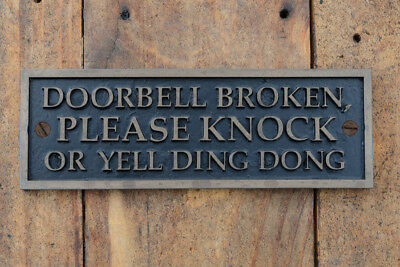

Our doorbell at our home is broken and I am in the process of putting a new doorbell system in place. Easy, you may say, in this age of Bluetooth electronic doorbells with cameras. Well, it turns out it isn’t that easy. I did install a new camera doorbell – a major name brand in the market. It worked for a while, but then it didn’t. The reason it quit working had to do with software: I also subsequently installed a new WiFi router. The doorbell needs to interface with the WiFi in order to connect with the doorbell chime and to send you the pictures of your front door that you can see on the app related to the doorbell. The problem was that the new router’s software and the doorbell’s software wouldn’t speak to one another. Perhaps I should have known this before I spent mega $$ on my router, but who knew? So now I am in the middle of installing a whole new doorbell system, and I am hitting more roadblocks along the way. Funny how what you think should be an easy project turns out to be all-consuming.

Need To Adapt

The point that I am making is that one needs to be able to adapt even if one finds what one thinks is the solution to their problems. This is because stuff happens that could render their solution obsolete. Don’t get too comfortable because the world may change and your solution doesn’t work any more.

Your Personal Finances

There are many ways this lesson applies to your personal finances. In fact, the process of changes and the need to adapt to changes plays out in real time every business day that the markets are open for business. Think about what your plans were a year ago (ok, 13 months ago), before Covid. How have you had to adapt your financial plans and goals since Covid? If you are lucky, you haven’t had to change and adapt very much at all. If that is the case, then your plan back then was solid, and you should keep plugging at it even now as we (hopefully) reach the back end of this awful period. If you have been personally set back by Covid, either through business or job loss or worse, it doesn’t mean your plans were no good. It means that stuff happens and you need to adapt. Maybe you have “retired” a little earlier in your life than you thought you would. If so, you have probably had to adapt and change your personal financial plan and goals a little more than you had hoped to do. Hopefully you have been able to do so without missing many beats.

Your Portfolio

Another issue may be with the composition of your investment portfolio. As markets change, what may have worked before may no longer work for you now. Interest rates change. Industries and sectors move in and out of favor. New technologies may disrupt companies that you may have a stake in. It can be disconcerting to you if you set up what you think is a strong portfolio only to have its foundation shaken by these market changes and disruptions.

The Ask

One thought I have for you is that you don’t have to face the stormy seas of all of these changes by yourself. I ask that you consider getting help from a Certified Financial Planner® such as yours truly. Though you may feel like you have a handle on your own finances, often, two heads are better than one. Having a trusted financial professional with whom you can discuss and debate plans and ideas may be the perfect ballast that you need to steer your ship. Back to my issue with my doorbell: I didn’t have the right person to help me find the right solution to my broken doorbell. I had good people who knew about doorbells, and other good people who knew about home WiFi systems, but not people who knew enough about both and how they interface with one another. The piecemeal approach didn’t work for me and it cost me. Don’t make the same mistake with your personal finances. If you work with a professional, as you should, make sure the professional has and understands the entire picture, not just a part of it. Only then can they come up with a solution that addresses the entirety of your situation.