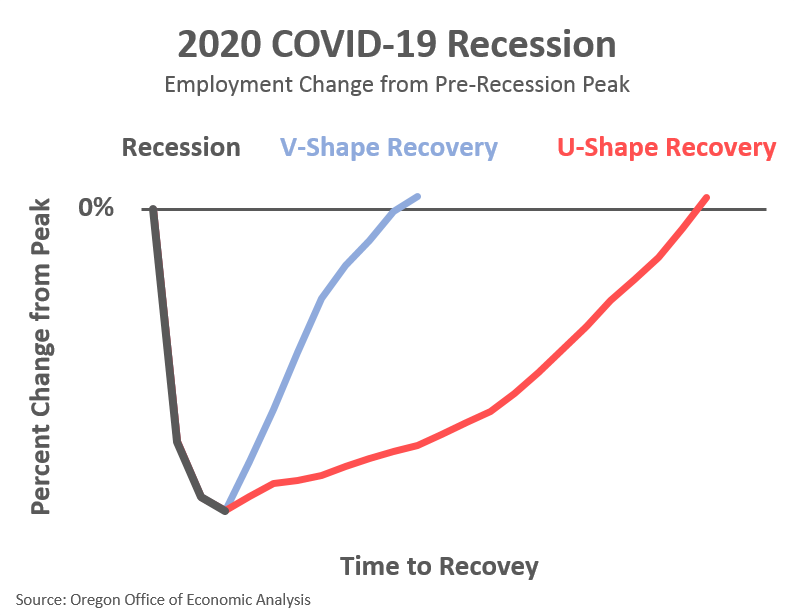

Economists are debating now whether, once we get to the other side, the recovery will be V-shaped or U-shaped. I admire Brian Wesbury of First Trust Advisors from Chicago. In this video presentation, Brian explains how he sees the difference as being a function of how long the enforced economic shutdown persists. A longer period of shutdown = a longer period of recovery = more likely a U-shaped recovery. Brian states most smaller businesses have about 28 days of cash on hand, and if the shutdown lasts longer than that it will force more and more businesses to close down. Brian believes the shutdown will begin to be lifted sometime in late April, and so the graph of the recovery will be somewhere between a V and a U. A V…U, maybe. I disagree with Brian somewhat.

Undercapitalized

Smaller companies just don’t have the access to equity or debt financing that larger companies do. This is true throughout the spectrum of private and publicly-traded companies. The increase in regulation, including but not limited to Sarbanes-Oxley and regulations such as those that have increased capital requirements among banks, favor big companies getting bigger and keeping potential competitive upstart companies from ever getting funded. With respect to smaller private companies, your restaurants, hair salons, yoga studios and the like, many of them battle with cash flow even during good times, and they are not equipped to last through a long shutdown. We are already 3 weeks into this imposed shutdown and nobody is saying it is going to end any time soon. The end of April is probably a best-case scenario right now. Businesses in some areas of the country that are less affected by Coronavirus may be able to open sooner than others, but that is a different argument. Brian Wesbury’s 28 days of cash is a macro argument, and I would bet there are a lot more small businesses that are below the median on that than are above the median. Look for a lot of your favorite restaurants not to reopen, especially if we go into May with the shutdown.

Turn On the Lights

Secondly, once the All Clear siren sounds, it won’t be easy just to turn on the lights and start up again. If a company has furloughed workers, they need to be rehired, and maybe those workers can now find a better gig somewhere else, so it won’t be easy for employers just to send a few text messages and expect their old staff to reappear. If they are being nice and abiding by some state mandates, landlords are foregoing rent during this shutdown, or at least waiving late fees. Once the all-clear is sounded, these landlords will want to be paid something before these businesses are able to start up again. Supply chains are being disrupted and they won’t be restarted immediately especially if your company is reliant on supplies from China other parts of Asia – cargo ships are big and move slowly. Just In Time inventory management was the name of the game prior to this shutdown, and it will take quite a bit of time to sync all of the factors together so that inventories work the way they used to. Just as baseball players need Spring Training to get back in shape, so too will this economy need a period of time to train for it to get back into shape.

The Great Recession

According to Yahoo finance, it took about 5.5 years for the S&P 500 to regain its highs after it hit its pre-Recession high in late-2007. There were a lot of fits and starts along the way. The Great Recession was different in that it involved a bubble in the real estate and mortgage markets that needed time to work itself through. However, my point is that large corrections such as that we are in now take time to resolve. I don’t think that this time it will take 5.5 years but I am not as optimistic as Brian Wesbury that the recovery will be V-shaped.

IMO

As an investor and looking at this as an opportunity to “buy low”, fret not. You will have more opportunities to buy low. I am not saying we will re-test the low that we hit on March 23, although that is possible. I am saying you have not missed your opportunity to buy low, and you will continue to have opportunities to do so for the next several months, in my opinion. This shutdown will continue to have economic ramifications for several months even after the Coronavirus threat is deemed to be minimized. Rather than a V or a U, I look for the graph of the recovery to look something like a W or a cup with a handle (look it up). Rather than 5.5 years, I believe it will take 2 to 3 years to retake the highs in the S&P 500 that we reached in late February, which is only 5-6 weeks ago, which is breathtaking in the rapidity in the fall that we have had since. For me, it points to having a long-term investing strategy and sticking to it, especially if you are not about to lose your job or otherwise need the money invested in your savings and retirement accounts.