Interesting take in this article by Jonathan Lansner, longtime business columnist of the Orange County Register. Lansner uses data from the Federal Reserve and from Freddie Mac to show that April’s average 30-Year Mortgage rate of 3.1% was lower than April’s 4.2% annualized inflation rate. That’s not just a tad bit lower; that’s a lot lower, 1.1 percentage points lower. First time this has happened in over 40 years – August 1980, to be exact. Let me give you my thoughts on why this has occurred and what might happen in the future.

Why Mortgage Rates Remain Low

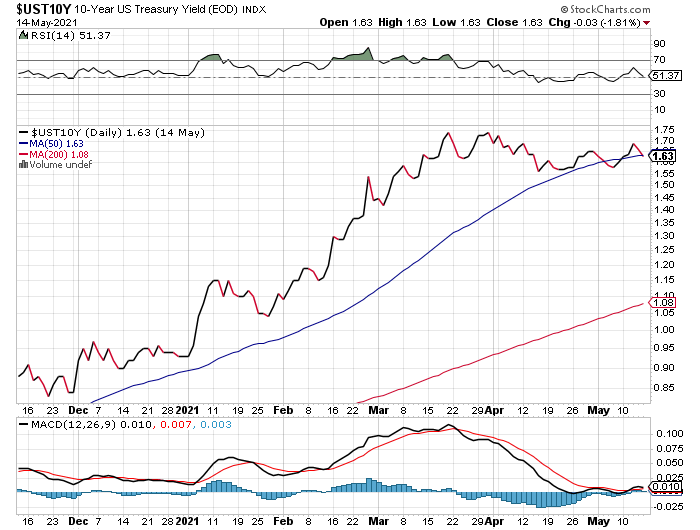

Mortgage rates are still in the low 3% range because US Treasury rates remain steadfastly low despite the uptick in inflation. Rates of 30 year mortgages are closely linked to 10 Year US Treasury yields because the average duration of 30 year mortgages is about 10 years (a little less, actually). Check out the chart of the 10 Year US Treasury. After rising from below 1% at the beginning of 2021 through mid-March, the yield on the 10 Year topped out at just over 1.7% during the 3rd week of March (coincidentally the 1 year anniversary of the nadir of the stock market in 2020). Since mid-March, however, Treasury buyers have rushed in and have kept yields below 1.7%. Why is this? Because 1.7% on “risk-free” US Treasuries looks like a great return to investors both in the US and in the rest of the world. As low as they are, rates on government debt in the US are higher and hence more attractive to international investors than are rates from other countries. As long as that remains the case, look for 10 Year rates and therefore mortgage rates to remain low. Unless inflation gets out of hand, which it might.

Inflation Risk

Is April’s 4.2% annualized inflation rate just an anomaly, or is it just the tip of the iceberg? Last week I wrote about the quadrupling of the price of lumber, which certainly contributed to April’s inflation in some way. Since I posted that article on lumber, its price has headed south, from $1,700 to just over $1,300, a drop of about 23% in a week. If lumber’s price remains subdued, so to speak, it speaks to the anomaly theory rather than the runaway inflation theory of the future. Supply chain disruption was and remains a big part of the world economy. The US economy seems to be recovering well but that’s not true of other geographies which export essential components so that the US economy can continue to roar forward. Perhaps the theory of a temporary period of disruption is another reason why US Treasury rates remain benign despite higher inflation numbers. The Federal Reserve itself believes inflation remains under control and that an annual rate of 2% or even slightly higher is acceptable, April’s figure notwithstanding. Do you believe or trust the Fed? If you don’t, proceed at your own peril because the Fed usually gets what it wants.

IMO

I believe the phenomenon of inflation rates greater than mortgage rates could remain a thing for several months hereafter. Anecdotally, gasoline is higher, the cost of going out to eat is higher, housing is higher, and so it stands to reason that we should get used to inflation rates of in excess of 2%. If supply chain disruptions are to blame, then I believe such disruptions will remain with us for at least a year, maybe more. Meanwhile, unless inflation really gets out of hand – say in excess of 5% for a sustained period, along with the perception that the Fed is out of touch and fighting the wrong battles – the demand for US Treasuries will remain strong and therefore Treasury rates will remain low. What does this mean for your investment outlook? Buy stocks, including and especially funds and/or ETFs that track stock performance.