Through the middle part of 2019, the US Treasury yield curve inverted slightly, meaning that longer-term interest rate yields were lower than shorter-term yields. It’s normally the other way around. Pundits (and some investors) at the time were concerned that the inverted yield curve was a precursor to a coming Recession. The yield curve soon righted itself, but several months later, lo and behold, Covid hit and our economy was sent into a recession. (Some now believe that the recession commenced in February 2020, before the worst of Covid in the US, but Covid was a factor even so). Therefore, once again, the inverted yield curve correctly predicted the current Recession, right?

Not So Fast

I find it difficult to believe that investors in US Treasury Securities collectively or anyone else could have predicted that a global pandemic was about to hit that would cause the forced shutdown of major world economies. There were many other factors involved in the inversion of the yield curve a year ago, not the least of which were supply/demand issues of different maturities along the yield curve. One could say that the economic expansion of a year ago was long in the tooth and a slowdown was bound to happen sooner or later. But I don’t believe that last year’s inversion correctly predicted the Covid shutdown. If it had, then I believe the magnitude of the inversion would have been much greater.

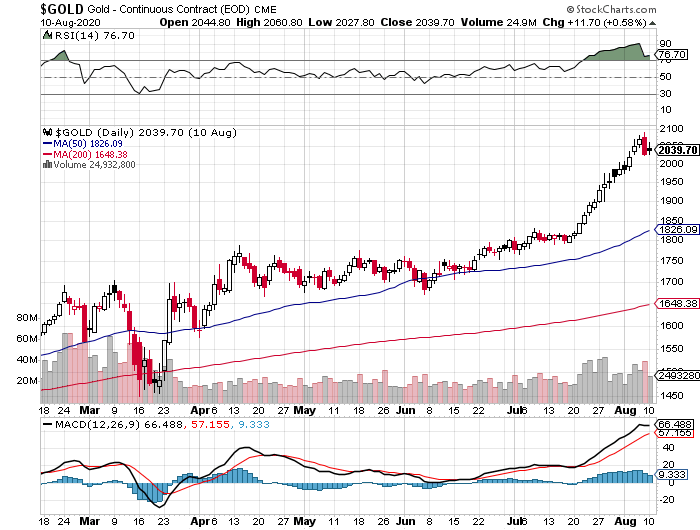

Gold Is Up

Now we have the price of gold up 25% since pre-Covid. The spot price of Silver is up by about 40% over the same period. This is the strongest rally in precious metal prices in years. Precious metals are said to be a predictor of upcoming inflation. Does this rally in their prices mean that inflation is back after having been dormant for many years?

Money Supply Expansion

Investors have been buying gold (and silver) in response to the huge expansion of the US money supply during the Covid period. According to the Federal Reserve Bank of St. Louis, the M2 money supply has increased by about $2.8 Trillion or 18% since pre-Covid and now sits at about $18.4 Trillion at last reading. At the same time, due to supply chain issues with grocery/food and other products, there are shortages which may or may not turn out to have been temporary. More money chasing fewer goods means what? Higher prices for those goods, or so says traditional economic teaching. If you believe there is any permanence to the Covid economy, especially if you believe that supply chain issues economy-wide are more permanent than not, then the stage is indeed set for higher inflation.

Investor Psychology

I read the increase in the price of precious metals including gold and silver not so much as a predictor of things to come but a hedge against inflation if the data materializes as such. It is always a good idea for investors to have a portion of their money invested in alternative asset classes such as precious metals, as such investments balance out returns and help make the portfolio look like what happens in the general economy. Real estate is another such alternative asset class. In addition to the hedge concept, perhaps investors are noticing, as they sit at home while working on Zoom calls, that they have neglected the metals class for may years because its returns have underperformed, and so now they are rebalancing their portfolios to move a small percentage out of stocks and bonds and into the metals. Even a small percentage of rebalancing could result in a relatively large movement of the needle with respect to the price of gold.

IMO

I believe that we could see higher inflation but that the economy will recover soon enough such that we will not see Argentine or Venezuela-level inflation. Inflation in the US is below 1% at last report, and the Fed targets 2%, so I am not panicking yet. That said, as time passes and inflation rates do turn out higher, then it’s not so much that the US economy can’t handle slightly higher inflation, it’s that investors may overreact and think the world is about to end. As always, stay calm and don’t panic. If it makes you feel better, go ahead and look to buy some gold in some capacity, whether it is through individual gold coins or through gold mining stocks or through a gold ETF such as GLD. However, don’t bet the farm that inflation will come roaring back. It will take a long time to sort through the Covid and (hopefully) post-Covid economy. Speculating that inflation and gold prices will go up is just that: speculation.