I was drawn to this article in the June 1, 2020 Wall Street Journal about investors who got hammered by investing in leveraged Exchange-Traded Notes, or ETNs. ETNs differ from Exchange-Traded Funds (ETFs) in that ETNs are structured as a debt instrument whereas ETFs are structured as equity and actually own equity interest in the companies that comprise the index. However, there are both ETNs and ETFs that offer the 2 times and 3 times the return objective. In the WSJ article, people lost money by investing in leveraged ETNs, wherein some bank bought the basic ETN, then borrowed money to buy more of it, and then re-offered the initial part plus the borrowed part in a packaged that promised 2 times or 3 times the return of the original instrument. So, if the ETN’s price goes up 1%, then the 2 times ETN goes up 2% and the 3 times ETN goes up 3%. What could go wrong? Lots. When the stock markets tanked through the course of March, 2 and 3-times translated to big losses for the investors profiled in this article.

Confusing

Are you already confused? Me, too. Leveraged ETNs and ETFs are confusing in their structure. They also tend not to do what they promise over a long period of time. That’s why I don’t recommend them. There are better alternatives if you want to leverage your return if you suspect that the market is going to jump, especially in the short term. More on that later.

Examples

If you have ever screened for ETFs (etfscreen.com is a great resource), you have probably seen these types of “2X” or “3X” ETFs . Banks such as ProShares and VelocityShares offer products such as the SSO, which is the 2X S&P 500, or the UGLD, which is the 3X on the price of Gold. Even more complicated are the Reverse 2X and 3X products, wherein the product moves in reverse relative to the underlying index. Most of the well-known indexes – the VIX, the Nasdaq 100, Russell 2000, All of the Dow Jones Indexes – have 2X and 3X derivative products that one can invest in. My advice: Don’t.

Returns Don’t Work Out

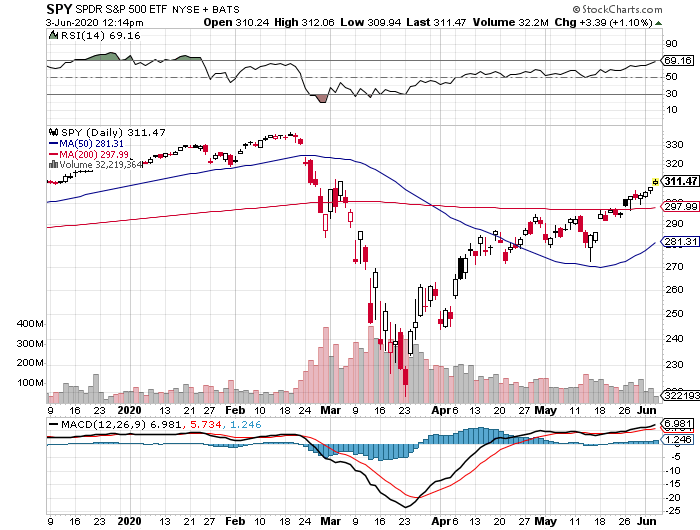

In my experience, just because a security offers the promise of a 2X return doesn’t mean you will get a 2X return. Let’s take one example: The SPY vs. the SSO. The SPY is the ETF for the S&P 500 Index, and the SSO is the ETF for 2X the S&P 500 Index. Here is a chart for the SPY, which shows the index to be currently trading about 7% below its pre-Covid high:

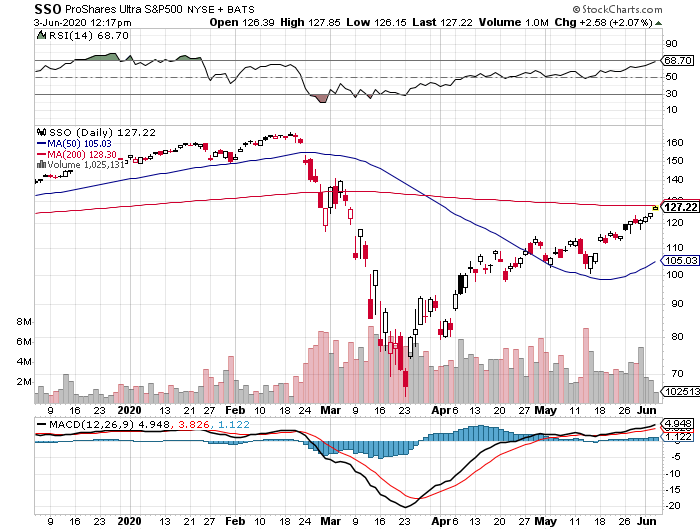

Now, here is the chart of SSO. If SPY is down 7%, then you might expect SSO to be down 2X or 14%, correct? Well, no. The SSO is down about 23% from its pre-Covid high. Not the 2X return, but something more, which in this case is worse for the investor:

Why don’t returns match what is promised? Because of the cost of the leverage and because of additional financial engineering through the use of options and the deteriorating value thereof due to the passage of time. It’s complicated, and that’s why I think you should stay away from these.

Alternatives

If you think a particular index is due for a jump one way or another, it is better to just buy call or put options on that index. They are much more straightforward, and your downside is that you lose the amount of the premium you paid to purchase the option. They won’t tank your entire portfolio or net worth, which is what happened with these poor souls in the WSJ article.

IMO

When you are offered 2X or 3X the return on a particular index or security, beware! They don’t work out as promised, and while your upside may be magnified, so might be your downside. It’s much better to be safe and invest in the standard 1X ETFs and buy your own options if you must. A more significant piece of advice is don’t do any of this without professional help. Contact me or your own financial advisor if you want such assistance.