The 2/10 spread is the difference between the current yield on 10-Year US Treasury Notes and the current yield on 2-Year Treasury Notes. The 2/10 spread in Treasuries is different than the 2/10 Split in bowling, which looks like this:

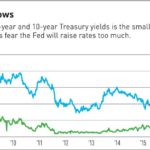

As I write this (on May Day), the 2/10 Treasury spread stands at 0.46% or 46 basis points, and it has been getting narrower. Here is a (somewhat cut-off) chart from Investors Business Daily that shows that the 2/10 spread has been narrowing during the past few months:

Sorry that chart didn’t copy correctly but, trust me, the spread has narrowed from about 120 basis points at 1/1/17 to 46 basis points now.

Invert

The concern on Wall Street is that the 2/10 spread will invert, meaning that 2-year rates will be higher than 10-year rates. This inverted spread has happened in the past but not for several years. The inversion is a leading indicator of an upcoming recession. Wall Street does not want the 2/10 spread to invert because that means the party is over or at least is most likely to end relatively soon. It makes sense if you think about it: If short-term rates are higher than long-term rates, that means there is greater uncertainty about the short-term than about the long-term.

The Fed

The 2/10 spread has been narrowing and is threatening to invert mostly because short-term rates have risen more than have long-term rates. Short-term rates have risen substantially because the Fed has pushed rates higher during the past 2 years. The Fed doesn’t set 2-year Treasury rates – market forces do – but market forces react directly to Fed moves and statements. 10-year rates are not as correlated to the Fed, so although 10-year rates have risen (about 50 basis points this year), they haven’t risen commensurate with 2-year rates.

Last week I wrote about the 10-year rate reaching 3%. I also wrote about technical resistance levels. Since reaching 3%, the 10-year rate has fallen back a bit and closed today at 2.96%. I wrote that the 10-year has touched but not exceeded 3% several times in the recent past. You could say that 3% is a Resistance level for the 10-year. We will see if the 10-year yield is able to muscle through the resistance and stay higher than 3%.

IMO

I believe that inflation may be slightly higher than in the previous recent past but not significantly so. I also believe this current Jerome Taylor-led Fed is not a hawkish, inflation-fighting Volker-type Fed. The Fed has stated they intend to raise rates 3 times during 2018 and are contemplating a 4th rate raise. I believe that the Fed will not continue to raise rates such that it will force the 2/10 spread to invert and thereby portend a recession. As time goes on, if the 10-year doesn’t break above the 3% resistance level, I believe the Fed will re-think the 4-raise policy for 2018, and may even back down on 3 raises. While I have also written that there is No Script for the Fed to rely on this time because we have not faced a backdrop of Quantitative Tightening, I think the threat of an inverted 2/10 spread is a more immediate factor that the Fed will consider and that they will come down on the side of letting the good times roll in the stock market.