Vanguard posted this interesting article on May 30, 2019, titled “Amid tight job market, tech drives low inflation.” The article contains a chart that shows that core inflation has been below the Federal Reserve’s 2% target for most quarters during the past 20+ years. This period has coincided with the explosion in technology and the advancement of innovations that have aided productivity. As technology has grown and improved, inflation has been kept at bay, and interest rates have remained low.

Sectors Affected

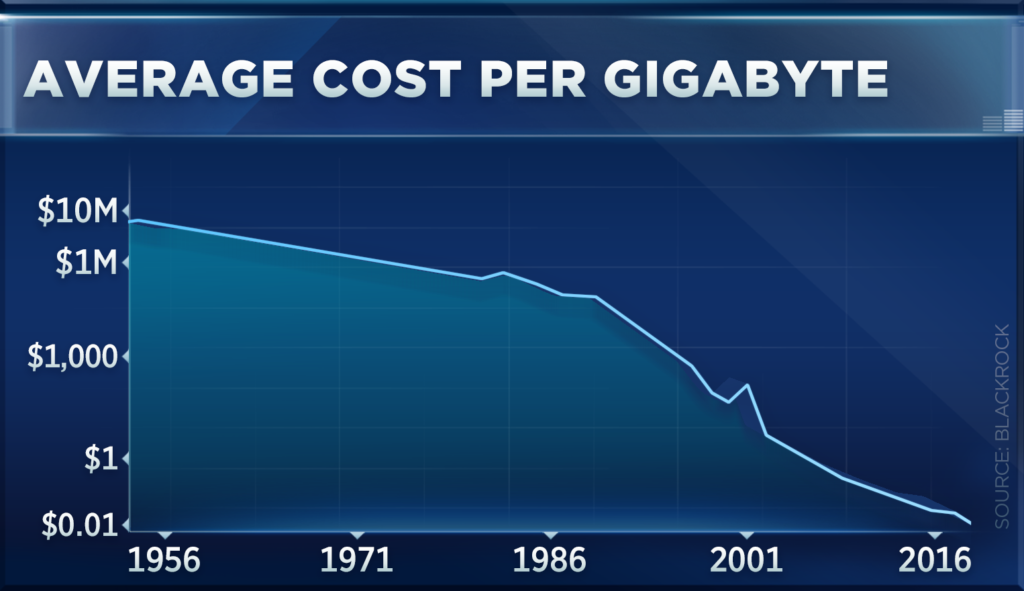

The Vanguard article also has a chart that shows various sectors of the economy and how much they calculate each sector has benefited from improved technology. The single sector that has benefited the most is, not surprisingly, the information technology sector. It makes sense if you think about it. Consider the computing power contained in a new iPhone today vs. its power when it was introduced back in 2007. The new phone may cost 3 times as much as the 2007 model, but you are getting over 30 times the amount of RAM and storage capacity (source: Computerworld.com). IPhones have over 10 times the capacity of a Cray Supercomputer from 35 years ago. Moore’s Law, in the flesh. It’s not that we are spending less for our iPhone (and laptop) units, it’s that we are spending a lot less per gigabyte of computing power. The more power we have, the less likely it is that inflation rears its head.

Among the other sectors Vanguard analyzed, the two most affected by improved technology are Professional Services and Manufacturing. Think about how more advanced banking and finance (included in Professional Services) are now compared with 20 years ago. Technology has transformed stock trading, to name one example, so that it is now seamless and very cheap to invest your money. As to the manufacturing sector, there is a lot of talk about robots and how they will displace so many workers, but the effect is that manufacturing automation has kept prices very low.

Globalization

It is not the point of the Vanguard article, but another reason inflation has been tame for 20 years (and more) has been globalization. The expansion of the manufacturing base to other, low labor-cost countries throughout the world has meant that there is competition for manufacturing plants. With increased competition, the cost of goods manufactured and sold has remained low. Do you think we are anywhere near a point in this world when we are maxed out on production capacity? I don’t think so. Tariffs aside, there is no evidence that we are about to embark on a period of higher cost of manufactured goods.

IMO

As long as inflation remains as low as it has been for the past 20 years, we are well-set for further economic expansion, in the largest macro sense. Technology has played a big role in keeping inflation low, and I don’t see any reason why this trend should not continue in the next 20 years. Does this mean the Federal Reserve should change its policy toward interest rates? Not necessarily, but I do believe that the Fed’s ability to tweak the economy by quarter-point changes in the Fed Funds rate are overrated, and that investors should look beyond what the Fed does and instead consider the effects of continued exponential improvement in technology and what that may mean for the long-term trend in inflation.