“Sustainability” has been a buzzword for many years. It comes from the effort to save the environment – don’t be wasteful, be sustainable – and it now is applicable to many aspects of our economy and our society. Colleges and college students are big on sustainability. Investors search for companies whose business models are economical, sustainable with respect to their ability internally to generate sufficient capital to maintain operations, and not wasteful.

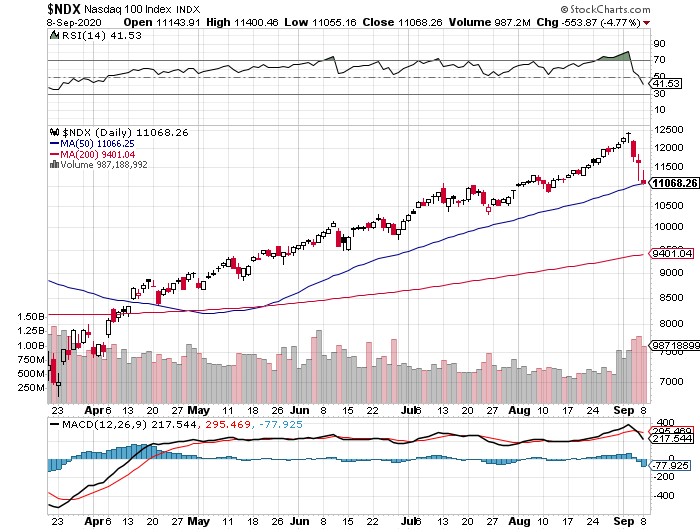

Volatility

Volatility is another word that has become en vogue especially for the stock market and especially this year. The VIX Index, which measures stock market volatility, spiked to 80 in March, a level last seen during the 2008 Financial Crisis. While the VIX has trended down since then, it has not broken below 20, and it has jumped back up during the last week.

Can’t Have Both

One of the reasons the stock market has been volatile this year is because the economic situation that we currently find ourselves in is not sustainable. Business shutdowns, working from home, no travel, extended furloughs and unemployment benefits, wearing masks, children unable to go to school – none of these are sustainable. We can all make a go of it all temporarily in the spirit of remaining healthy and saving lives, but this is not something we can abide by for the long term. Because the current situation is not sustainable and because there is so much uncertainty about treatments, vaccines, and their efficacy, investors don’t know when the economy will emerge on the other side and find its own water level, or if it ever will.

The Interim

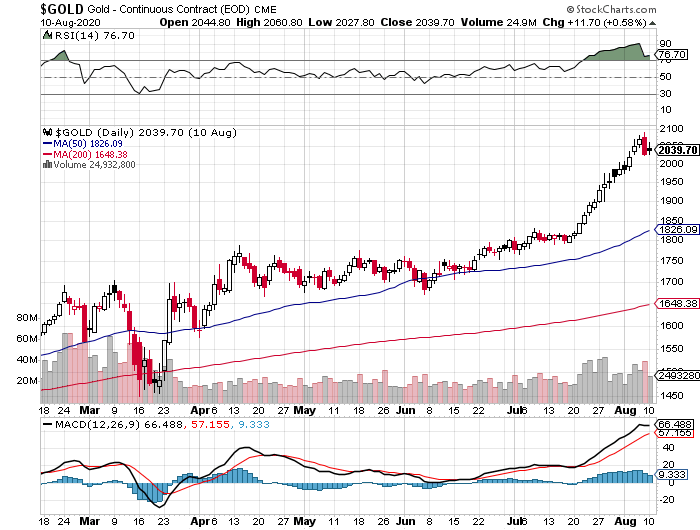

In the interim, investors have moved forward by plowing money into companies that do well in the “stay at home” economy and by avoiding stocks that need the pre-Covid economy to return. For instance, Amazon has soared while traditional retail has hit the skids or even, like Lord & Taylor and Saks, filed bankruptcy. However, I view the “stay at home” economy model as something that is temporary, and though perhaps we will not go back to 100% the same model we had just back earlier this year, we will need to get back to a great extent in order to grow our economy and to “sustain” all of the derivatives that feed on a growing economy such as large government-run institutions.

Not Sustainable

We citizens are trying to make the best of this bad situation, but it is not sustainable with respect to the way civilization conducted its business from the dawn of such up until March 2020. Landlords need tenants to move back into their buildings and pay rent so that mortgages are paid. Online school is perhaps nice for some but doesn’t offer the social interaction that in-person school does and is not the answer for all of society in the long run. Working parents need their kids to go back to school so that they can get a move on with their own lives.

IMO

Millennials have taken to the concept of sustainability through their environmental predisposition now want it in all other aspects of their lives. The problem with life is that stuff happens, and Covid is “stuff” that is anything but sustainable. Covid means uncertainty in all aspects of work and life and that leads to volatility. I believe that as long as Covid is a factor in our economy, we will have volatility in the equity markets. Investors will need to get comfortable with this higher level of volatility if they want to invest in equities. The alternative asset classes of cash or bonds don’t offer adequate returns. We need to return to a society and an economy that substantially resembles pre-Covid so that it and we can sustain what it had become.