How much do you think you will spend once you retire? Most likely, you believe your spending will go down once you retire. A Rule of Thumb is your spending during retirement will be 70% of what it is when you are working.

Does the 70% Rule of Thumb work in practice? This article from a recent edition of the Wall Street Journal suggests that not only is 70% of pre-retirement spending too low of an estimate but that your retirement spending may actually be more than you spend while you are still working. Once you retire, you will have a lot more free time to do things, many of which cost money. It costs a lot just to run a home! I spend almost $100/month just for internet access. You have to have internet access these days, right? Add cable or satellite TV to that. Did you “cut the cord”? Not really, if you are still paying for internet access. Especially if you are still working and already on a tight budget, I can understand how your spending can increase instead of decrease during retirement.

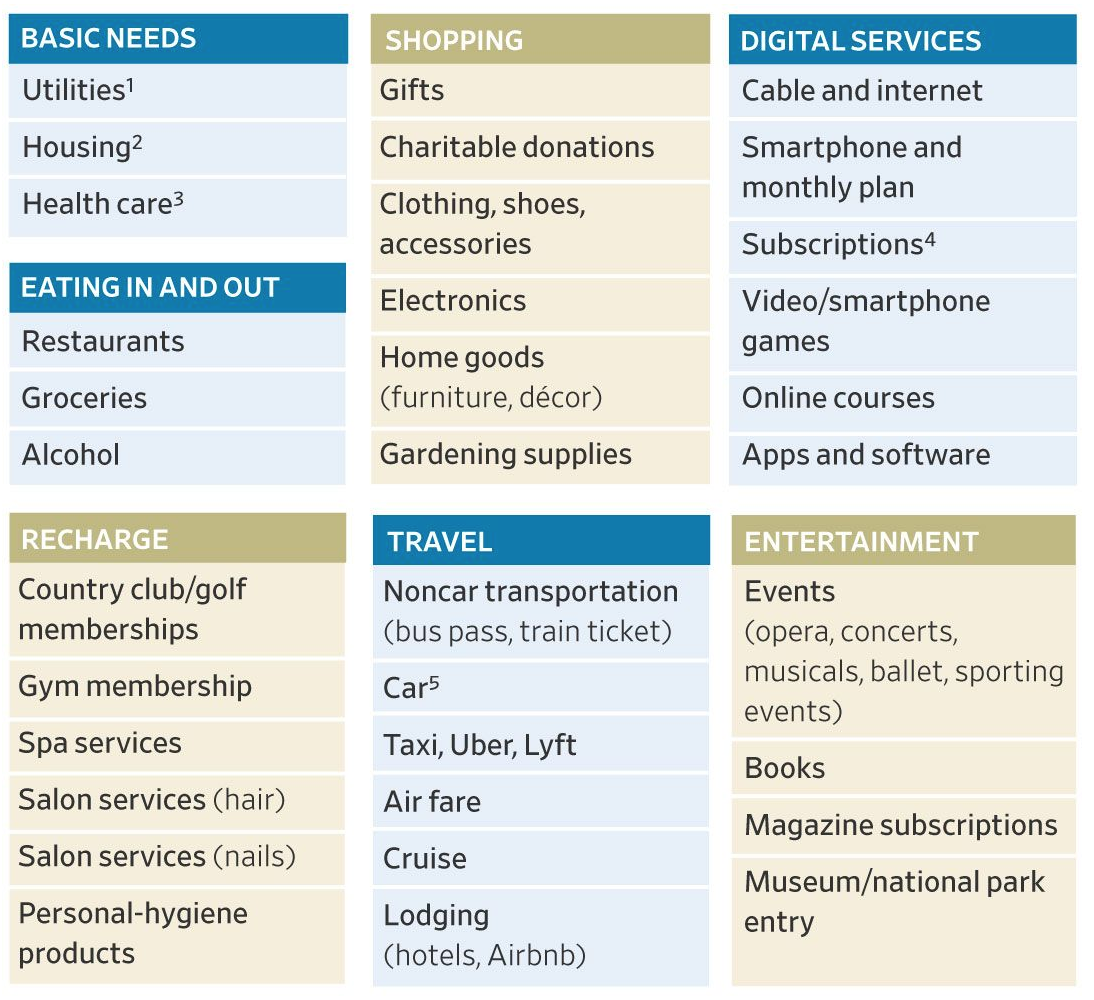

Chart

What I find particularly useful about the WSJ article is the chart it has in it, which is shown above. The chart is really a checklist of categories to consider when you think about what you spend your money on. The bulk of the article discusses each item in the chart and explains what each means. I suggest using the chart as a starting point for you to do an inventory of what you are currently spending money on. Then, look at each spending item and think about whether it “sparks joy” for you. Or, if it doesn’t spark joy, maybe it is necessary – insurance doesn’t spark joy, but you have to have it. If you are thinking about retirement in the next several years, use this chart to create an action plan of what you want to cut out. Because, if you don’t cut anything out, your spending could easily go up during retirement instead of down, and you may not have enough money, especially if you remain in good health and live a long time in retirement.

IMO

While you are working, you should always have an action plan for what you plan to jettison if something bad happens, such as loss of a job, huge medical bill, or loss of a spouse or a loved one. When you do actually pull the trigger and retire, use this chart as well as your current expenditures as a path toward knowing how you are going to afford your retirement. Do you know any older people who worry a lot? Don’t be a worrier in retirement – put your retirement spending plan together and execute it. You will be happier in retirement if you do. Need help? Contact me!