It’s March, so you may soon get your annual Social Security Statement in the mail. At the top, it will say about what your payment will be at Full Retirement Age. Seems simple, right?

Read The Fine Print

Well, it’s not quite that simple. If you read the assumptions for how the SSA calculates your benefit, you will see that they assume you will continue to work and pay into Social Security until Full Retirement Age. So, if you are inclined to continue to go to work every day until your mid to late 60’s, have at it! However, for those of us who might not want to stick around at the office water cooler that long, the Social Security Statement of benefits is not fully accurate.

Calculate Your Own Benefits

Instead of relying on the Social Security Administration’s calculation, you will have to calculate your own benefits yourself. How might you do that? Go to the Social Security Administration website, ssa.gov, and go to the bottom of the home page. There is an icon there called Calculators. Click that, and then click the Online Calculator icon. Next, you have to manually input your earnings record for every year. It’s somewhat of a pain to do so, but it really doesn’t take very long. Then you have to assume you will quit working at some point during the next 2 years. For the experiment that I ran, I assumed my client would pay in during 2019 but not at all in 2020 and thereafter. The client still has several years to go until Full Retirement Age. Next, you choose whether you want your calculation done in today’s dollars or in inflated future dollars – I find it easier to understand using today’s dollars. Finally, you hit Calculate, and voila! You have calculated your own Social Security benefits! The Online Calculator function is limited in that you can’t input different levels of earnings for each year 2020 and beyond, but it is useful for what it does.

Differences

In general, the closer you are to Full Retirement Age, the less the difference will be between the SSA’s calculation and your own calculation of your benefits. If you are in your mid-50’s or older and you have been paying in all of these years but you don’t want to calculate your own benefits, as a general rule, you can take the SSA’s calculation, and your actual benefit will be about 97% of that amount if you quit work next year but don’t file to receive Social Security benefits until Full Retirement Age. If you are younger than your mid-50’s, I highly recommend you do your own Benefits calculation. Those of us who are in their late 50’s or older probably pay more attention to what their Social Security benefits will be. Nevertheless, for anyone, knowing what your Social Security benefits will be is an important element of your financial and retirement planning at any age.

Vocabulary

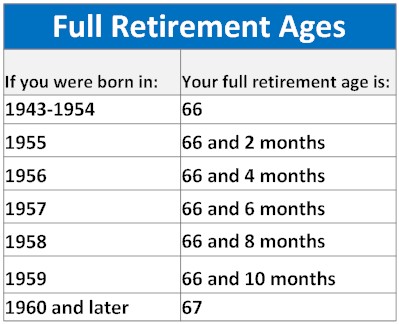

If you read your Statement, or, better yet, create an account at ssa.gov, be mindful of the meaning of the word “retirement”. For the SSA, “retirement” means that you quit work and immediately file to receive social security benefits. However, you probably think about “retirement” in terms of no longer going to work every day. The filing for benefits part is a separate issue. Then there is Full Retirement Age, or FRA. FRA is based on what year you were born in, and the following chart breaks it down:

In general, you can file for Social Security as early as Age 62, but your benefits will be 8% per year lower than they would be if you wait to file until your FRA. Alternatively, your benefits grow 8% for each year you wait to file after your FRA up to age 70.

IMO

Because of recent law changes, there are fewer strategies available for filing for Social Security benefits. It is much more straightforward. However, there are some different things to think about, including whether to file early, or wait until FRA, or wait even longer. A good financial planner can help you make those decisions.