Last time I wrote that I expect interest rates to remain low for years to come in part because that will help with the national debt. I also wrote that people who save and people who look for a current return on their investment portfolio will be hurt by low interest rates. If these savers want to look for alternatives to traditional fixed income investments that offer Total Return – current income plus the potential for capital growth – then savers may want to consider my Covered Call strategy.

Covered Calls

Covered calls are considered to be a conservative way to create current income from a long portfolio. Covered call selling or “writing” involves several steps:

- The investor is long the stock or stock index in question.

- The investor chooses call options that equate to the number of shares (or fewer) that they own in the underlying stock or index.

- The strike prices of call options are typically at or higher than the price that the stock is currently trading at.

- The exercise dates of the options are anywhere from a week to several months out. I like a short time frame, but others may like longer. 1 to 4 weeks is typical.

- The investor sells or “writes” the call options and collects the premium for selling the call options.

- At exercise date, if the underlying stock or index is trading below the strike price of the option, then the option expires worthless and the investor keeps the premium.

- If the underlying stock or index is trading above the strike price at exercise date, then the call option owner will “call” the stock away from the investor at the strike price of the option. The investor still keeps the option premium they collected when they sold the call option.

Upside/Downside

The upside of this type of transaction, known as covered call writing, is that the call option gets to keep the option premium no matter what happens next to the stock price. The downside is that the investor may be foregoing some of the “upside” of the stock. For example, if the strike price of the option is $40 and the stock is trading at $43 at exercise date, then the investor will have to “put” the stock to the call owner at $40 and will lose the $3 of upside. However, they have already collected the call option premium to soften the blow. Another downside is that the investor must maintain their long position as long as they are currently short the option – otherwise the investor would be “naked”, which is not a good thing.

Index Funds

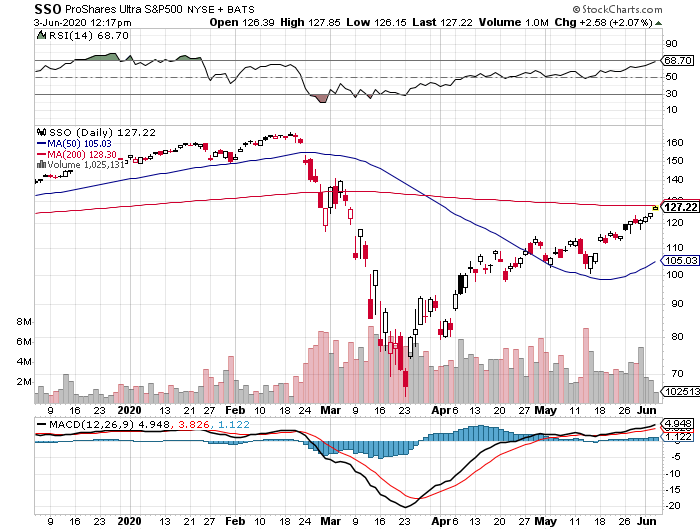

My strategy involves writing call options on index funds that I already own. I like to write call options every week that expire a week hence, because I feel like I have a better idea of what may happen a week out than what may happen a month out. I choose strike prices that are higher than the current price of the index fund because it allows me to participate in at least some upside in the index fund. If the price of the index fund trades up above the strike price of the option and my fund gets called away from me: Oh, well, at least I didn’t sell at a loss, and I kept my option premium.

Results

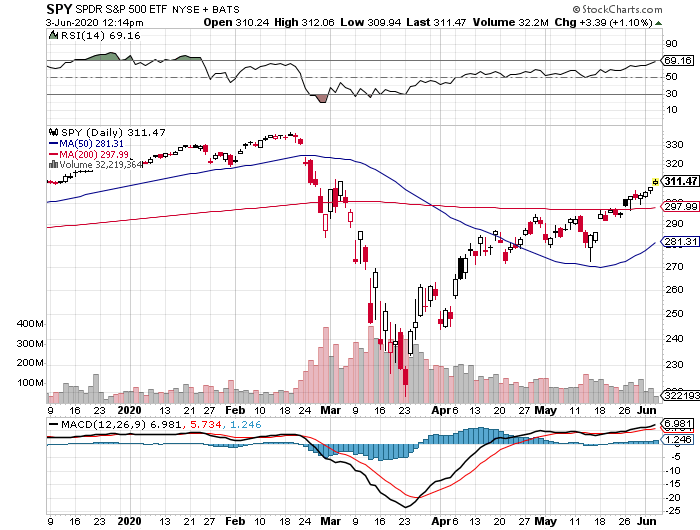

Over the past 18 months, I have been able to generate a current yield in the high 6%-range, by my own calculation. I have had my long positions called away from me a few times but mostly not, so I have been able to participate in most of +the gains (and losses!) of the index funds that I own, which are mainly the S&P 500 and Nasdaq 100 indexes. Even during the horrible loss periods earlier this year – March in particular – at least I kept my option premiums. As always, past results are not indicative of future performance, but I believe this is a sustainable strategy that can be tweaked on a weekly basis based on changes in the market.

Cash Dividend

Although I don’t currently, one could look at the weekly sale of options and the resulting premium as a weekly cash “payday” or “dividend”. I currently leave the cash in my account but I could withdraw it if I want and keep the long index fund position in my account. There is not currently a way to automatically reinvest the “dividend” into more of the index fund, but one could manually do so, which would be easy and cheap in this era of reduced or zero commissions.

IMO

Think about your current portfolio, and think about what it would be like to earn an additional current yield on that portfolio. Granted, a systematic call option writing strategy necessitates discipline and minimizes the investor’s ability to sell quickly if and when they want to. However, if you are a long-term investor and the additional current yield is appealing, you may want to contact me to determine how you might avail yourself to this strategy.