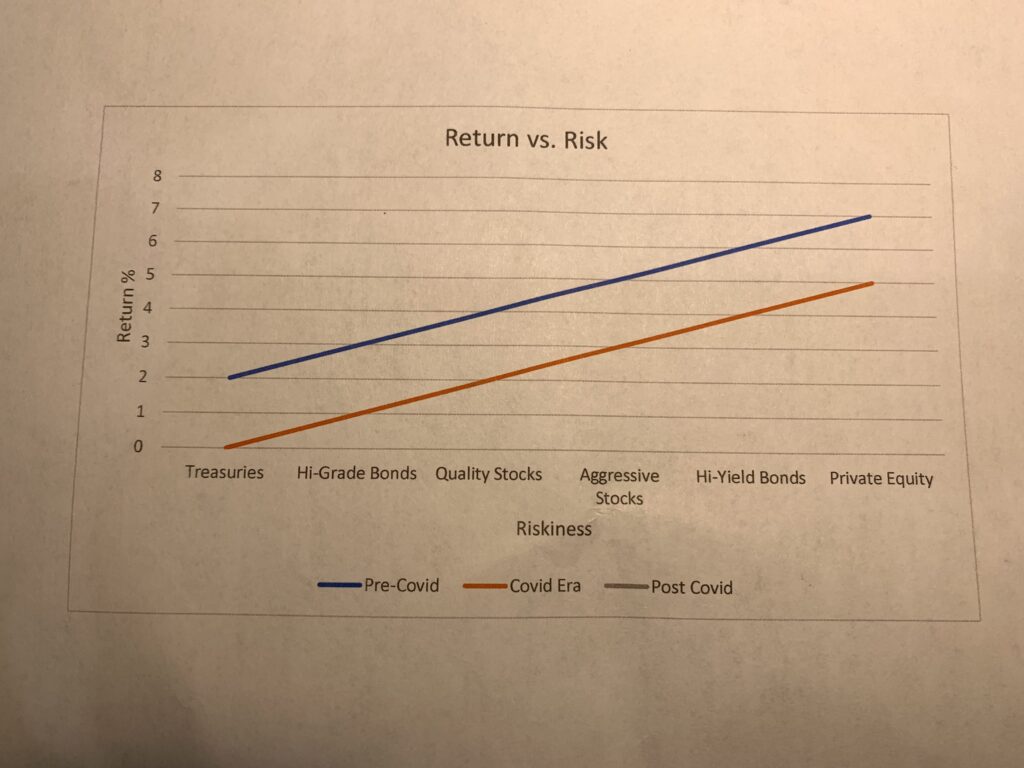

Special-Purpose Acquisition Companies, or SPAC’s, are the hottest thing on Wall Street. In 2020 alone, the year of Covid, SPAC IPO’s have raised over $57 Billion with two months to go, dwarfing the previous high of $13.6 Billion, raised in 2019. By investing in a SPAC IPO, investors are giving a “blank check” to a management team to go out and purchase a business and operate it as a publicly-traded company. The acquisition target is likely not identified at the time of the IPO. Does this sound like a good investment opportunity to you? It may be, but unless you really do your homework, you are setting yourself up for failure.

SPAC’s

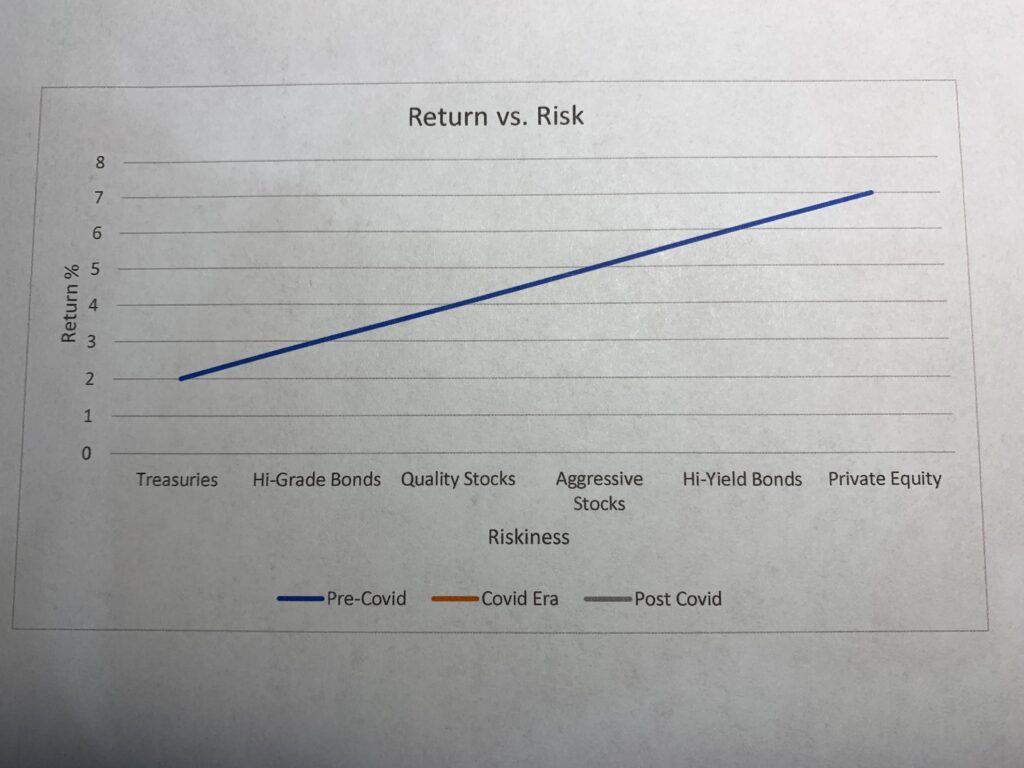

SPAC’s are sort of a way for average investors to invest in private equity-type deals. Only institutions or accredited investors are eligible to invest in traditional private equity, and they do so because returns can be high, but so can corresponding risk. Often, in private equity deals, a business is targeted followed by a search to find a team to manage the business, but it can also happen the other way around.

Anyone Can Invest

Anyone can invest in a SPAC – you don’t need to be an accredited investor. In a SPAC, as opposed to traditional private equity, the management team comes first, followed by the business acquisition after the IPO money has been raised. That’s why SPAC’s are referred to as “blank checks” – investors are giving money to a team and it’s up to the team to spend it how they want. The valuation and the fundamentals of the acquisition target are not known to the SPAC investors at the time of the SPAC IPO. SPAC investors are therefore giving over the right to analyze and negotiate a good deal to the SPAC management team. Of course, the SEC has guidelines for how SPAC’s are to spend their IPO money, but, still, an investor has to take a leap of faith to entrust their investment just in a team of people and let them go for it without your pre-approval.

Is It Really That Far-Fetched?

Though investing your good money with a management team in search of a business sounds different, it really isn’t. Think about mutual funds, which most investors own in some capacity. An actively-managed mutual fund operates somewhat in the same way: investors give money to the mutual fund managers, who in turn take the money pool and invest it typically in publicly-traded companies that they believe to be undervalued or that they believe have potential to appreciate such that their returns will outperform market returns. Investors trust that the mutual fund manager is superior at doing their investment analysis better than they can working on their own. Though mutual funds diversify by investing in many public companies, SPAC’s typically are less diversified, investing in only one or a couple of businesses. That said, the concept of delegating the acquisition and investment decision to someone who is more able is not that strange, and is a common element between actively-managed mutual funds and SPAC’s.

Should You SPAC?

Should you invest in a SPAC? In my opinion, if you do so, you better have a very strong knowledge, belief, and experience with the management team in charge of the SPAC. Since you can’t do your homework on whatever company they plan to acquire, you had better be darn sure that the team are comprise of people with integrity (so that they won’t just make off with your money) and acumen. Beyond that, there are other things to consider. For instance, typically a management team has experience in a certain type of business or industry. You as a possible investor should consider whether there are good opportunities in that industry for acquisitions. If it is a “hot” industry, perhaps there are a lot of other money pools out there trolling for potential acquisitions, in which case the price of those acquisitions could be bid up. On the flip side, perhaps this team’s experience is in a market that is petering out. If so, is there a catalyst within that market that could cause it to either stabilize or turn back in the right direction? These are the type of questions that you should consider before you invest.

IMO

Caveat Emptor – buyer beware – is very appropriate for investors who are looking to invest in a SPAC because they think they can earn private equity-type returns. While there are other types of investments out there that fit a similar profile, SPAC investors have to be extremely comfortable with whoever is in charge of the SPAC. While the investor may not be able to do their homework on the target company, there are elements they can bone up on, and so there are ways they can and should get more comfortable before they open their checkbooks.