I just finished reading “Mastering the Market Cycle” by Howard Marks, the legendary head of Oaktree Capital Management. I have had the pleasure of hearing Howard speak in person a couple of times, and he is very engaging and funny. Howard comes from the University of Chicago, the same school as Milton Friedman, so Howard’s economics are relatively supply-side and “conservative”.

Pendulum

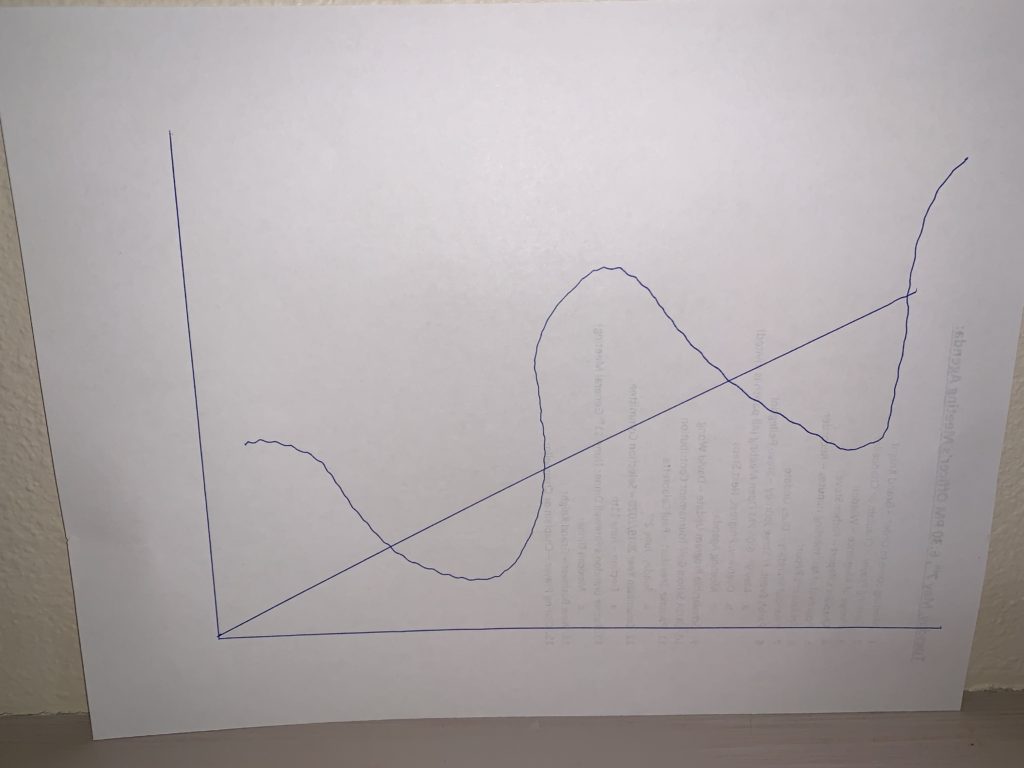

One of Howard’s core theses in the book is that markets move in a pendulum. Too much pessimism begets opportunities, which leads to buying and stock market rallies, which eventually leads to irrational exuberance, which leads to selloffs and stock market corrections, so we end back with too much pessimism. Back in the trough where we started, but maybe a little higher than above because the economy usually has positive growth. Here is a photo of a graph of Howard’s pendulum that I drew myself (isn’t it lovely?:

Pendulum or Roller Coaster?

I agree with Howard that markets run in cycles, and that pessimism can be overdone which can lead to great investing opportunities. However, I take issue with the pendulum analogy. A pendulum implies that the forward and backward movement in markets is even, that it takes as long for a bull market as it does for a correction. History doesn’t back this up. Bull markets can take years or even decades; we are currently in a bull market that started in March 2009. Corrections, instead, are a short, sharp shock. Even the 40%-50% correction of the Great Recession occurred over only about 2 years from 2007 to early 2009,. Stocks take the stairs up and the elevator down. Now, the thrill with a roller coaster ride is on the way down. That’s not so with the stock market, so I will give you that flaw in my analogy. Also, on a roller coaster ride, you usually disembark at the same place where you got on, and that’s not the case with the stock market. However, the pendulum analogy also implies an even arc, which Howard also doesn’t imply. So neither analogy is perfect, but I like the roller coaster better because market corrections are much more violent than are bull markets.

Not a Straight Line

Another problem with both the pendulum and roller coaster analogies is that both imply that the way up and the way down are either straight lines or parabolic arcs that one can easily discern. The reality is much different. As we all know, the market wants to deke and head fake us every millisecond. Instead of a straight or parabolic line, the more accurate representation is that of a Richter Scale readout, such as this:

Inflection Point

Because of the market volatility that represents like a Richter Scale readout, it is very difficult at any given time to figure out where we are within the cycle. If it was easy, then there wouldn’t be any discussion among the Federal Reserve Bank board members about what to do about interest rates. More than that, we would all be millionaires. However, I agree with Howard’s point that fortunes are made at the inflection points, where bear markets turn to bulls and vice versa, along with the intestinal fortitude to invest contrary to then-prevailing market conditions. Another investing legend, Paul Tudor Jones of Tudor Investment Corporation, says the same thing.

The difficulty is that we aren’t at an inflection point on either side. At any given time, it is much, much more likely that we are in the middle of a bull market or, less likely, in the middle of a correction. What does Howard Marks say you should do then? During an upswing, he says, go ahead and buy, but be very cautious. During a downswing, look for an opportunity to buy, and don’t worry so much about buying at the very bottom. At every circumstance, Howard says, the decision should be whether the price you are paying is more or less than the intrinsic value of what you are buying. If you think you are getting a bargain, then buy it, no matter the market conditions. The market will eventually come around to your evaluation. This also takes intestinal fortitude, and it is much easier said than done.

IMO

Howard doesn’t tell us where he thinks we are right now – are we in a bull market, or has the bull run its course and so we are at an inflection point? That is not the objective of “Mastering the Market Cycle”. However, I have some thoughts on this that I will spell out in my next blog posting.