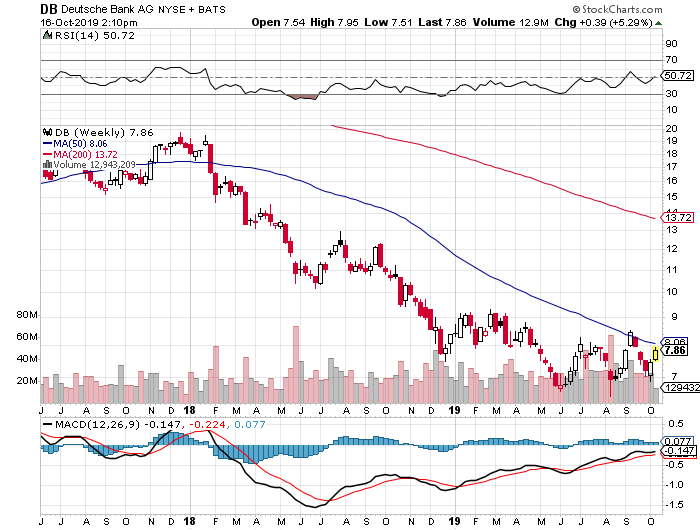

Negative Rates In Europe

Negative rates have been a disaster for banks in Europe and they would be a disaster here in the US. Deutsche Bank (DB), for example, is at a near all-time low at about $8, and other European banks have performed similarly. It is very difficult for banks to make money when rates are zero or below. They have to rely on fee income, which may be strong but not nearly as lucrative as is traditional lending. Rates have lingered at zero or below in Europe for several years, as they have in Japan. By selling bank stocks down to their lows, investors indicate that they don’t see a good future in European bank stocks.

US Banks Reach Highs

Investors in US banks, by contrast, see a bright future. JPM’s stock reached a high on October 16 after a strong earnings report. Other large banks such as Wells Fargo (WFC) and Bank of America (BAC) followed suit and also reached highs. Investors are indicating that they don’t see a recession looming and that economic growth and bank earnings will continue to be strong.

IMO

I side with those who are buying US bank stocks, although I don’t own any of them directly. I agree that we are not headed to recession any time soon and that corporate earnings, including bank earnings, will continue to grow. Summers has a bias and is trying to do his part to put forward the notion that the US economy is not as strong as the statistics suggest and so voters should consider his side in the next election. The stock market is a leading indicator, and that bank stocks are at a high indicates that investors on balance believe a recession is not imminent and therefore interest rates will not be turning negative any time soon.